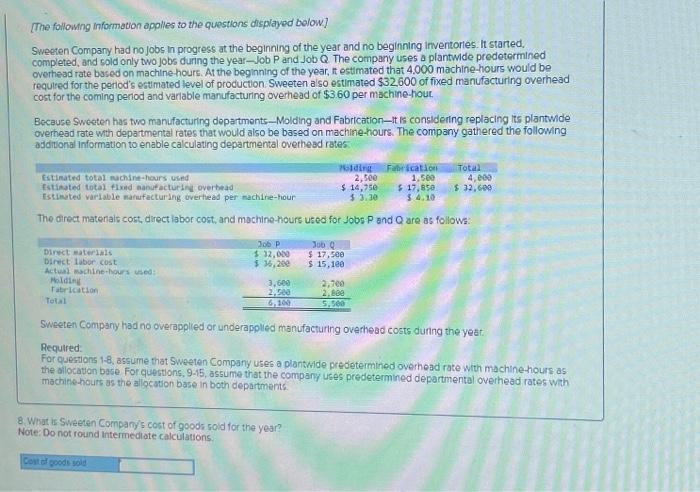

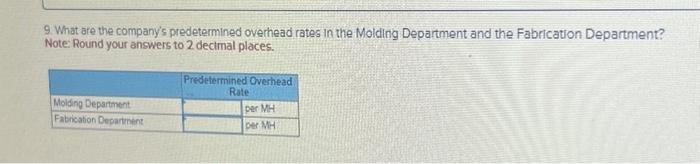

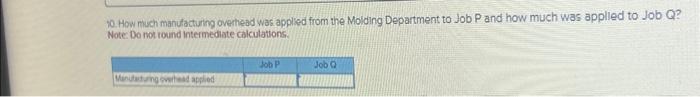

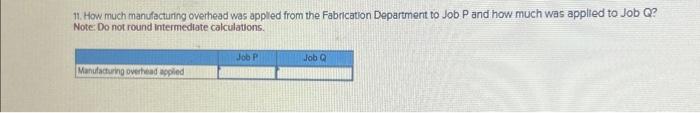

14. Assume that Siveeten Company uses cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish seling prices for all of its jobs. if Job P includes 20 units and Job a includes 30 units, what seling price would the company establish for Jobe P and Q? What are tho selling prices for both jobs when stated on a per unit basis? Note Do not round intermediate calculations. Round your final answers to nearest whole dollar. 11. How much manulacturing overhead was appled from the Fabrication Department to Job P and how much was applied to Job Q? Note: Do not round intermediate cakculations. [The followng information applies to the questions displayed bolow] Sweeten Company had no jobs in progress at the beginning of the year and no beginning inventorles. It staned. completed, and sold only two jobs during the year-job P and Job Q The company uses a plantwie predetermined overhead rate based on machine hours. At the beginning of the year, it estimated that 4.000 machine-hours would be requited for the period's estimated level of production. Sweeten also estimated $32,600 of fixed manufacturing overhead cost for the coming period and varlable manufacturing overhead of $3.60 per machine-hour. Because Sweeten has two manufacturing departments-Molding and Fabrication-It is considering replacing its plantwide overhead rate wth departmental rates that would also be based on machine-hours. The company gathered the following asditional information to enable calculating departmental overhead rates The direct materials cost, direct labor cost, and mochine-hours used for Jobs P and Q are as follows: Sweeten Company had no overapplied or underapolied manufacturing overhead costs duning the yeat: Required: For questions 18, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base for questions, 915, assume that the company uses predetermined departmental overhead rates with machithe-houts as the allocation base in both departments 8. What is Sweeten Companys cost of goods soid for the year? Note: Do not round intermedlote calculations. 12. If Job P includer 20 units, what is ite unit product cost? Note: Do not round imtermediate calculations. 15. What is Sweeten Company's cost of goods sold for the year? Note: Do not round intermediate calculations. 13. If Job Q includes 30 units, what is its unit product cost? Note: Do not round intermediate calculations. Round your final answer to nearest whole dollar. 10. How much manufacturing overhead was applied from the Moiding Department to Job P and how much was applied to Job Q? Note Do not round intermediate calculations. 9. What are the company's predetermined overhead rates in the Molding Department and the Fabrication Department? Note: Round your answers to 2 decimal places