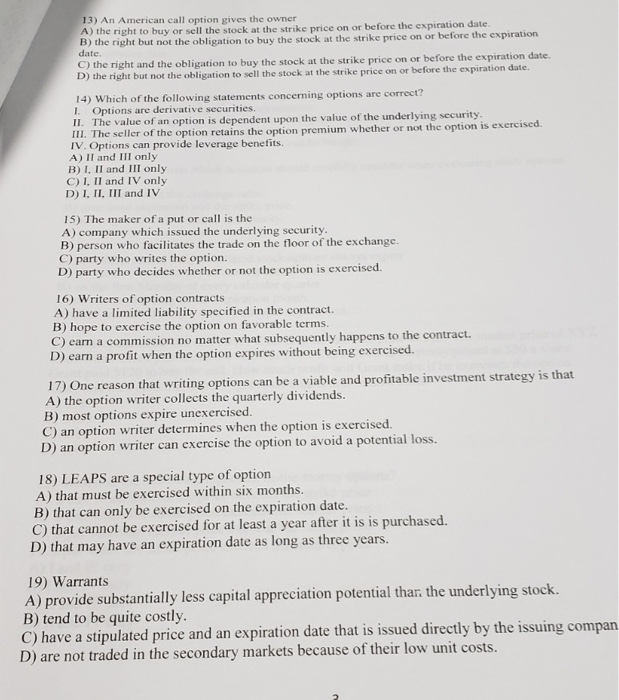

13) An American call option gives the owner A) the right to buy or sell the stock at the strike price on or before the expiration date. B) the right but not the obligation to buy the stock at the strike price on or before the expiration date C) the right and the obligation to buy the stock at the strike price on or before the expiration date D) the right but not the obligation to sell the stock at the strike price on or before the expiration date. 14) Which of the following statements concerning options are correct? 1. Options are derivative securities. II. The value of an option is dependent upon the value of the underlying security. m. The seller of the option retains the option premium whether or not the option is exercised. IV. Options can provide leverage benefits All and Ill only B) I, II and III only C) I, II and IV only D) I, II, III and IV 15) The maker of a put or call is the A) company which issued the underlying security. B) person who facilitates the trade on the floor of the exchange. C) party who writes the option. D) party who decides whether or not the option is exercised. 16) Writers of option contracts A) have a limited liability specified in the contract. B) hope to exercise the option on favorable terms. C) earn a commission no matter what subsequently happens to the contract. D) earn a profit when the option expires without being exercised. 17) One reason that writing options can be a viable and profitable investment strategy is that A) the option writer collects the quarterly dividends. B) most options expire unexercised. C) an option writer determines when the option is exercised. D) an option writer can exercise the option to avoid a potential loss. 18) LEAPS are a special type of option A) that must be exercised within six months. B) that can only be exercised on the expiration date. C) that cannot be exercised for at least a year after it is is purchased. D) that may have an expiration date as long as three years. 19) Warrants A) provide substantially less capital appreciation potential than the underlying stock. B) tend to be quite costly. C) have a stipulated price and an expiration date that is issued directly by the issuing compan D) are not traded in the secondary markets because of their low unit costs