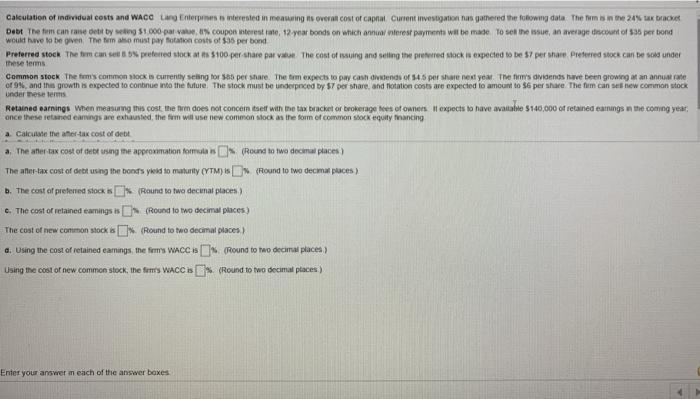

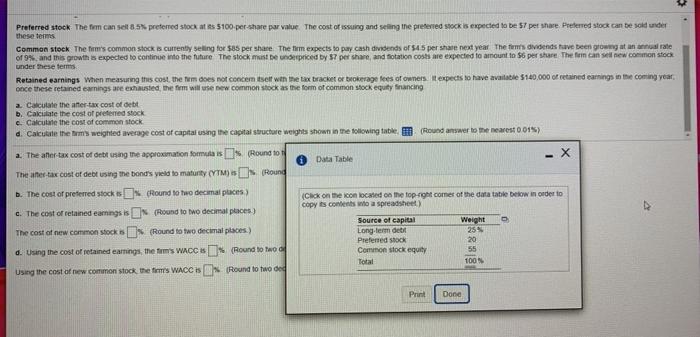

Calculation of individual costs and WACC tang Enterpress interested in measuring his overall cost of capiat. Current investigation fun gamered the foowing data The Time 24% tax bracket Dobr. The tem cantante der by en 51.000 para coupon wterest rate, 12 year bonds on which annual interest payment wit be made. To set the issue, an average discount of 536 per bond would have to be given the forma must pay frotation costs of $36 per bond Preferred stock The tem can set preferred stock 100 pershare par var. The cost of issuing and selling the preferred stock is expected to be 57 per share preferred stock can be sold under these terms Common stock The fm's common stock is currently selling for 85 per share. The tem expects to pay cash dividends of 45 pet share next year. The tems dividends have been growing an annual of 9% and the growth is expected to continue into the future. The stock must be underpriced by 57 per share, and Totation costs are expected to amount to 56 per share. The fim can ses new common stock under these terms Retained earnings when measumng this cost the ton does not concem esett with the tax bracket or brokerage lees of owners expects to have avaubte 140.000 of retained earnings n the coming year, once these reared earrings are exhausted, the form will use new common stock as the form of common stock equity Mancing a. Calculate the art cost of debt a. The aner tax cost of the using the approximation tomon (Round to two decimal places The after-tax cost of debt using the bontsykid to maturity CYTM) D {Round to two decima puces) b. The cost of prebered stocks Round to two decenat places c. The cost of retained earnings (Round to two decimal places) The cost of new common stock (Round to two decimal places) d. Using the cost of retained earnings, the firm's WACC S % Pound to modecimal places) Using the cost of new common stock, the formes WACCO ((Round to two decimal places) Enter your answer m each of the answer boxes Preferred stock. The firm can selt 8.5% preferred stock at 5100 per share par value. The cost of issuing and selling the preferred stock is expected to be 57 per shure Preferred stock can be sold under these terms Common stock The firm's common stock is currently selling for $85 per share the firm expects to pay cash dividends of $45 per share next year The forms dividends have been gong at nate of 9% and this growth is expected to continue into the future the stock med priced by 57 per share and flotation costs are expected to amount to $6 persture The fu can sel new common stock under these terms Retained earnings When measuring this cost the form does not concem self win the tax bracket or brokerage lees of owners. It expects to have available 5140,000 of retained earnings in the coming year, once these retained earnings are exhausted the firm will use new common stock as the form of common stock equity financing a. Calculate the after tax cost of debt b. Calculate the cost of preferred stock e. Calculate the cost of common stock d. Calculate them weighted average cost of capital using the capital structure weights shown in the following table (Round answer to the nearest 001) a. The after tax cost of debt using the approximation formula is (Round to Data Table - X The aner-tax cost of debt using the band's yeld to maturity (TM) I (Round D. The cost of preferred stocks Round to two decimal places (Click on the con located on the top right comer of the datatable below in order to copy its contents who a spreadsheet c. The cost of retained earnings is found to two decimal places Source of capital Weight The cost of new common stock > (Round decimal places.) cong-term det 25 Preferred stock 20 d. Using the cost of retained earnings, the fom's WACC I (Round to wool Common stock equity 55 Total 100% Using the cost of new common stock the time WACC (Round to twoord Print Done