Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14 - 23 please. im struggling once i get here ownloads/FNCE%203050%20HW6%20Questions.pdf 7 If your effective tax rate is 25%, how much will you pay in

14 - 23 please. im struggling once i get here

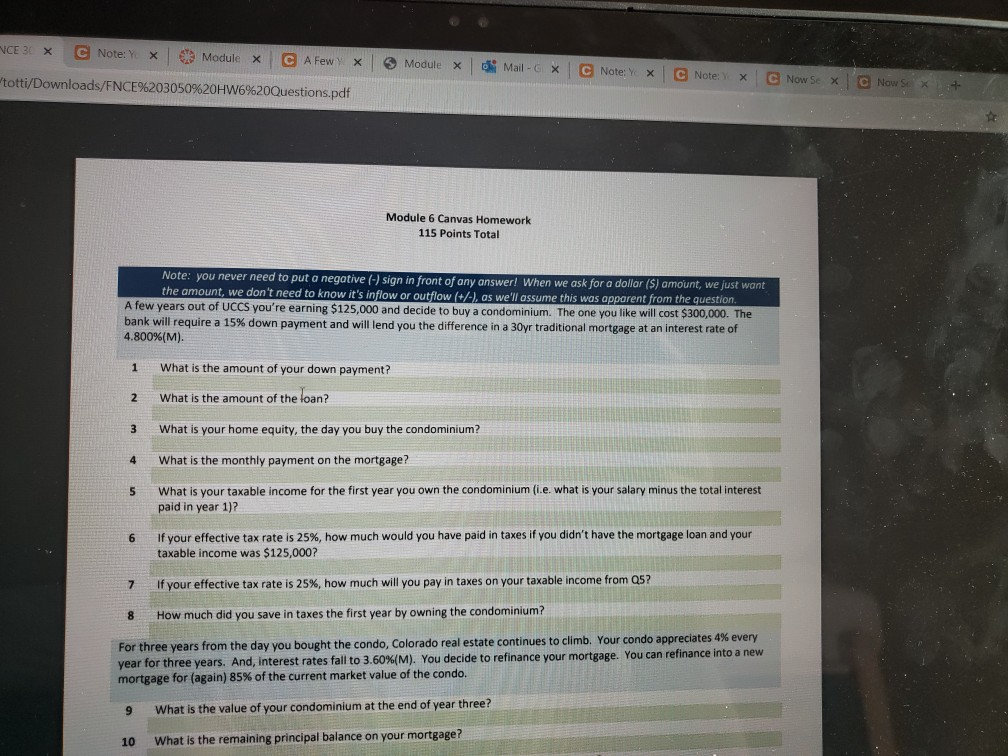

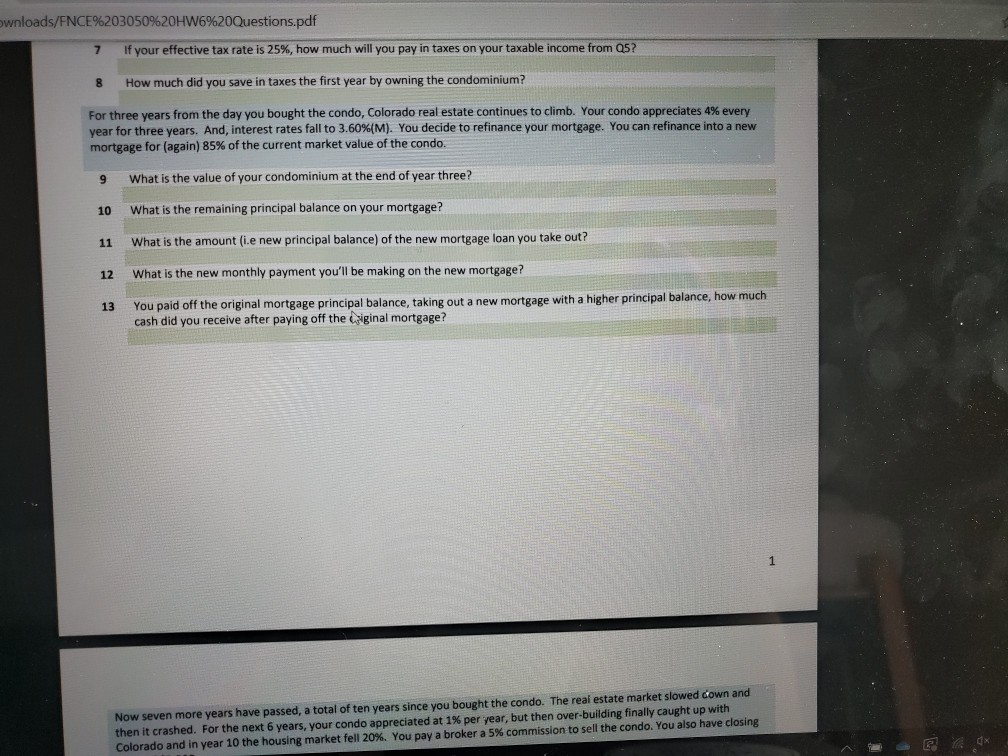

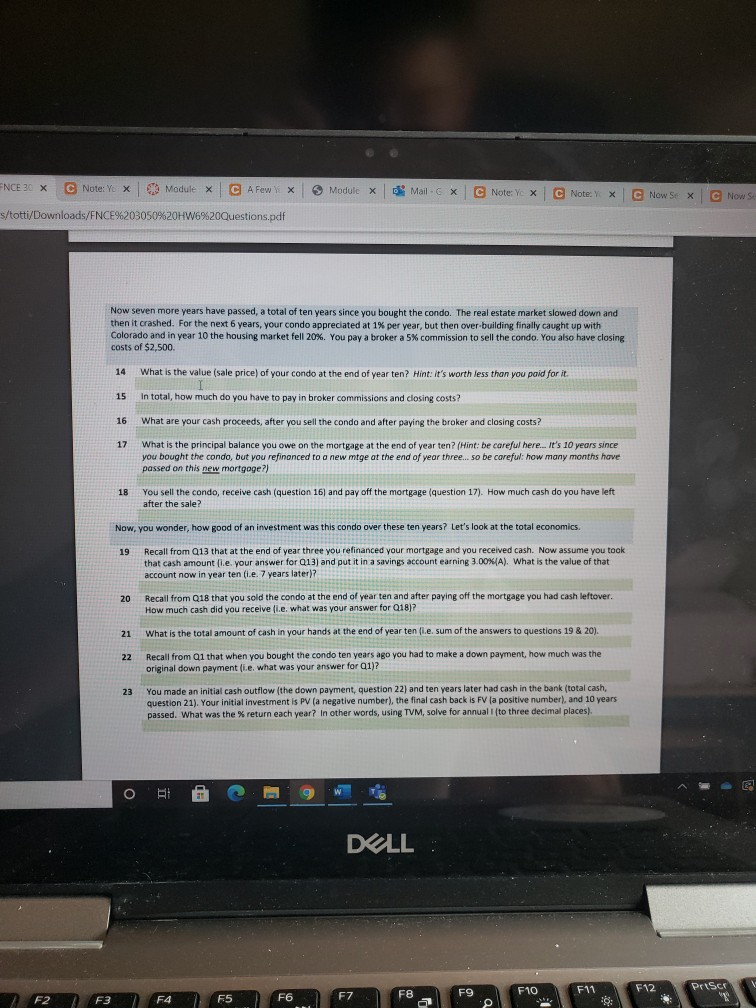

ownloads/FNCE%203050%20HW6%20Questions.pdf 7 If your effective tax rate is 25%, how much will you pay in taxes on your taxable income from Q5? 8 How much did you save in taxes the first year by owning the condominium? For three years from the day you bought the condo, Colorado real estate continues to climb. Your condo appreciates 4% every year for three years. And, interest rates fall to 3.60%(M). You decide to refinance your mortgage. You can refinance into a new mortgage for (again) 85% of the current market value of the condo. 9 What is the value of your condominium at the end of year three? 10 What is the remaining principal balance on your mortgage? 11 What is the amount (ie new principal balance) of the new mortgage loan you take out? 12 What is the new monthly payment you'll be making on the new mortgage? 13 You paid off the original mortgage principal balance, taking out a new mortgage with a higher principal balance, how much cash did you receive after paying off the exiginal mortgage? Now seven more years have passed, a total of ten years since you bought the condo. The real estate market slowed down and then it crashed. For the next 6 years, your condo appreciated at 1% per year, but then over-building finally caught up with Colorado and in year 10 the housing market fell 20%. You pay a broker a 5% commission to sell the condo. You also have closing ENCE 3X C Note: Yox Module x C A Few YX Module X d Mail-6 X C Note: Yox C Note: Note: YX C Now Sex C News s/totti/Downloads/ENCE%203050%20HW6%20Questions.pdf Now seven more years have passed, a total of ten years since you bought the condo. The real estate market slowed down and then it crashed. For the next 6 years, your condo appreciated at 1% per year, but then over building finally caught up with Colorado and in year 10 the housing market fell 20%. You pay a broker a 5% commission to sell the condo. You also have closing costs of $2,500. 14 What is the value (sale price of your condo at the end of year ten? Hint: it's worth less than you paid for it. In total, how much do you have to pay in broker commissions and closing costs? 