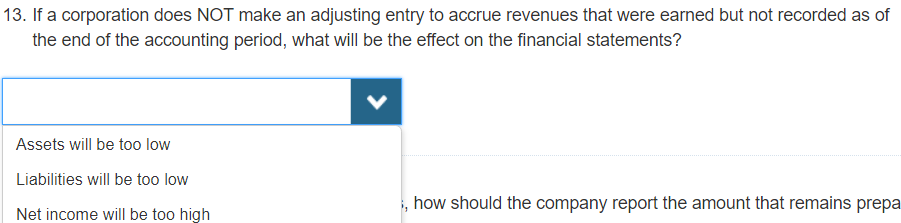

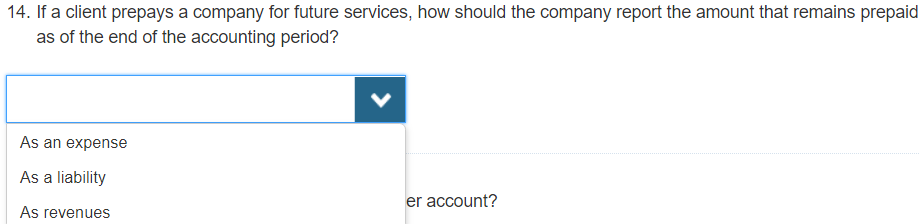

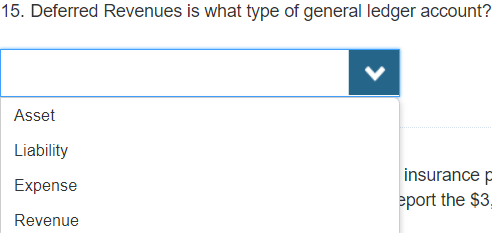

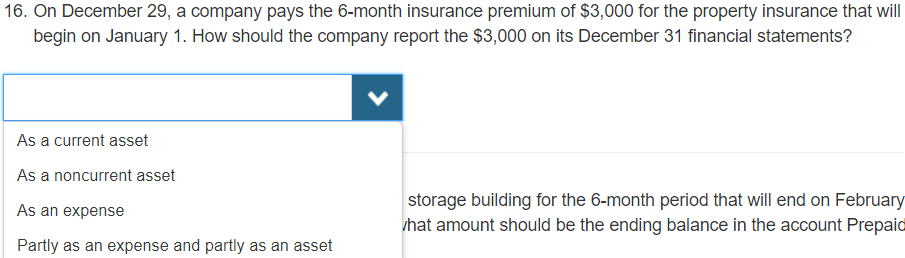

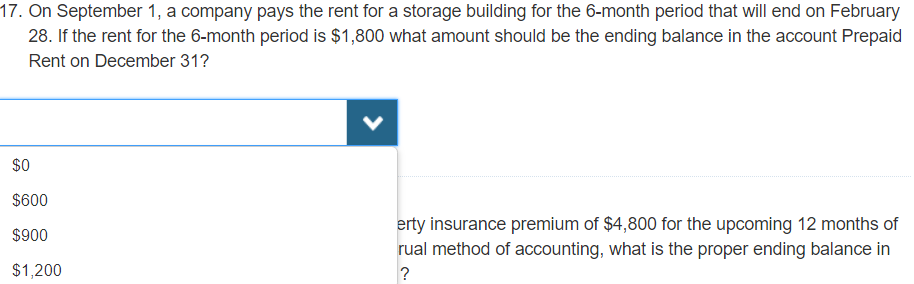

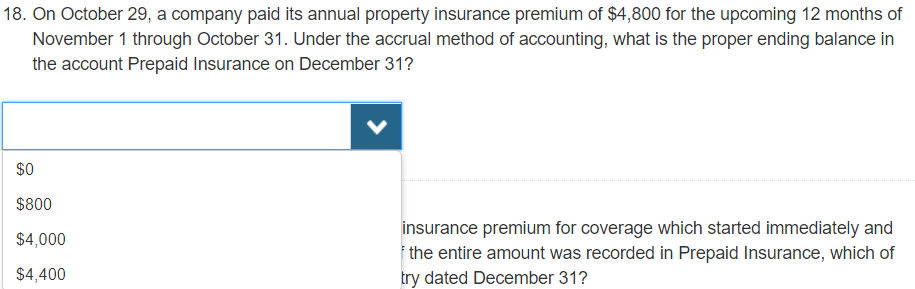

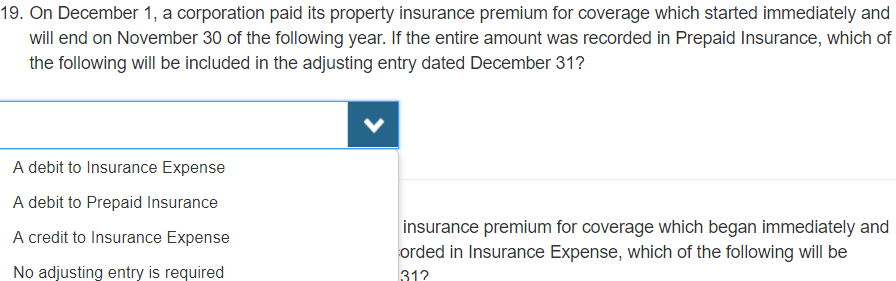

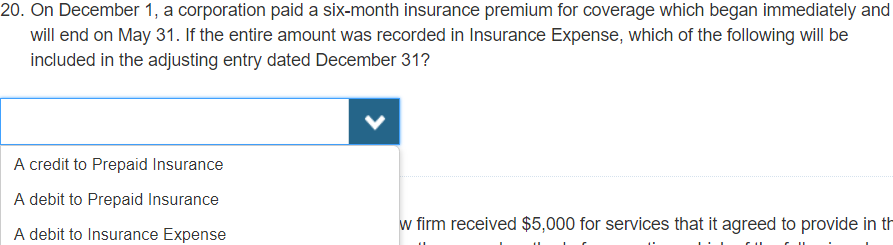

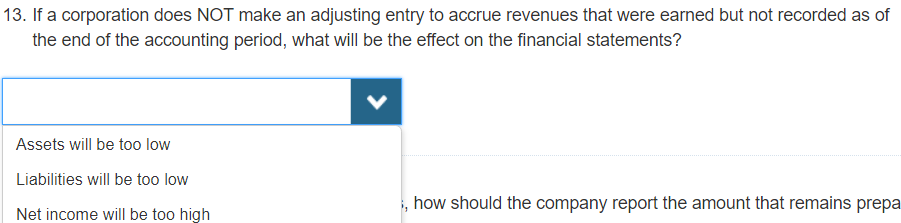

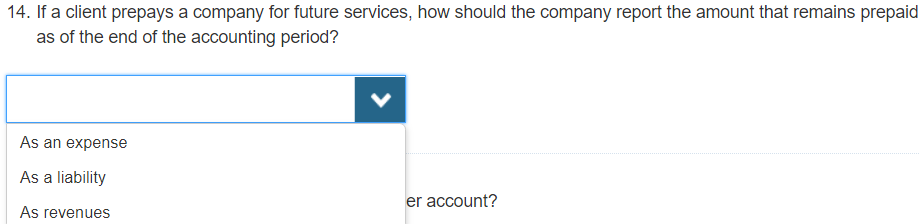

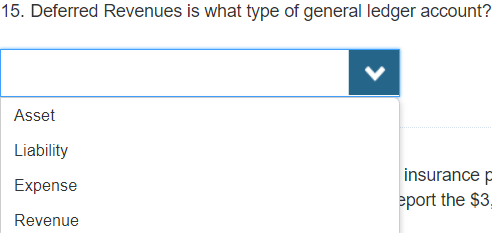

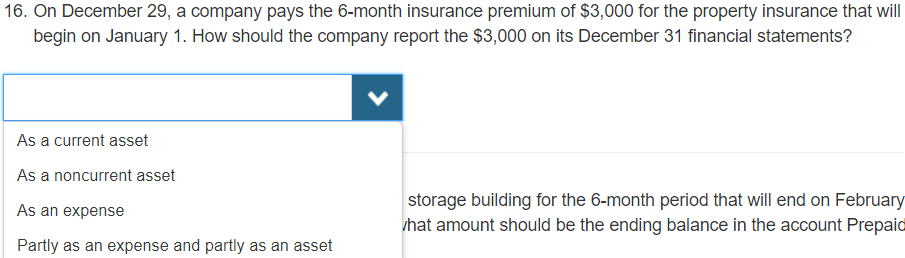

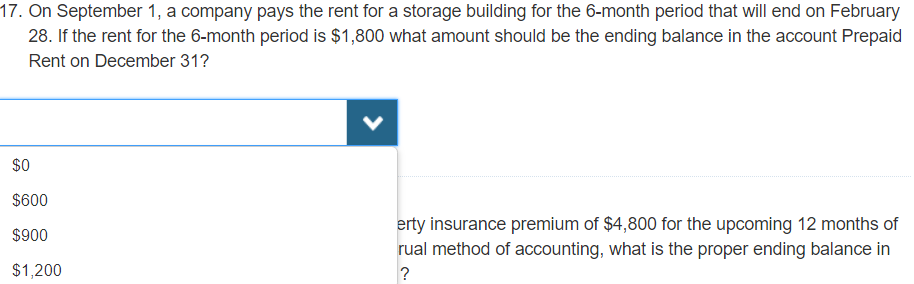

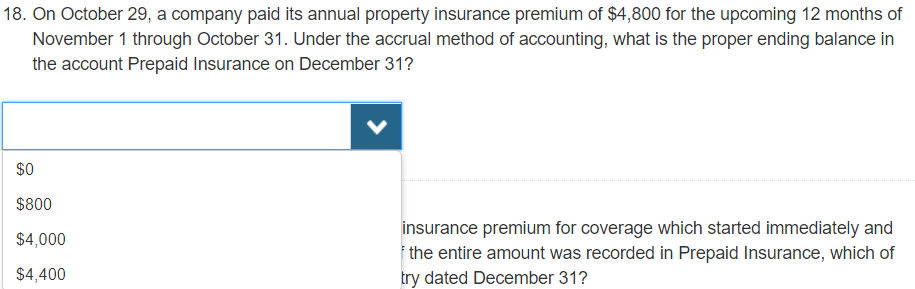

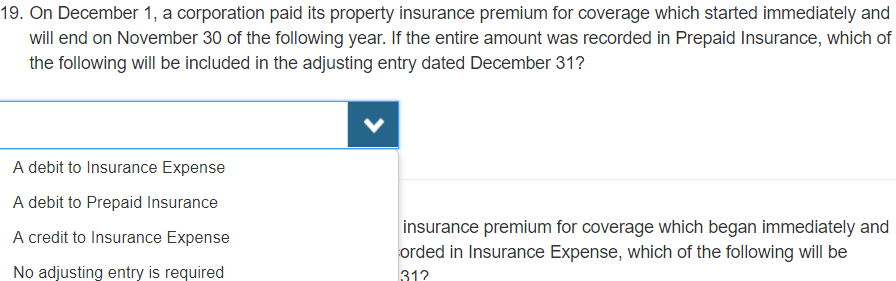

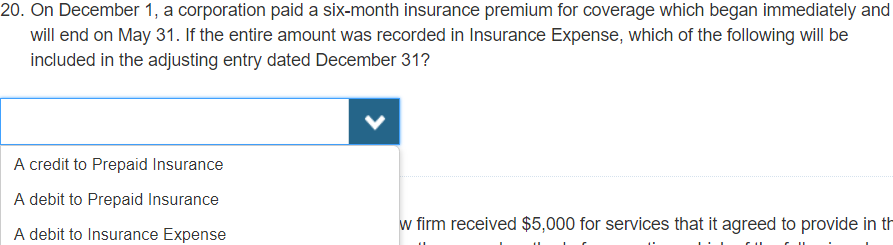

13. If a corporation does NOT make an adjusting entry to accrue revenues that were earned but not recorded as of the end of the accounting period, what will be the effect on the financial statements? Assets will be too low Liabilities will be too low Net income will be too high , how should the company report the amount that remains prepa 14. If a client prepays a company for future services, how should the company report the amount that remains prepaid as of the end of the accounting period? As an expense As a liability As revenues er account? 