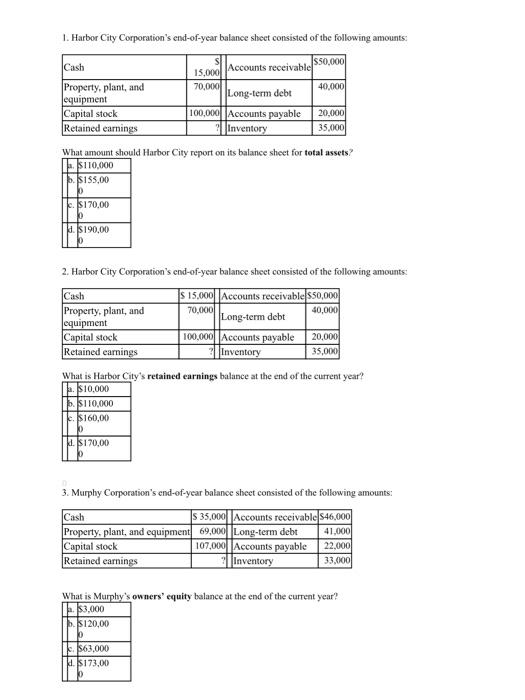

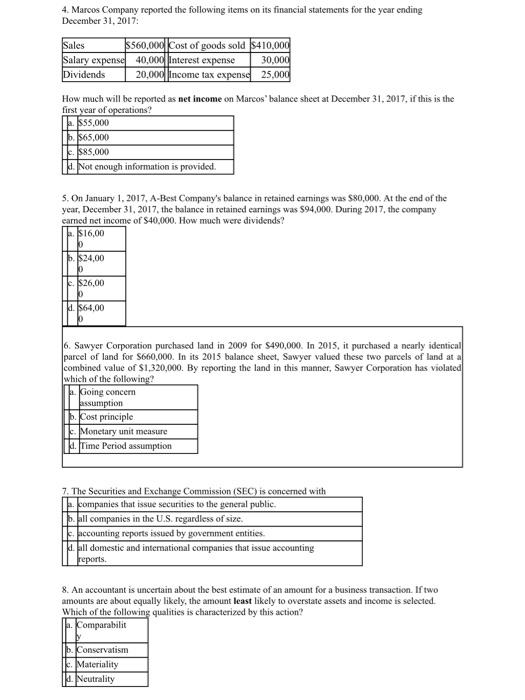

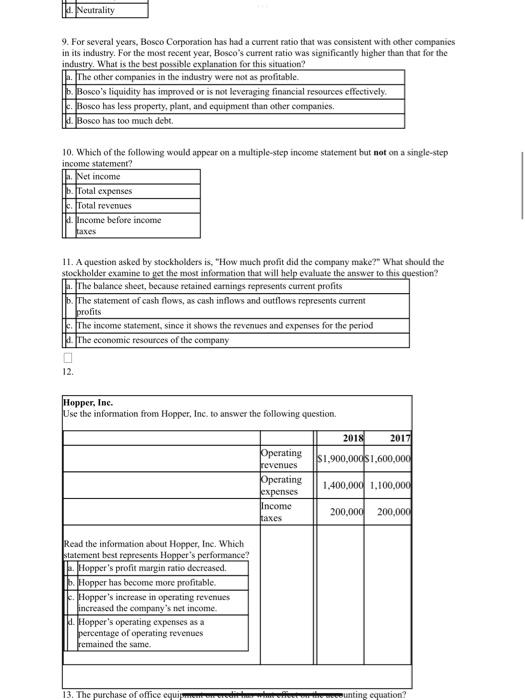

