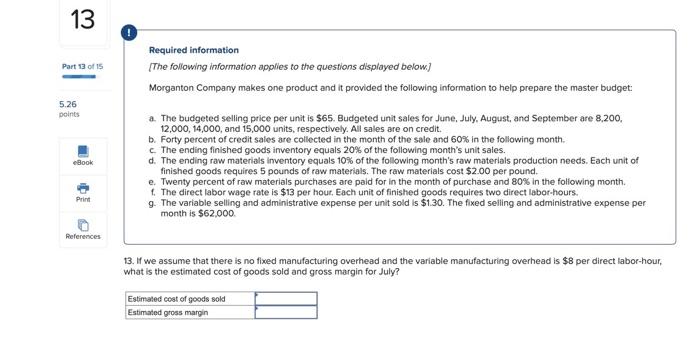

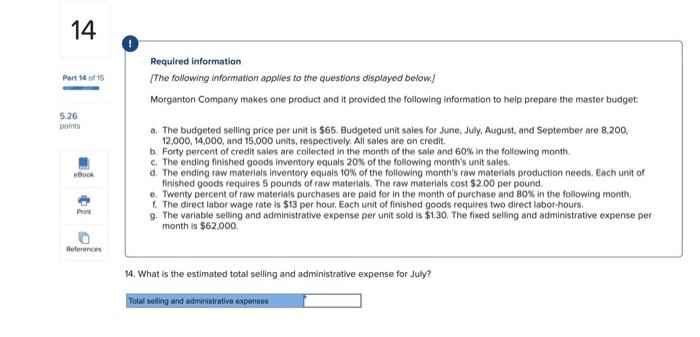

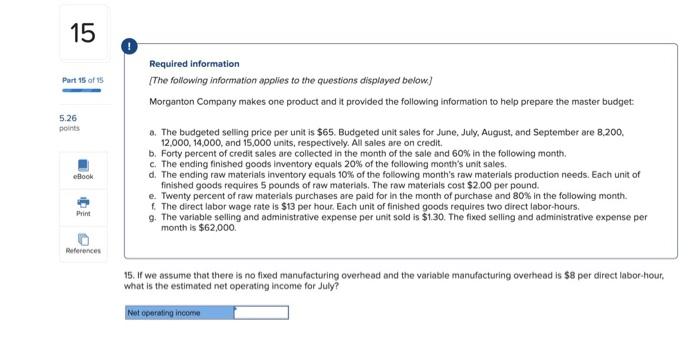

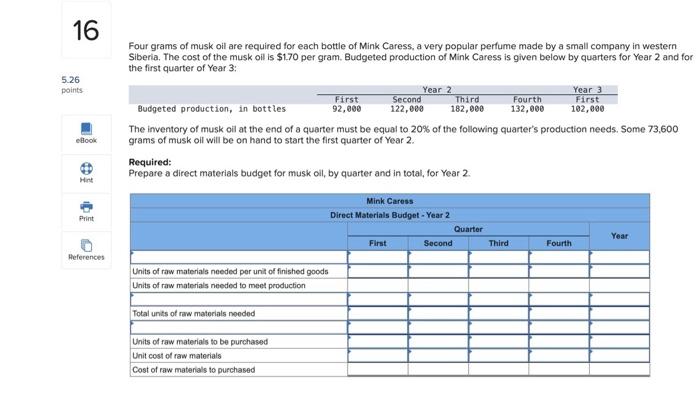

13 Part 1 of 15 Required information The following information applies to the questions displayed below) Morganton Company makes one product and it provided the following information to help prepare the master budget: 5.26 points Book a. The budgeted selling price per unit is $65. Budgeted unit sales for June July August, and September are 8.200, 12,000, 14,000, and 15,000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. The ending finished goods inventory equals 20% of the following month's unit sales. d. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. e. Twenty percent of raw materials purchases are paid for in the month of purchase and 80% in the following month. 4. The direct labor wage rate is $13 per hour. Each unit of finished goods requires two direct labor-hours. 9. The variable selling and administrative expense per unit sold is $1.30. The fixed seling and administrative expense per month is $62.000 Print References 13. If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $8 per direct labor-hour, what is the estimated cost of goods sold and gross margin for July? Estimated cost of goods sold Estimated gross margin 14 1 Part 14 of 15 Required information The following information applies to the questions displayed below.) Morganton Company makes one product and it provided the following information to help prepare the master budget: 5.26 points Book a. The budgeted selling price per unit is $65. Budgeted unit sales for June July August, and September are 8.200, 12,000, 14.000, and 15.000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. c. The ending finished goods inventory equals 20% of the following month's unit sales, d. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound Twenty percent of raw materials purchases are paid for in the month of purchase and 80% in the following month, The direct labor wage rate is $13 per hour. Each unit of finished goods requires two direct labor-hours. 9. The variable selling and administrative expense per unit sold is $130. The fixed seling and administrative expense per month is $62.000. Print References 14. What is the estimated total selling and administrative expense for July? Total selling and administrative expenses 15 Part 1 of 1 Required information The following information applies to the questions displayed below) Morganton Company makes one product and it provided the following information to help prepare the master budget 5.26 points eBook a. The budgeted selling price per unit is $65. Budgeted unit sales for June July August, and September are 8.200. 12,000, 14,000, and 15,000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. c. The ending finished goods Inventory equals 20% of the following month's unit sales. d. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. e. Twenty percent of raw materials purchases are paid for in the month of purchase and 80% in the following month. The direct labor wage rate is $13 per hour. Each unit of finished goods requires two direct labor-hours. 9. The variable selling and administrative expense per unit sold is $1.30. The fixed selling and administrative expense per month is $62,000 Print References 15. If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $8 per direct labor-hour, what is the estimated net operating income for July? Net operating income 16 5.26 points Four grams of musk oil are required for each bottle of Mink Caress, a very popular perfume made by a small company in western Siberia. The cost of the musk oil is $1.70 per gram. Budgeted production of Mink Caress is given below by quarters for Year 2 and for the first quarter of Year 3: Year 2 Year 3 First Second Third Fourth First Budgeted production, in bottles 92,000 122,000 182,000 132,000 102,000 The inventory of musk oil at the end of a quarter must be equal to 20% of the following quarter's production needs. Some 73,600 grams of musk oil will be on hand to start the first quarter of Year 2. Required: Prepare a direct materials budget for musk oil, by quarter and in total, for Year 2 look Print Mink Caress Direct Materials Budget - Year 2 Quarter Second Year First Third Fourth References Units of raw materials needed per unit of finished goods Units of raw materials needed to meet production Total units of raw materials needed Units of raw materials to be purchased Unit cost of raw materials Cost of raw materials to purchased