Show all work/explanations for full credit !

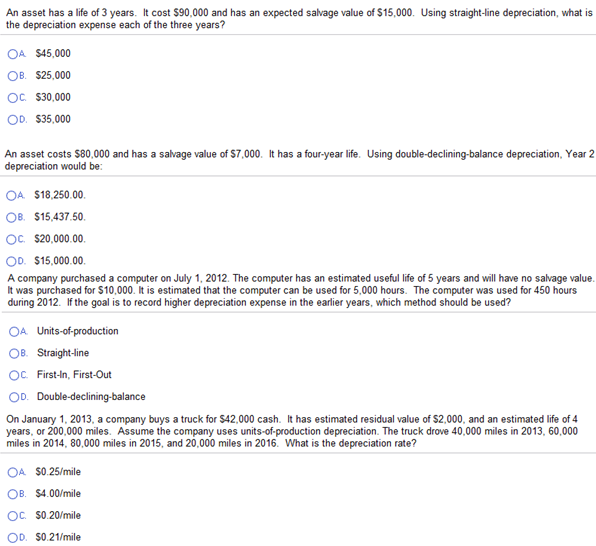

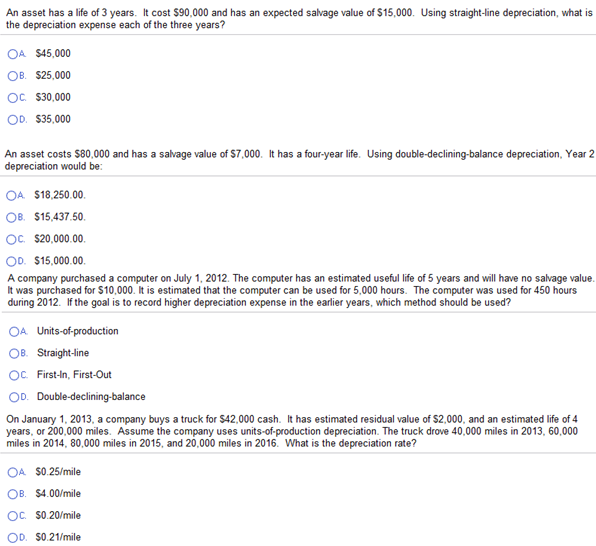

An assets has a life of 3 years. It cost $90,000 and has an expected salvage value of $15,000. Using straight - line depreciation, what is the depreciation expense each of the three years? $45,000 $25,000 $30,000 $35,000 An asset costs $80,000 and has a salvage value of $7,000. It has a four - year life. Using double - declined - balance depreciation, year 2 depreciation would be: $18,250.00. $15,437.50. $20,000.00. $15,000.00. A company purchased a computer on July 1, 2012. The computer has an estimated useful life of 5 years and will have no salvage value. It was purchased for $10,000. It is estimated that the computer can be used for 5,000 hours. The computer was used for 450 hours during 2012. If the goal is to record higher depreciation expense in the earlier years, which method should be used? Units - of - production Straight - line First - In, First - Out Double - declining - balance On January 1, 2013, a company buys a truck for $42,000 cash. IT has estimated residual value of $2,000, and an estimated life of 4 years, or 200,000 miles. Assume the company uses units - of - production - depreciation. The truck drove 40,000 miles in 2013, 60,000 miles in 2014, 80,000 miles in 2015, and 20,000 miles in 2016. What is the depreciation rate?$0.25/mile $4.00/mile $0.20/mile $0.21/mile An assets has a life of 3 years. It cost $90,000 and has an expected salvage value of $15,000. Using straight - line depreciation, what is the depreciation expense each of the three years? $45,000 $25,000 $30,000 $35,000 An asset costs $80,000 and has a salvage value of $7,000. It has a four - year life. Using double - declined - balance depreciation, year 2 depreciation would be: $18,250.00. $15,437.50. $20,000.00. $15,000.00. A company purchased a computer on July 1, 2012. The computer has an estimated useful life of 5 years and will have no salvage value. It was purchased for $10,000. It is estimated that the computer can be used for 5,000 hours. The computer was used for 450 hours during 2012. If the goal is to record higher depreciation expense in the earlier years, which method should be used? Units - of - production Straight - line First - In, First - Out Double - declining - balance On January 1, 2013, a company buys a truck for $42,000 cash. IT has estimated residual value of $2,000, and an estimated life of 4 years, or 200,000 miles. Assume the company uses units - of - production - depreciation. The truck drove 40,000 miles in 2013, 60,000 miles in 2014, 80,000 miles in 2015, and 20,000 miles in 2016. What is the depreciation rate?$0.25/mile $4.00/mile $0.20/mile $0.21/mile