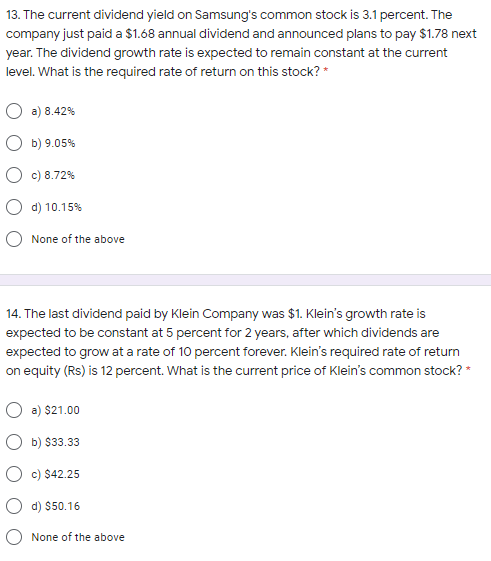

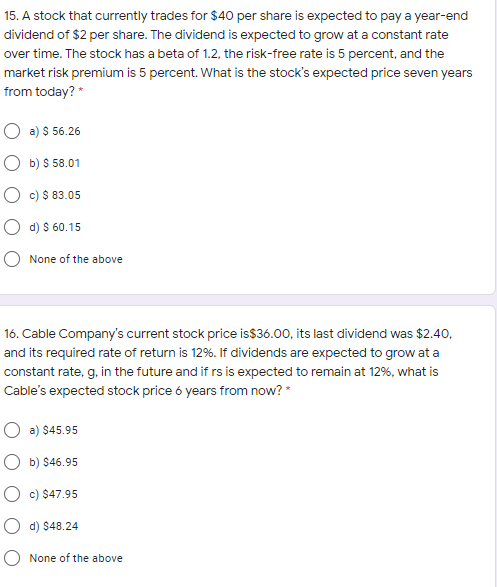

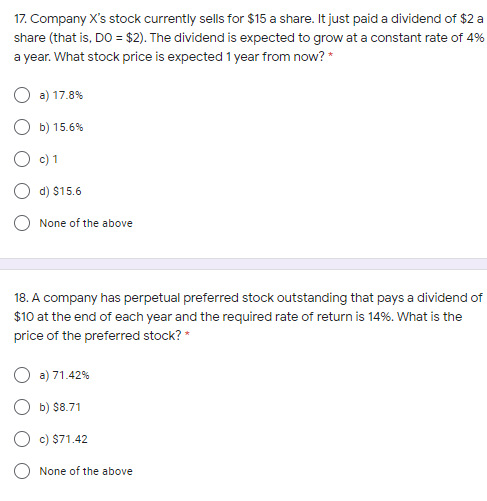

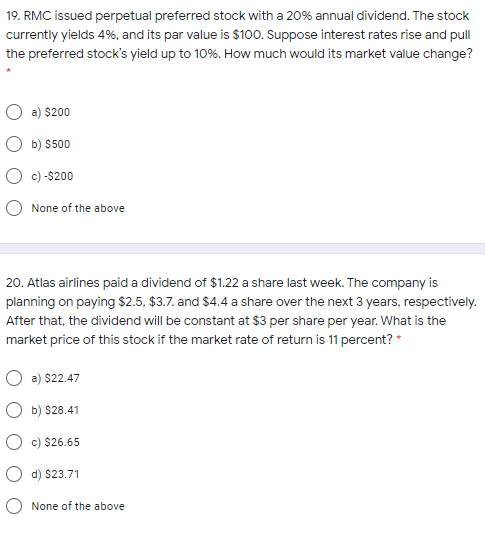

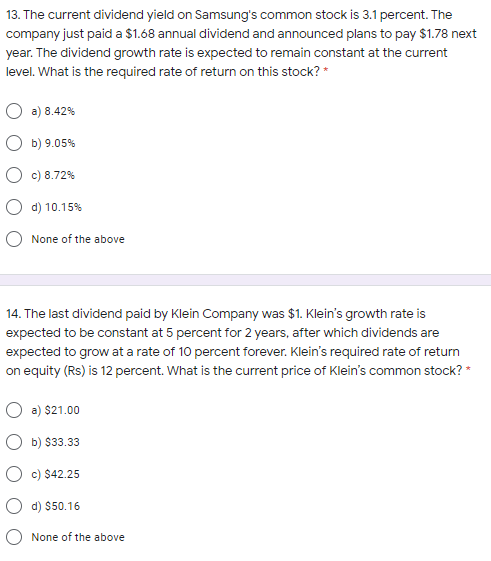

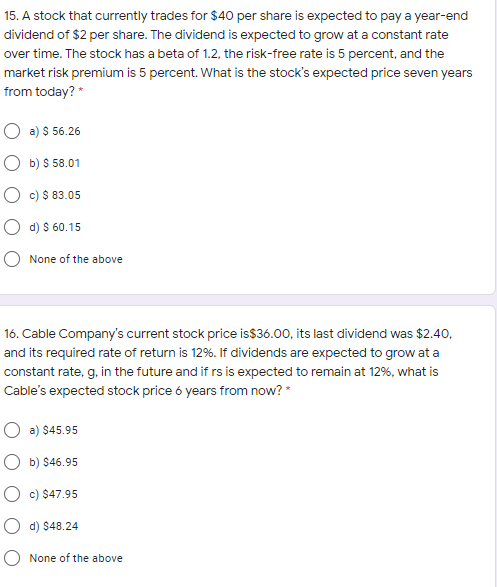

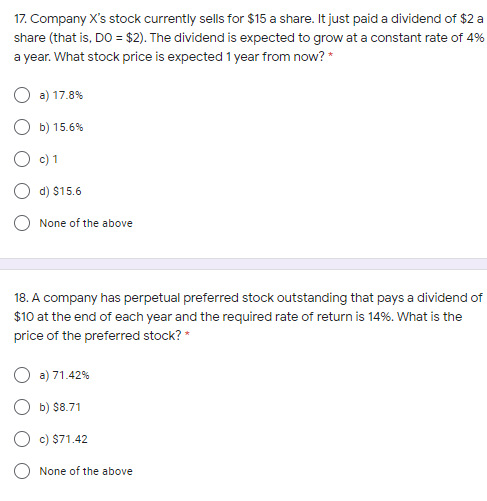

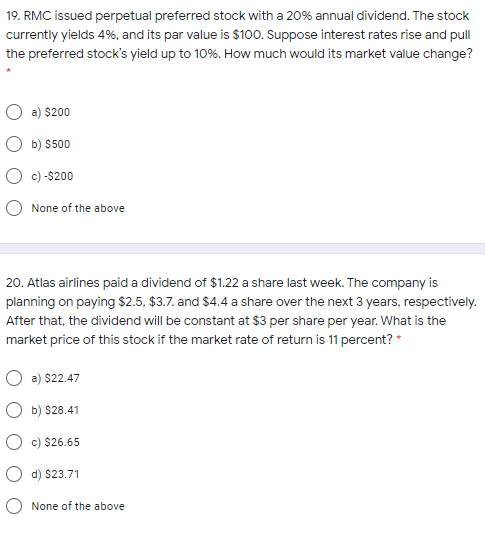

13. The current dividend yield on Samsung's common stock is 3.1 percent. The company just paid a $1.68 annual dividend and announced plans to pay $1.78 next year. The dividend growth rate is expected to remain constant at the current level. What is the required rate of return on this stock?* a) 8.42% b) 9.05% c) 8.72% d) 10.15% None of the above 14. The last dividend paid by Klein Company was $1. Klein's growth rate is expected to be constant at 5 percent for 2 years, after which dividends are expected to grow at a rate of 10 percent forever. Klein's required rate of return on equity (Rs) is 12 percent. What is the current price of Klein's common stock?* a) $21.00 O b) $33.33 c) $42.25 O d) $50.16 None of the above 15. A stock that currently trades for $40 per share is expected to pay a year-end dividend of $2 per share. The dividend is expected to grow at a constant rate over time. The stock has a beta of 1.2, the risk-free rate is 5 percent, and the market risk premium is 5 percent. What is the stock's expected price seven years from today?