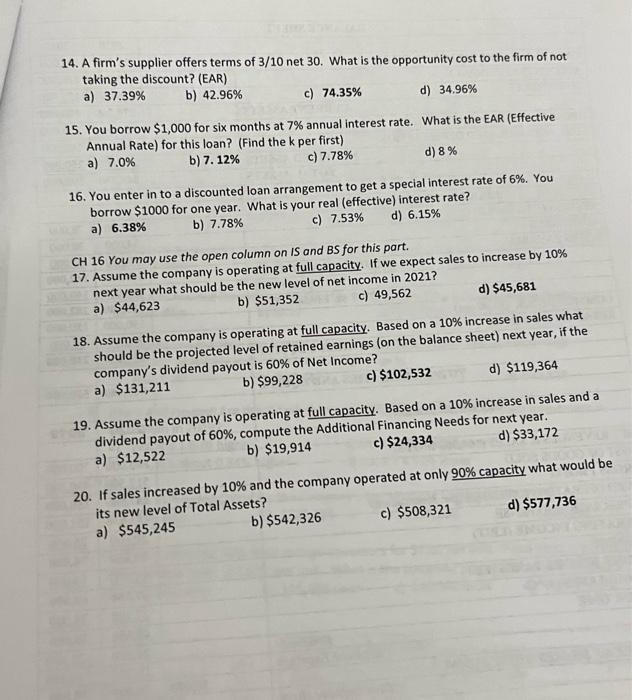

14. A firm's supplier offers terms of 3/10 net 30 . What is the opportunity cost to the firm of not taking the discount? (EAR) a) 37.39% b) 42.96% c) 74.35% d) 34.96% 15. You borrow $1,000 for six months at 7% annual interest rate. What is the EAR (Effective Annual Rate) for this loan? (Find the k per first) a) 7.0% b) 7.12% c) 7.78% d) 8% 16. You enter in to a discounted loan arrangement to get a special interest rate of 6%. You borrow $1000 for one year. What is your real (effective) interest rate? a) 6.38% b) 7.78% c) 7.53% d) 6.15% CH 16 You may use the open column on IS and BS for this part. 17. Assume the company is operating at full capacity. If we expect sales to increase by 10% next year what should be the new level of net income in 2021? a) $44,623 b) $51,352 c) 49,562 d) $45,681 18. Assume the company is operating at full capacity. Based on a 10% increase in sales what should be the projected level of retained earnings (on the balance sheet) next year, if the company's dividend payout is 60% of Net Income? a) $131,211 b) $99,228 c) $102,532 d) $119,364 19. Assume the company is operating at full capacity. Based on a 10% increase in sales and a dividend payout of 60%, compute the Additional Financing Needs for next year. a) $12,522 b) $19,914 c) $24,334 d) $33,172 20. If sales increased by 10% and the company operated at only 90% capacity what would be its new level of Total Assets? a) $545,245 b) $542,326 c) $508,321 d) $577,736 14. A firm's supplier offers terms of 3/10 net 30 . What is the opportunity cost to the firm of not taking the discount? (EAR) a) 37.39% b) 42.96% c) 74.35% d) 34.96% 15. You borrow $1,000 for six months at 7% annual interest rate. What is the EAR (Effective Annual Rate) for this loan? (Find the k per first) a) 7.0% b) 7.12% c) 7.78% d) 8% 16. You enter in to a discounted loan arrangement to get a special interest rate of 6%. You borrow $1000 for one year. What is your real (effective) interest rate? a) 6.38% b) 7.78% c) 7.53% d) 6.15% CH 16 You may use the open column on IS and BS for this part. 17. Assume the company is operating at full capacity. If we expect sales to increase by 10% next year what should be the new level of net income in 2021? a) $44,623 b) $51,352 c) 49,562 d) $45,681 18. Assume the company is operating at full capacity. Based on a 10% increase in sales what should be the projected level of retained earnings (on the balance sheet) next year, if the company's dividend payout is 60% of Net Income? a) $131,211 b) $99,228 c) $102,532 d) $119,364 19. Assume the company is operating at full capacity. Based on a 10% increase in sales and a dividend payout of 60%, compute the Additional Financing Needs for next year. a) $12,522 b) $19,914 c) $24,334 d) $33,172 20. If sales increased by 10% and the company operated at only 90% capacity what would be its new level of Total Assets? a) $545,245 b) $542,326 c) $508,321 d) $577,736