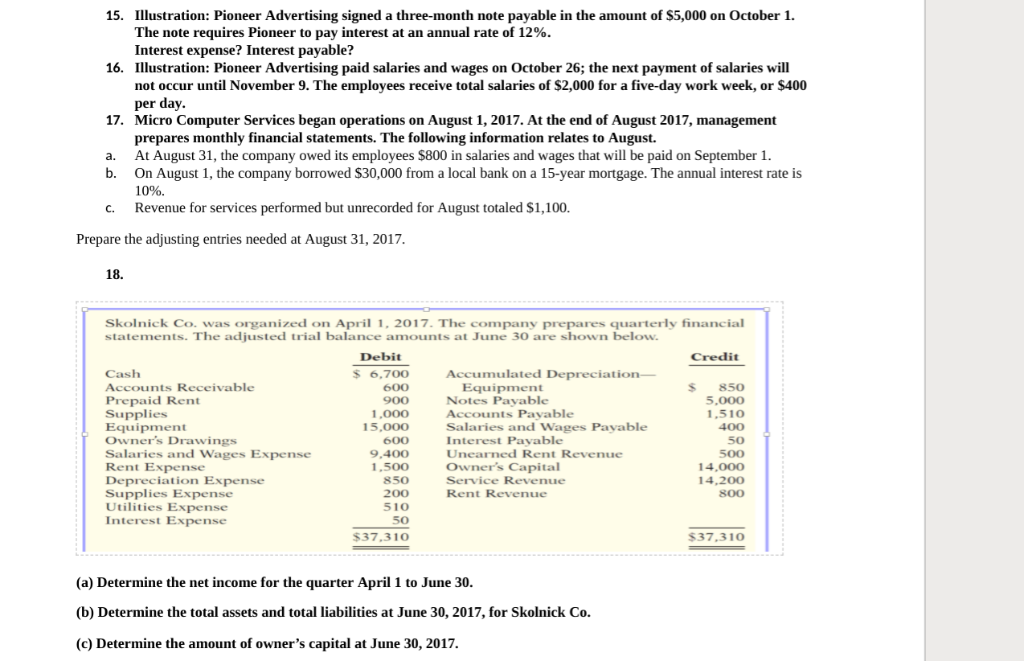

13. The ledger of Hammond Company, on March 31, 2017, includes these selected accounts before adjusting entries are prepared. Debit Credit Prepaid Insurance $ 3,600 Supplies 2,800 Equipment 25,000 Accumulated Depreciation-Equipment $5,000 Unearned Service Revenue 9,200 An analysis of the accounts shows the following. 1. Insurance expires at the rate of s100 per month. 2. Supplies on hand total $800. 3. The equipment depreciates $200 a month. 4. During March, services were performed for one-half of the unearned service revenue Prepare the adjusting entries for the month of March. 14. Illustration: In October Pioneer Advertising performed services worth $200 that were not billed to clients on or before October 31 Oct. 31 Accounts Receivable? Service Revenue? On November 10, Pioneer receives cash of $200 for the services performed Cash? ccounts Receivable? 15. Illustration: Pioneer Advertising signed a three-month note payable in the amount of $5,000 on October 1. The note requires Pioneer to pay interest at an annual rate of 12%. Interest expense? Interest payable? Illustration: Pioneer Advertising paid salaries and wages on October 26; the next payment of salaries will not occur until November 9. The employees receive total salaries of $2,000 for a five-day work week, or $400 per day. 16. 17. Micro Computer Services began operations on August 1, 2017. At the end of August 2017, management prepares monthly financial statements. The following information relates to August. At August 31, the company owed its employees $800 in salaries and wages that will be paid on September1 On August 1, the company borrowed $30,000 from a local bank on a 15-year mortgage. The annual interest rate is 10%. a. b. C. Revenue for services performed but unrecorded for August totaled S$1,100 Prepare the adjusting entries needed at August 31, 2017 18. Skolnick Co. was organized on April 1, 2017.The company prepares quarterly financial statements. The adjusted trial balance amounts at June 30 are shown below. Debit Credit $ 6.700 600 umulated Depreciati Cash Accounts Receivable Prepaid Rent Supplies Equipment Owner's Drawings Salaries and Wages Expense Rent Expense Depreciation Expense Supplies Expense Utilities Expense Interest Expense Equipment Notes Payable Accounts Pavable Salaries and Wages Payable Interest Pavable Uneaned Rent Revenue Owner's Capital Service Revenue Rent Revenue S850 5,000 1,510 400 50 500 14,000 14,200 800 1,000 15,00O 9.400 1.500 850 200 510 50 $37.310 $37,310 (a) Determine the net income for the quarter April 1 to June 30 (b) Determine the total assets and total liabilities at June 30, 2017, for Skolnick Co. (c) Determine the amount of owner's capital at June 30, 2017