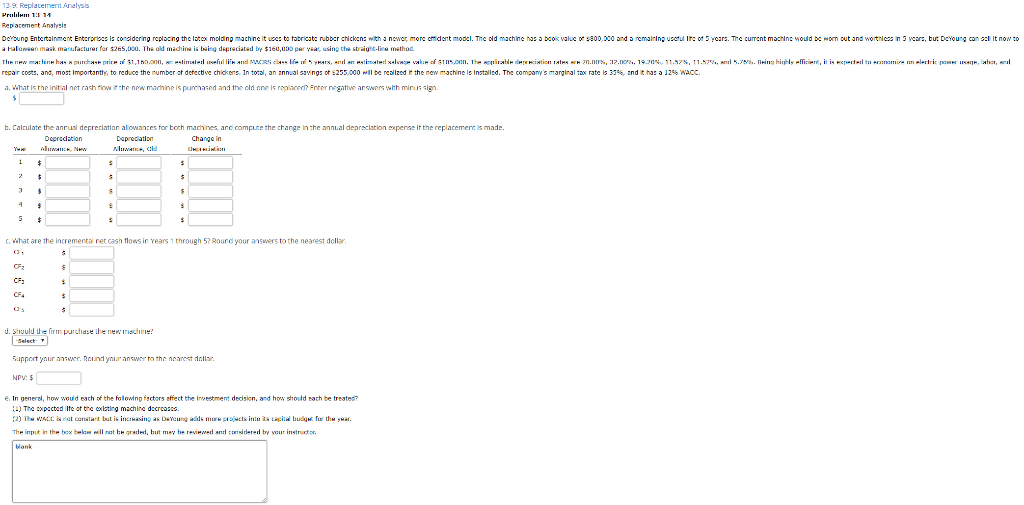

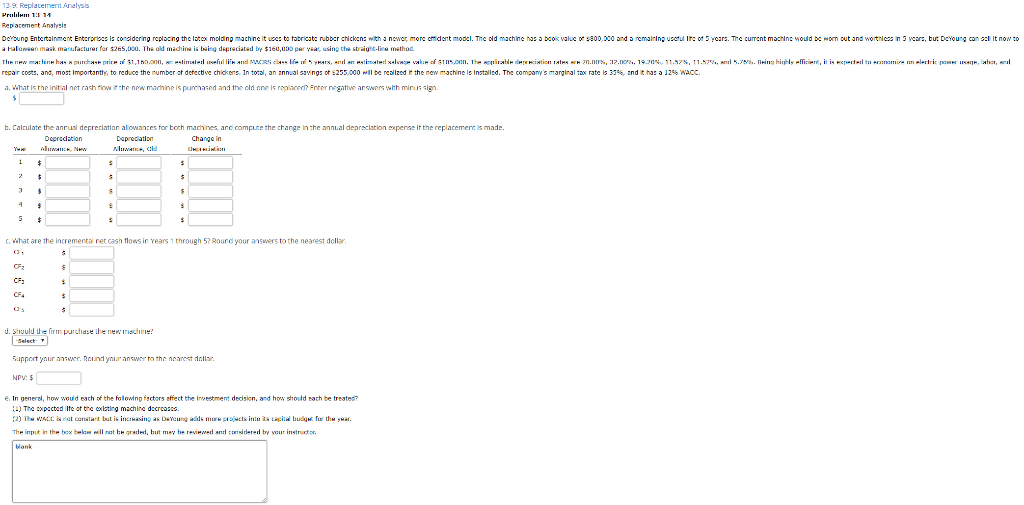

139 Replacement Analysis Prullem 1:1 14 Replacement Analysis Debung Entertainment Enterprise is considering replacing the late moldinpach ncit ze to tabricate rubber chicken with a newer, more c ont model. The old machine has a book valuco 800.000 and a remaining setul Ile of 5 years. The current machine would be worn out and worth ces in 5 years, but Dcyoung cancel It now to a Halloween mak manufacturer for $265.000. The old machine is being depreciated by $160,per year, using the straight-line method. The new hin c hasi 1,100.00, imate and c le a and animal of A1. the won als N 20.00, 12.07.10.2011.17, 11.5%, . .. Bring highly efficient, it is experten miren electric powe r , recar coets, and most importantly, to reduce the number of detective chickens In total, an annual savings of 1255.000 will be realized the new machine is installed. The company's marginal tax rate is 35%, and it has a 125 WACC. 1. What is the initial netrachlow he new machine is purchased and the old one e v e rentive answers with minus sign b. Calculate the annual depreciation allowances for both machines, and compute the change in the annual depreciation expense of the replacement is made Depreciation Depreciation Change in Y AWAR, NEW ERAT , Cold UN What are the incrementa net cash flows in Years 1 through 57 Round your answers to the nearest dollar purchase new machine? u. Svould defir Select Support your answer. Round your answer to the nearest dollar. NPV: $ In general, how would each of the folowing factors affect the investment decision, and how should each be treated? 1.) The expected life of the exciting machine decreases 2) The WAC C Constant but is increasing as DeYoung Adds more projects into il capital budget for the war The input in the box below will the grade, but may be reviewed and considered to your instructor 139 Replacement Analysis Prullem 1:1 14 Replacement Analysis Debung Entertainment Enterprise is considering replacing the late moldinpach ncit ze to tabricate rubber chicken with a newer, more c ont model. The old machine has a book valuco 800.000 and a remaining setul Ile of 5 years. The current machine would be worn out and worth ces in 5 years, but Dcyoung cancel It now to a Halloween mak manufacturer for $265.000. The old machine is being depreciated by $160,per year, using the straight-line method. The new hin c hasi 1,100.00, imate and c le a and animal of A1. the won als N 20.00, 12.07.10.2011.17, 11.5%, . .. Bring highly efficient, it is experten miren electric powe r , recar coets, and most importantly, to reduce the number of detective chickens In total, an annual savings of 1255.000 will be realized the new machine is installed. The company's marginal tax rate is 35%, and it has a 125 WACC. 1. What is the initial netrachlow he new machine is purchased and the old one e v e rentive answers with minus sign b. Calculate the annual depreciation allowances for both machines, and compute the change in the annual depreciation expense of the replacement is made Depreciation Depreciation Change in Y AWAR, NEW ERAT , Cold UN What are the incrementa net cash flows in Years 1 through 57 Round your answers to the nearest dollar purchase new machine? u. Svould defir Select Support your answer. Round your answer to the nearest dollar. NPV: $ In general, how would each of the folowing factors affect the investment decision, and how should each be treated? 1.) The expected life of the exciting machine decreases 2) The WAC C Constant but is increasing as DeYoung Adds more projects into il capital budget for the war The input in the box below will the grade, but may be reviewed and considered to your instructor