Answered step by step

Verified Expert Solution

Question

1 Approved Answer

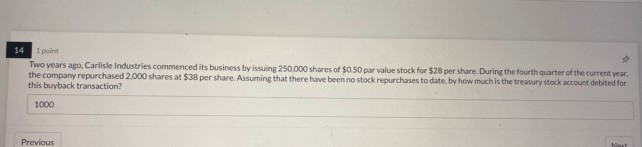

14 1 point Two years ago. Carlisle Industries commenced its business by Issuing 250,000 shares of $0.50 par value stock for $28 per share. During

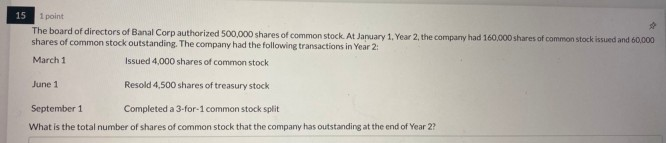

14 1 point Two years ago. Carlisle Industries commenced its business by Issuing 250,000 shares of $0.50 par value stock for $28 per share. During the fourth quarter of the current year, the company repurchased 2,000 shares at $38 per share. Assuming that there have been no stock repurchases to date, by how much is the treasury stock account debited for this buyback transaction? 1000 Previous 14 I point 2 Two years ago. Carlisle Industries commenced its business by Issuing 250,000 shares of $0.50 par value stock for $28 per share. During the fourth quarter of the current year, the company repurchased 2,000 shares at $38 per share. Assuming that there have been no stock repurchases to date, by how much is the treasury stock account debited for this buyback transaction? Previous 15 1 point The board of directors of Banal Corp authorized 500,000 shares of common stock. At January 1, Year 2, the company had 160,000 shares of common stock issued and 60.000 shares of common stock outstanding. The company had the following transactions in Year 2: March 1 Issued 4,000 shares of common stock June 1 Resold 4,500 shares of treasury stock September 1 Completed a 3-for-1 common stock split What is the total number of shares of common stock that the company has outstanding at the end of Year 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started