Answered step by step

Verified Expert Solution

Question

1 Approved Answer

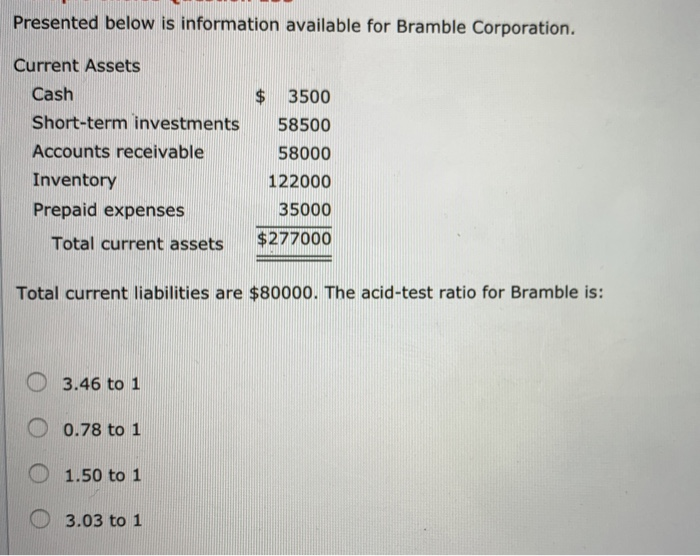

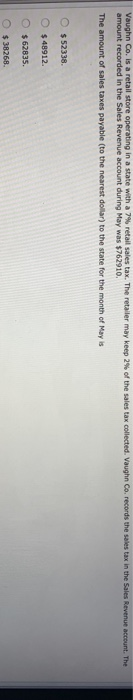

1. 2. 3. 4. 5. Presented below is information available for Bramble Corporation. Current Assets Cash $3500 Short-term investments 58500 58000 122000 35000 Total current

1.

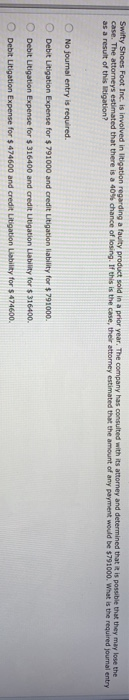

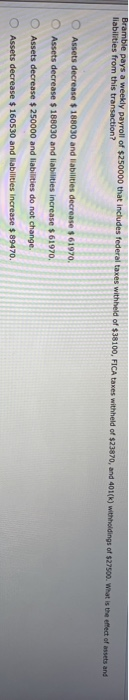

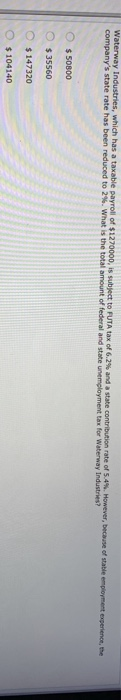

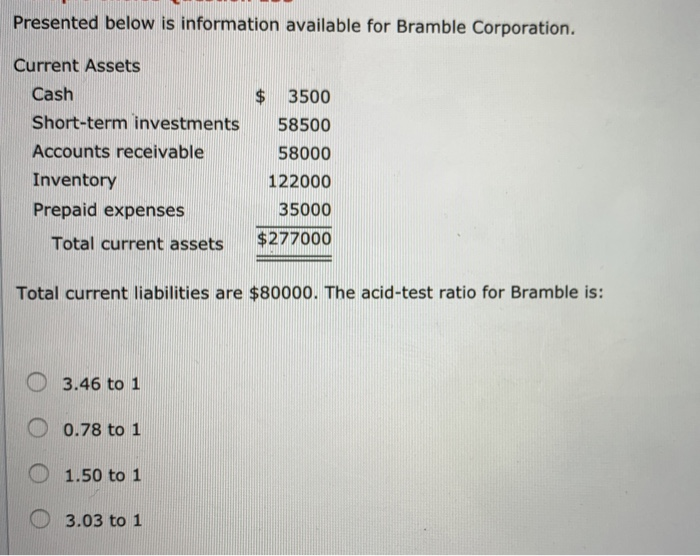

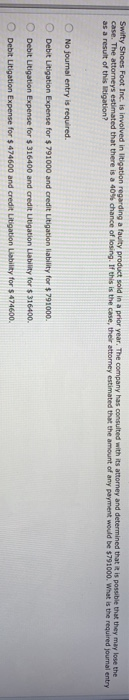

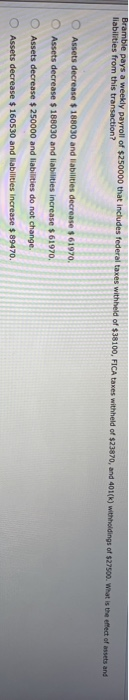

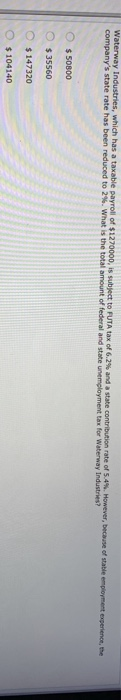

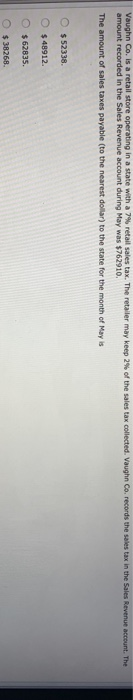

Presented below is information available for Bramble Corporation. Current Assets Cash $3500 Short-term investments 58500 58000 122000 35000 Total current assets $277000 Accounts receivable Inventory Prepaid expenses Total current liabilities are $80000. The acid-test ratio for Bramble is: O 3.46 to 1 (-) 0.78 to 1 1.50 to 1 3.03 to 1 Swifty Shoes Foot Inc. is involved in litigation regarding a faulty product sold in a prior year. The company has consulted with its attorney and determined that it is possible that they may lose the of losing. If this is the case, their attorney estimated that the amount of any payment would be $791000. What is the required journal entry O No journal entry is required. O Debit Litigation Expense for $ 791000 and credit Litigation liability for $ 791000. O Debit Lutigation Expense for $ 316400 and credit Litigation Liabity for s 316400. O Debit Litigation Expense for $ 474600 and credit Litigation Liability for s 474600. omora SS0000 that includes federal taxes withheld of S38100, FCA taxes with held of $23870, and 401(k) s of $2750o. What is the effect of assets and liabilities from this transaction? O O Assets decrease $ 188030 and liabilities decrease $ 61970 Assets decrease $ 188030 and liabilities increase $61970 Assets decrease $250000 and liabilities do not change Assets decrease $ 160530 and liabilities increase 89470 s, which has a taxable payroll of $12 tate rate has been reduced to 2%. What is the total amount of federal and state unemployment tax O $ 50800 O $35560 O s 147320 O $ 104140 Vaughn Co is a retail store operating in a state with a 7% retail sales tax. The retailer may keep 2% of the sales tax collected Vaughn Co. records the sales tax in the Sales Revenue account. The amount recorded in the Sales Revenue account during May was $762910. The amount of sales taxes payable (to the nearest dollar) to the state for the month of May is O s 52338. $48912. 0362835. $38268

2.

3.

4.

5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started