Answered step by step

Verified Expert Solution

Question

1 Approved Answer

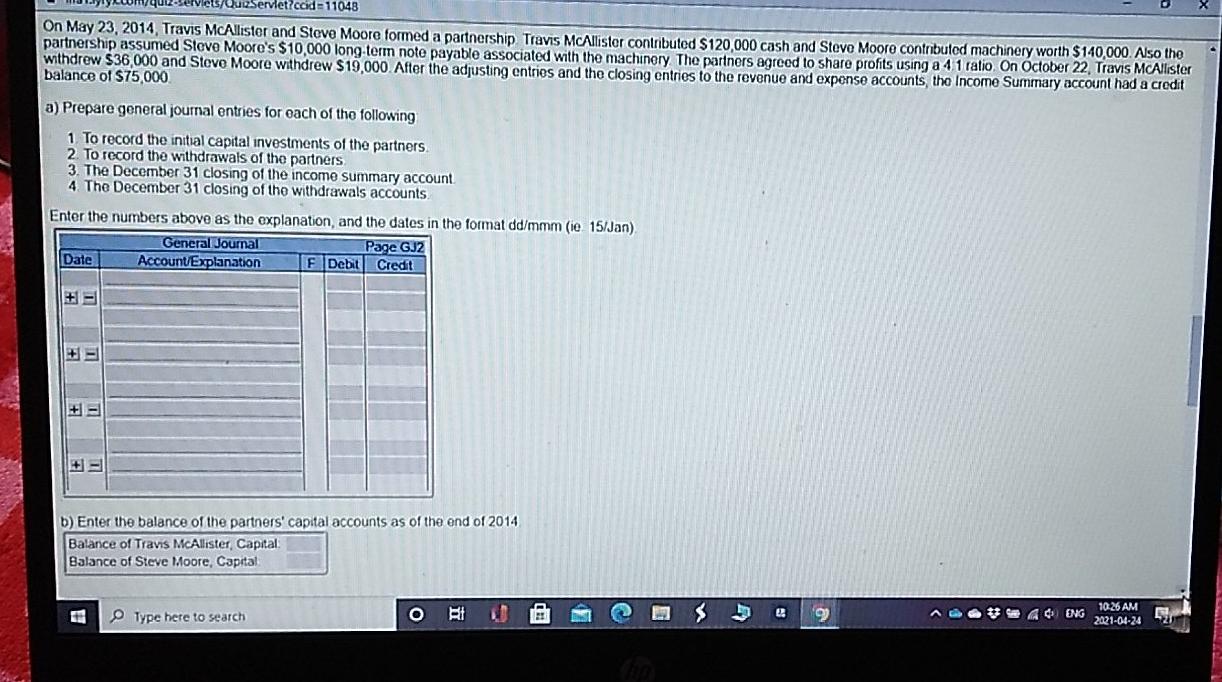

12.Servletccid=11048 On May 23, 2014, Travis McAllister and Steve Moore formed a partnership Travis McAllister contributed $120,000 cash and Steve Moore contributed machinery worth $140,000.

12.Servletccid=11048 On May 23, 2014, Travis McAllister and Steve Moore formed a partnership Travis McAllister contributed $120,000 cash and Steve Moore contributed machinery worth $140,000. Also the partnership assumed Steve Moore's $10,000 long term note payable associated with the machinery The partners agreed to share profits using a 41 ralio On October 22, Travis McAllister withdrew $36,000 and Steve Moore withdrew $19,000. After the adjusting entries and the closing entries to the revenue and exponse accounts the Income Summary account had a credit balance of $75,000 a) Prepare general journal entries for each of the following 1 To record the initial capital investments of the partners 2. To record the withdrawals of the partners 3. The December 31 closing of the income summary account 4 The December 31 closing of the withdrawals accounts Enter the numbers above as the explanation, and the dates in the format dd/mmm (ie 15/Jan) General Journal Page GJ2 Date Account Explanation F Debit Credit b) Enter the balance of the partners' capital accounts as of the end of 2014 Balance of Travis McAllister, Capital Balance of Steve Moore, Capital 5 Type here to search O 3 v 4 4 UG 10:26 AM 2021-04-24 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started