Answered step by step

Verified Expert Solution

Question

1 Approved Answer

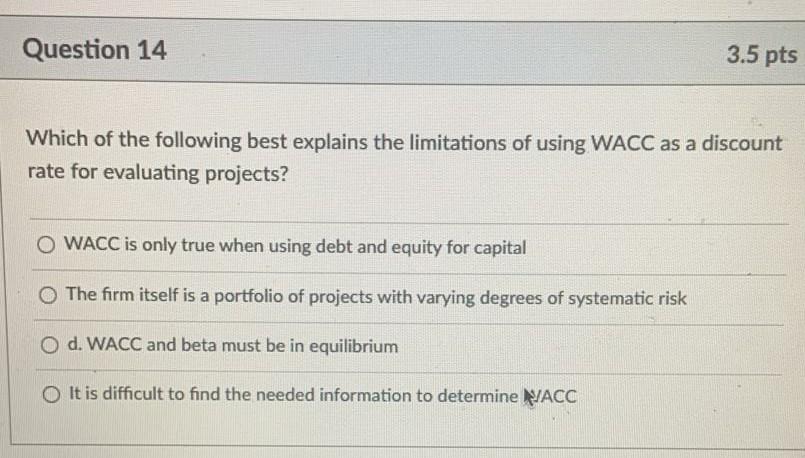

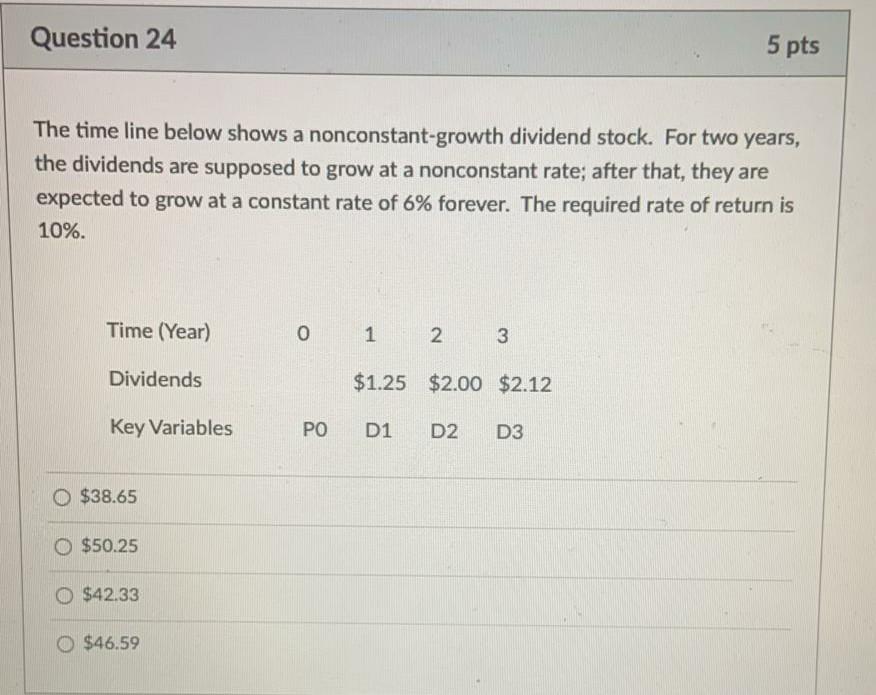

14 and 24 need 1000 percent perfect answer in 10 minutes i will rate positive if answer is correct Question 14 3.5 pts Which of

14 and 24 need 1000 percent perfect answer in 10 minutes i will rate positive if answer is correct

Question 14 3.5 pts Which of the following best explains the limitations of using WACC as a discount rate for evaluating projects? O WACC is only true when using debt and equity for capital O The firm itself is a portfolio of projects with varying degrees of systematic risk O d. WACC and beta must be in equilibrium O It is difficult to find the needed information to determine HACC Question 24 5 pts The time line below shows a nonconstant-growth dividend stock. For two years, the dividends are supposed to grow at a nonconstant rate; after that, they are expected to grow at a constant rate of 6% forever. The required rate of return is 10%. Time (Year) 0 1 2 3 Dividends $1.25 $2.00 $2.12 Key Variables PO D1 D2 D3 O $38.65 O $50.25 0 $42.33 O $46.59Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started