15 16 17 What are your cash proceeds, after you sell the condo and after paying the broker and closing costs? What is the principal balance you owe on the mortgage at the end of year ten? (Hint: be careful here... It's 10 years since you bought the condo, but you refinanced to a new mtge at the end of year three... so be careful: how many months have passed on this new mortgage?) You sell the condo, receive cash (question 16) and pay off the mortgage (question 17). How much cash do you have left after the sale? 18 Now, you wonder, how good of an investment was this condo over these ten years? Let's look at the total economics. 19 Recall from Q13 that at the end of year three you refinanced your mortgage and you received cash. Now assume you took that cash amountle your answer for Q13) and put it in a savings account earning 3.00%/A). What is the value of that account now in year ten (e. 7 years later)? Recall from Q18 that you sold the condo at the end of year ten and after paying off the mortgage you had cash leftover. . How much cash did you receive i.e. what was your answer for Q18)? 20 21 What is the total amount of cash in your hands at the end of year tenie sum of the answers to questions 19 & 20). 22 Recall from ai that when you bought the condo ten years ago you had to make a down payment, how much was the original down payment (ie. what was your answer for 1)? 23 You made an initial cash outflow (the down payment, question 22) and ten years later had cash in the bank (total cash, question 21). Your initial investment is pv (a negative number), the final cash back is FV (a positive number), and 10 years passed. What was the return each year? In other words, using TVM, solve for annual to three decimal places). HE g w DELL F11 Priser F10 F12 F8 1 F2 F3 F4 F7 F5 F6 F9 9 .: ownloads/FNCE%203050%20HW6%20Questions.pdf 7 If your effective tax rate is 25%, how much will you pay in taxes on your taxable income from Q5? 8 How much did you save in taxes the first year by owning the condominium? For three years from the day you bought the condo, Colorado real estate continues to climb. Your condo appreciates 4% every year for three years. And, interest rates fall to 3.60%(M). You decide to refinance your mortgage. You can refinance into a new mortgage for (again) 85% of the current market value of the condo. 9 What is the value of your condominium at the end of year three? 10 What is the remaining principal balance on your mortgage? 11 What is the amount (ie new principal balance) of the new mortgage loan you take out? 12 What is the new monthly payment you'll be making on the new mortgage? 