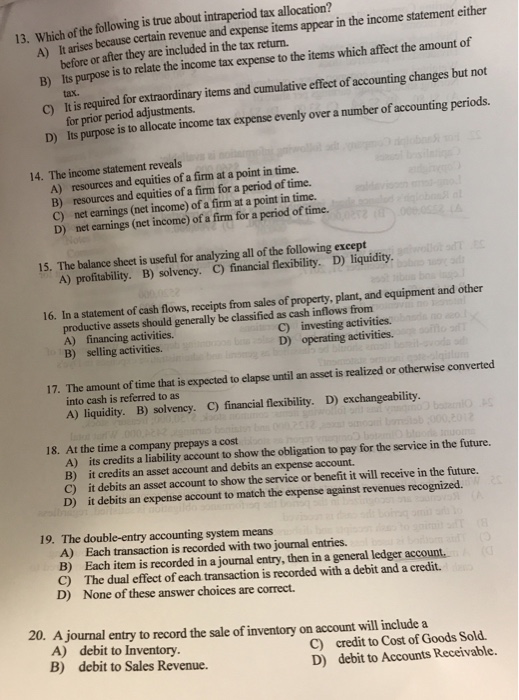

13. Which of the following is true about intraperiod tax allocation? A) It arises because certain revenue and expense items appear in the income statement either before or after they are included in the tax return. Its purpose is to relate the income tax expense to the items which affect the amount of B) C) D) It is required for extraordinary items and cumulative effect of accounting changes but not for prior period adjustments Its purpose is to allocate income tax expense evenly over a number of accounting periods. tax. 14. The income statement reveals A) resources and equities of a firm at a point in time. B) resources and equities of a firm for a period of time. C) net earnings (net income) of a firm at a point in time. D) net earnings (net income) of a firm for a period of time. 15. The balance sheet is useful for analyzing all of the following except A) profitability. B) solvency. C) financial flexibility. D) liquidity 16. In a statement of cash flows, receipts from sales of property, plant, and equipment and other productive assets should generally be classified as cash inflows from A) financing activities. B) selling activities. C) investing activities. D) operating activities. 17. The amount of time that is expected to elapse until an asset is realized or otherwise converted into cash is referred to as A) liquidity. B) solvency. C) financial flexibility. D) exchangeability 18. At the time a company prepays a cost A) its credits a liability account to show the obligation to pay for the service in the future. B) it credits an asset account and debits an expense account. C) it debits an asset account to show the service or benefit it will receive in the future. D) it debits an expense account to match the expense against revenues recognized. 19. The double-entry accounting system means A) Each transaction is recorded with two journal entries. B) Each item is recorded in a journal entry, then in a general ledger account. C) The dual effect of each transaction is recorded with a debit and a credit. D) None of these answer choices are correct. 20. A journal entry to record the sale of inventory on account will include a A) B) debit to Inventory. debit to Sales Revenue. C) credit to Cost of Goods Sold D) debit to Accounts Receivable