Question

12.What was the amount of cash provided by operating activities? a. $85,000 b. $75,000 c. $77,000 d. $75,500 13.What was the net cash inflow from

12.What was the amount of cash provided by operating activities?

a. $85,000

b. $75,000

c. $77,000

d. $75,500

13.What was the net cash inflow from investing activities?

a. $13,500

b. $4,000

c. $6,500

d. $3,500

14 Huge Cart Inc. gives you the following information pertaining to the year 2014.

Sales Revenue (all credit sales) $850,000

Sales Returns and Allowances 50,000

Cost of goods sold 500,000

Accounts Receivable, Ending Balance 100,000

Average Accounts Receivable 75,000

Net income 150,000

The accounts receivable turnover for Huge Cart Inc. is:

a. 11.33

b. 10.67

c. 8.50

d. 8.00

15.The CHS Company has provided the following information for 2014:

-Accounts receivable written-off as uncollectible during the year amounted to $11,500.

-The accounts receivable balance at the beginning of the year was $150,000.

-The accounts receivable balance at the end of the year was $210,000.

-The allowance for doubtful accounts balance at the beginning of the year was $14,000.

-The allowance for doubtful accounts balance at the end of theyear after the recording of bad debt expense was $12,900.

How much was CHS Company's bad debt expense in 2014?

A. $11,500.

B. $12,900.

C. $10,400.

D. $14,000.

16.Carol wants to invest money in a 6% CD account that compoundsannually. Carol would like the account to have a balance of $50,000 five years from now. How much must Carol deposit toaccomplish her goal?

A. $35,069.

B. $37,131.

C. $37,363.

D. $35,369.

17. Claudine Corporation will deposit $5,000 into a fund at the beginning of each year for the next five years. How much will accumulate by the end of the fifth year if the fund earns 9% interest?

A. $32,617.

B. $29,924.

C. $27,250.

D. $26,800.

18.Why is the allowance method preferred over the direct write-off method of accounting for baddebts?

a.Estimates are used

b.Determining worthless accounts under direct write-off method is difficult to do.

c. Improved matching of bad debt expense with revenue.

d.None of the above

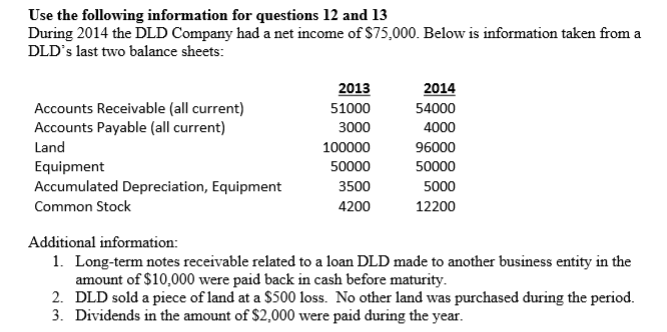

Use the following information for questions 12 and 13 During 2014 the DLD Company had a net income of S75,000. Below is information taken from a DLD's last two balance sheets Accounts Receivable (all current) Accounts Payable (all current) Land Equipment Accumulated Depreciation, Equipment Common Stock 2013 51000 3000 100000 50000 3500 4200 2014 54000 4000 96000 50000 5000 12200 Additional information: Long-term notes receivable related to a loan DLD made to another business entity in the amount of $10,000 were paid back in cash before maturity DLD sold a piece of land at a S500 loss. No other land was purchased during the period Dividends in the amount of S2,000 were paid during the year 1. 2. 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started