13 You paid off the original mortgage principal balance, taking out a new mortgage with a higher principal balance, how much cash did you receive after paying off the exiginal mortgage? Now seven more years have passed, a total of ten years since you bought the condo. The real estate market slowed down and then it crashed. For the next 6 years, your condo appreciated at 1% per year, but then over-building finally caught up with Colorado and in year 10 the housing market fell 20%. You pay a broker a 5% commission to sell the condo. You also have closing ENCE 3X C Note: Yox Module x C A Few YX Module X d Mail-6 X C Note: Yox C Note: Note: YX C Now Sex C News s/totti/Downloads/ENCE%203050%20HW6%20Questions.pdf Now seven more years have passed, a total of ten years since you bought the condo. The real estate market slowed down and then it crashed. For the next 6 years, your condo appreciated at 1% per year, but then over building finally caught up with Colorado and in year 10 the housing market fell 20%. You pay a broker a 5% commission to sell the condo. You also have closing costs of $2,500. 14 What is the value (sale price of your condo at the end of year ten? Hint: it's worth less than you paid for it. In total, how much do you have to pay in broker commissions and closing costs? 15 16 17 What are your cash proceeds, after you sell the condo and after paying the broker and closing costs? What is the principal balance you owe on the mortgage at the end of year ten? (Hint: be careful here... It's 10 years since you bought the condo, but you refinanced to a new mtge at the end of year three... so be careful: how many months have passed on this new mortgage?) You sell the condo, receive cash (question 16) and pay off the mortgage (question 17). How much cash do you have left after the sale? 18 Now, you wonder, how good of an investment was this condo over these ten years? Let's look at the total economics. 19 Recall from Q13 that at the end of year three you refinanced your mortgage and you received cash. Now assume you took that cash amountle your answer for Q13) and put it in a savings account earning 3.00%/A). What is the value of that account now in year ten (e. 7 years later)? Recall from Q18 that you sold the condo at the end of year ten and after paying off the mortgage you had cash leftover. . How much cash did you receive i.e. what was your answer for Q18)? 20 21 What is the total amount of cash in your hands at the end of year tenie sum of the answers to questions 19 & 20). 22 Recall from ai that when you bought the condo ten years ago you had to make a down payment, how much was the original down payment (ie. what was your answer for 1)? 23 You made an initial cash outflow (the down payment, question 22) and ten years later had cash in the bank (total cash, question 21). Your initial investment is pv (a negative number), the final cash back is FV (a positive number), and 10 years passed. What was the return each year? In other words, using TVM, solve for annual to three decimal places). HE g w DELL F11 Priser F10 F12 F8 1 F2 F3 F4 F7 F5 F6 F9 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started