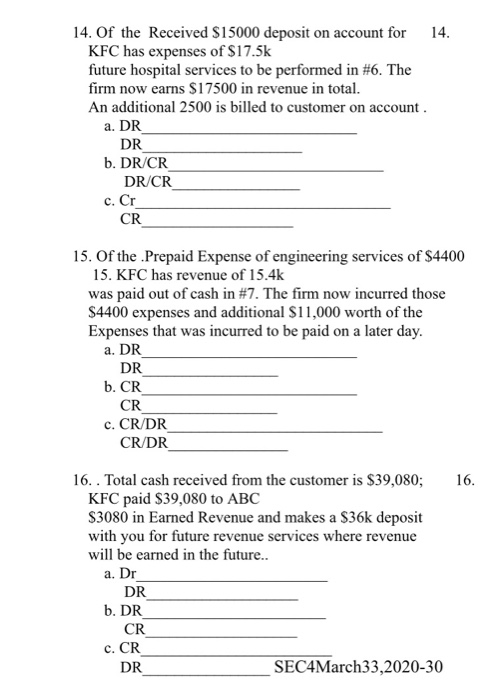

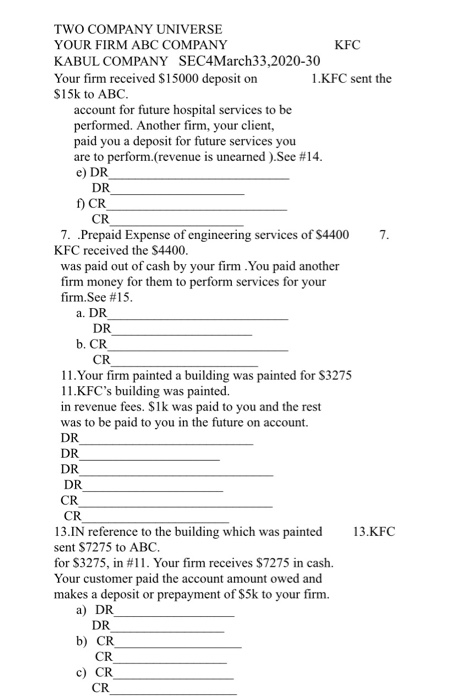

14. 14. Of the Received $15000 deposit on account for KFC has expenses of $17.5k future hospital services to be performed in #6. The firm now earns $17500 in revenue in total. An additional 2500 is billed to customer on account. a. DR DR b. DR/CR DR/CR c. Cr CR 15. Of the Prepaid Expense of engineering services of $4400 15. KFC has revenue of 15.4k was paid out of cash in #7. The firm now incurred those $4400 expenses and additional $11,000 worth of the Expenses that was incurred to be paid on a later day. a. DR DR b. CR CR c. CR/DR CR/DR 16. 16. Total cash received from the customer is $39,080; KFC paid $39,080 to ABC $3080 in Earned Revenue and makes a $36k deposit with you for future revenue services where revenue will be earned in the future.. a. Dr DR b. DR CR c. CR DR SEC4March33,2020-30 TWO COMPANY UNIVERSE YOUR FIRM ABC COMPANY KFC KABUL COMPANY SEC4March33,2020-30 Your firm received $15000 deposit on 1.KFC sent the $15k to ABC. account for future hospital services to be performed. Another firm, your client, paid you a deposit for future services you are to perform.(revenue is unearned ).See #14. e) DR DR f) CR CR 7. Prepaid Expense of engineering services of $4400 7. KFC received the $4400. was paid out of cash by your firm. You paid another firm money for them to perform services for your firm. See #15. a. DR DR b. CR 11. Your firm painted a building was painted for $3275 11.KFC's building was painted. in revenue fees. Slk was paid to you and the rest was to be paid to you in the future on account. DR DR DR DR CR CR CR 13.KFC 13.IN reference to the building which was painted sent $7275 to ABC for $3275, in #11. Your firm receives $7275 in cash. Your customer paid the account amount owed and makes a deposit or prepayment of $5k to your firm. a) DR DR b) CR CR c) CR CR 14. 14. Of the Received $15000 deposit on account for KFC has expenses of $17.5k future hospital services to be performed in #6. The firm now earns $17500 in revenue in total. An additional 2500 is billed to customer on account. a. DR DR b. DR/CR DR/CR c. Cr CR 15. Of the Prepaid Expense of engineering services of $4400 15. KFC has revenue of 15.4k was paid out of cash in #7. The firm now incurred those $4400 expenses and additional $11,000 worth of the Expenses that was incurred to be paid on a later day. a. DR DR b. CR CR c. CR/DR CR/DR 16. 16. Total cash received from the customer is $39,080; KFC paid $39,080 to ABC $3080 in Earned Revenue and makes a $36k deposit with you for future revenue services where revenue will be earned in the future.. a. Dr DR b. DR CR c. CR DR SEC4March33,2020-30 TWO COMPANY UNIVERSE YOUR FIRM ABC COMPANY KFC KABUL COMPANY SEC4March33,2020-30 Your firm received $15000 deposit on 1.KFC sent the $15k to ABC. account for future hospital services to be performed. Another firm, your client, paid you a deposit for future services you are to perform.(revenue is unearned ).See #14. e) DR DR f) CR CR 7. Prepaid Expense of engineering services of $4400 7. KFC received the $4400. was paid out of cash by your firm. You paid another firm money for them to perform services for your firm. See #15. a. DR DR b. CR 11. Your firm painted a building was painted for $3275 11.KFC's building was painted. in revenue fees. Slk was paid to you and the rest was to be paid to you in the future on account. DR DR DR DR CR CR CR 13.KFC 13.IN reference to the building which was painted sent $7275 to ABC for $3275, in #11. Your firm receives $7275 in cash. Your customer paid the account amount owed and makes a deposit or prepayment of $5k to your firm. a) DR DR b) CR CR c) CR CR