Answered step by step

Verified Expert Solution

Question

1 Approved Answer

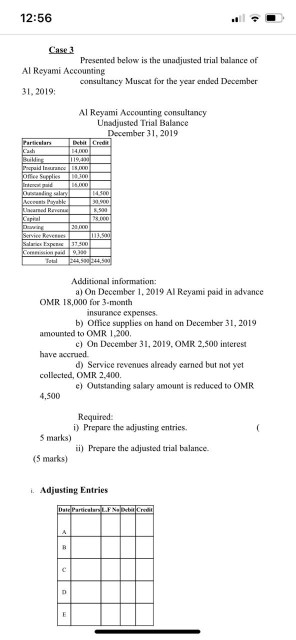

12:56 Case 3 Presented below is the unadjusted trial balance of Al Reyami Accounting consultancy Muscat for the year ended December 31, 2019: Al Reyami

12:56 Case 3 Presented below is the unadjusted trial balance of Al Reyami Accounting consultancy Muscat for the year ended December 31, 2019: Al Reyami Accounting consultancy Unadjusted Trial Balance December 31, 2019 DNB Credit Additional information: a) On December 1, 2019 Al Reyami paid in advance OMR 18,000 for 3-month insurance expenses. b) Office supplies on hand on December 31, 2019 amounted to OMR 1,200 c) On December 31, 2019. OMR 2,500 interest have accrued. d) Service revenues already earned but not yet collected, OMR 2,400. c) Outstanding salary amount is reduced to OMR 4,500 Required: i) Prepare the adjusting entries. S marks) ii) Prepare the adjusted trial balance. (5 marks) i. Adjusting Entries Date Particulars L.F Nopea credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started