Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14. Almost all of the states allow 15. A state might levy a(n) treatment to an LLC for income tax purposes. tax when an investor

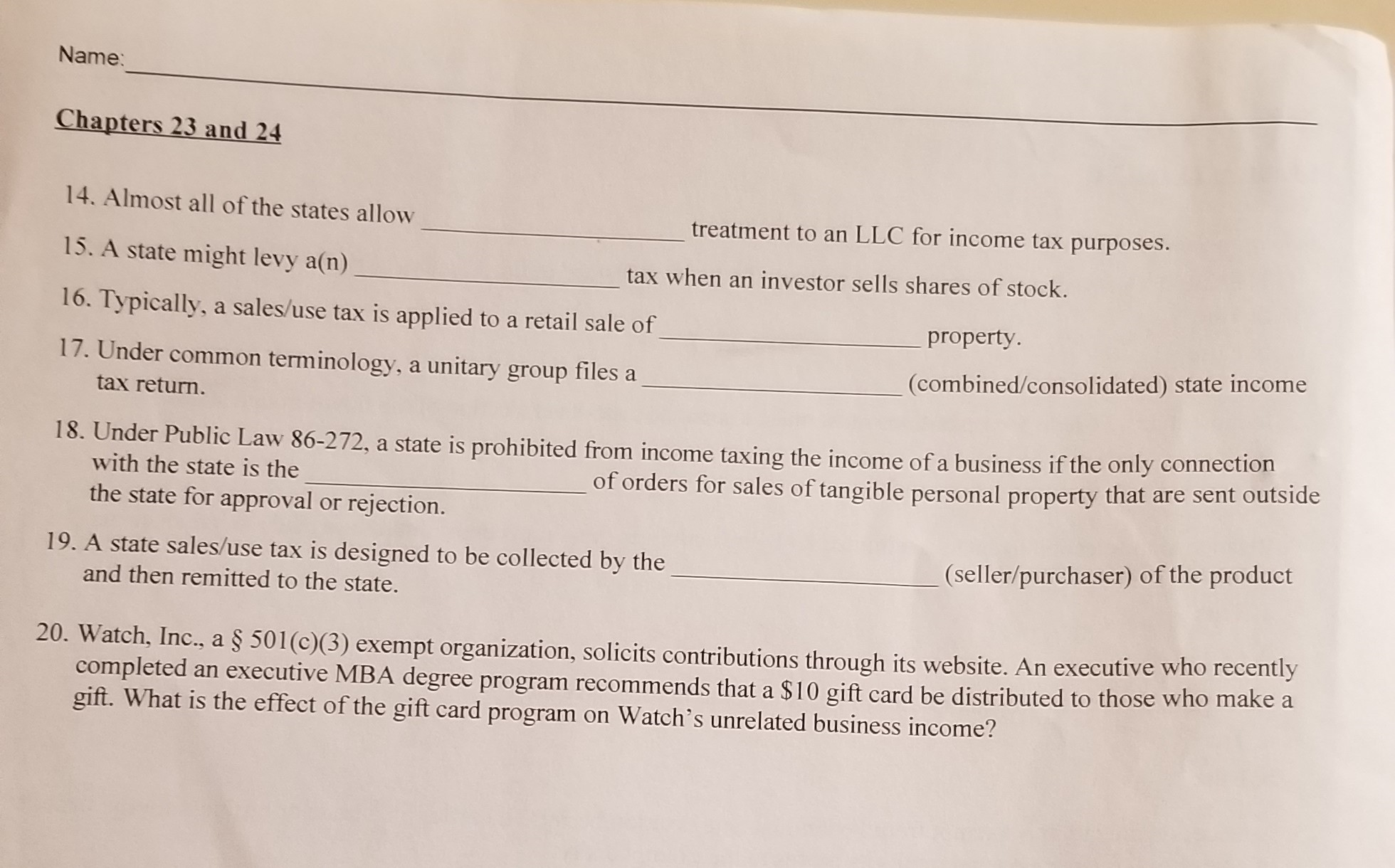

14. Almost all of the states allow 15. A state might levy a(n) treatment to an LLC for income tax purposes. tax when an investor sells shares of stock. 16. Typically, a sales/use tax is applied to a retail sale of 17. Under common terminology, a unitary group files a property. tax return. (combined/consolidated) state income 18. Under Public Law 86-272, a state is prohibited from income taxing the income of a business if the only connection with the state is the the state for approval or rejection. of orders for sales of tangible personal property that are sent outside 19. A state sales/use tax is designed to be collected by the and then remitted to the state. (seller/purchaser) of the product 20. Watch, Inc., a 501 (c)(3) exempt organization, solicits contributions through its website. An executive who recently completed an executive MBA degree program recommends that a $10 gift card be distributed to those who make a gift. What is the effect of the gift card program on Watch's unrelated business income? 14. Almost all of the states allow 15. A state might levy a(n) treatment to an LLC for income tax purposes. tax when an investor sells shares of stock. 16. Typically, a sales/use tax is applied to a retail sale of 17. Under common terminology, a unitary group files a property. tax return. (combined/consolidated) state income 18. Under Public Law 86-272, a state is prohibited from income taxing the income of a business if the only connection with the state is the the state for approval or rejection. of orders for sales of tangible personal property that are sent outside 19. A state sales/use tax is designed to be collected by the and then remitted to the state. (seller/purchaser) of the product 20. Watch, Inc., a 501 (c)(3) exempt organization, solicits contributions through its website. An executive who recently completed an executive MBA degree program recommends that a $10 gift card be distributed to those who make a gift. What is the effect of the gift card program on Watch's unrelated business income

14. Almost all of the states allow 15. A state might levy a(n) treatment to an LLC for income tax purposes. tax when an investor sells shares of stock. 16. Typically, a sales/use tax is applied to a retail sale of 17. Under common terminology, a unitary group files a property. tax return. (combined/consolidated) state income 18. Under Public Law 86-272, a state is prohibited from income taxing the income of a business if the only connection with the state is the the state for approval or rejection. of orders for sales of tangible personal property that are sent outside 19. A state sales/use tax is designed to be collected by the and then remitted to the state. (seller/purchaser) of the product 20. Watch, Inc., a 501 (c)(3) exempt organization, solicits contributions through its website. An executive who recently completed an executive MBA degree program recommends that a $10 gift card be distributed to those who make a gift. What is the effect of the gift card program on Watch's unrelated business income? 14. Almost all of the states allow 15. A state might levy a(n) treatment to an LLC for income tax purposes. tax when an investor sells shares of stock. 16. Typically, a sales/use tax is applied to a retail sale of 17. Under common terminology, a unitary group files a property. tax return. (combined/consolidated) state income 18. Under Public Law 86-272, a state is prohibited from income taxing the income of a business if the only connection with the state is the the state for approval or rejection. of orders for sales of tangible personal property that are sent outside 19. A state sales/use tax is designed to be collected by the and then remitted to the state. (seller/purchaser) of the product 20. Watch, Inc., a 501 (c)(3) exempt organization, solicits contributions through its website. An executive who recently completed an executive MBA degree program recommends that a $10 gift card be distributed to those who make a gift. What is the effect of the gift card program on Watch's unrelated business income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started