15. Deferred Revenues is what type of general ledger account? Asset Liability Expense Revenue insurance p eport the $3 16. On December 29, a company pays the 6-month insurance premium of S3,000 for the property insura nce that will begin on January 1. How should the company report the $3,000 on its December 31 financial statements? As a current asset As a noncurrent asset As an expense Partly as an expense and partly as an asset storage building for the 6-month period that will end on February hat amount should be the ending balance in the account Prepaic 17. On September 1, a company pays the rent for a storage building for the 6-month period that will end on February 28. If the rent for the 6-month period is $1,800 what amount should be the ending balance in the account Prepaid Rent on December 31? $O $600 $900 $1,200 erty insurance premium of $4,800 for the upcoming 12 months of rual method of accounting, what is the proper ending balance in 18. On October 29, a company paid its annual property insurance premium of $4,800 for the upcoming 12 months of November 1 through October 31. Under the accrual method of accounting, what is the proper ending balance in the account Prepaid Insurance on December 31? $0 $800 $4,000 $4,400 insurance premium for coverage which started immediately and the entire amount was recorded in Prepaid Insurance, which of y di 31? 19. On December 1, a corporation paid its property insurance premium for coverage which started immediately and will end on November 30 of the following year. If the entire amount was recorded in Prepaid Insurance, which of the following will be included in the adjusting entry dated December 31? A debit to Insurance Expense A debit to Prepaid Insurance A credit to Insurance Expense No adjusting entry is required insurance premium for coverage which began immediately and orded in Insurance Expense, which of the following will be 31? 20. On December 1, a corporation paid a six-month insurance premium for coverage which began immediately and will end on May 31. If the entire amount was recorded in Insurance Expense, which of the following will be included in the adjusting entry dated December 31? A credit to Prepaid Insurance A debit to Prepaid Insurance A debit to Insurance Expense firm received $5,000 for services that it agreed to provide in ti