* O a) $ 56.26 O b) S 58.01 O c) $ 83.05 d) $ 60.15 None of the above 16. Cable Company's current stock price is$36.00, its last dividend was $2.40, and its required rate of return is 12%. If dividends are expected to grow at a constant rate, g, in the future and if rs is expected to remain at 12%, what is Cable's expected stock price 6 years from now? a) $45.95 Ob) $46.95 Oc) $47.95 O d) $48.24 None of the above 17. Company X's stock currently sells for $15 a share. It just paid a dividend of $2 a share (that is, DO = $2). The dividend is expected to grow at a constant rate of 4% a year. What stock price is expected 1 year from now? O a) 17.8% Ob) 15.6% O c) 1 d) $15.6 None of the above 18. A company has perpetual preferred stock outstanding that pays a dividend of $10 at the end of each year and the required rate of return is 14%. What is the price of the preferred stock?* a) 71.42% b) $8.71 O c) $71.42 O None of the above 19. RMC issued perpetual preferred stock with a 20% annual dividend. The stock currently yields 4%, and its par value is $100. Suppose interest rates rise and pull the preferred stock's yield up to 10%. How much would its market value change? a) $200 b) $500 Oc)-$200 None of the above 20. Atlas airlines paid a dividend of $1.22 a share last week. The company is planning on paying $2.5, $3.7. and $4.4 a share over the next 3 years, respectively. After that, the dividend will be constant at $3 per share per year. What is the market price of this stock if the market rate of return is 11 percent?* a) $22.47 b) $28.41 O c) $26.65 O d) $23.71 None of the above