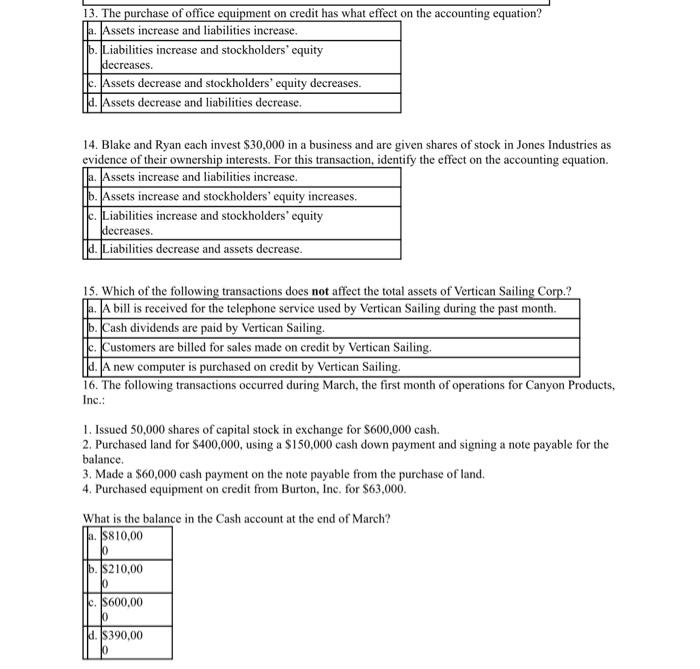

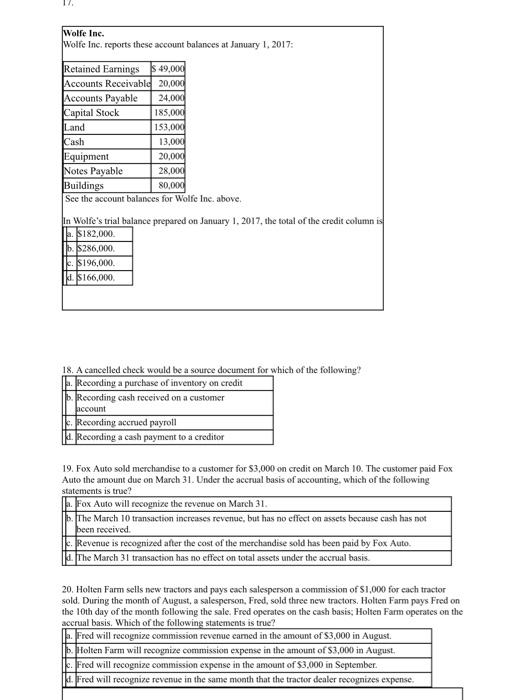

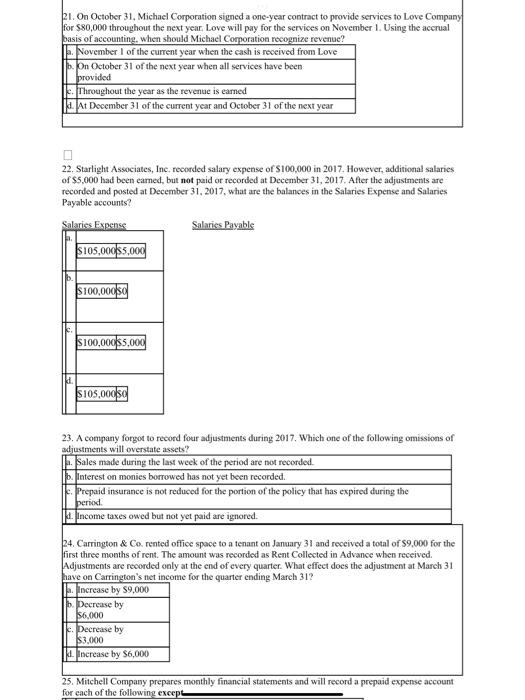

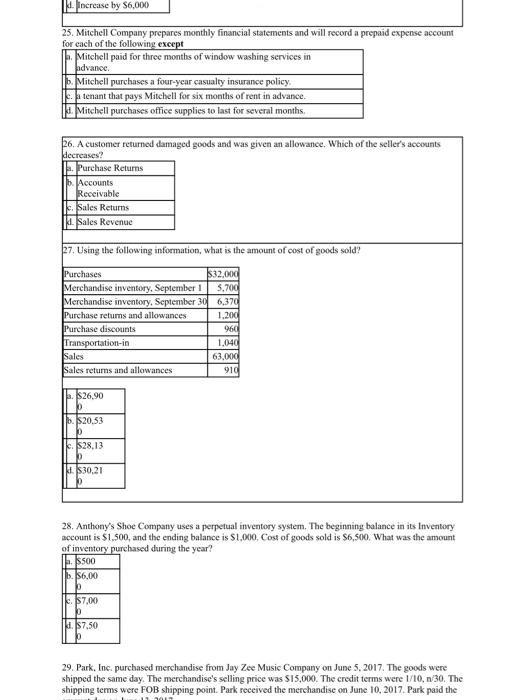

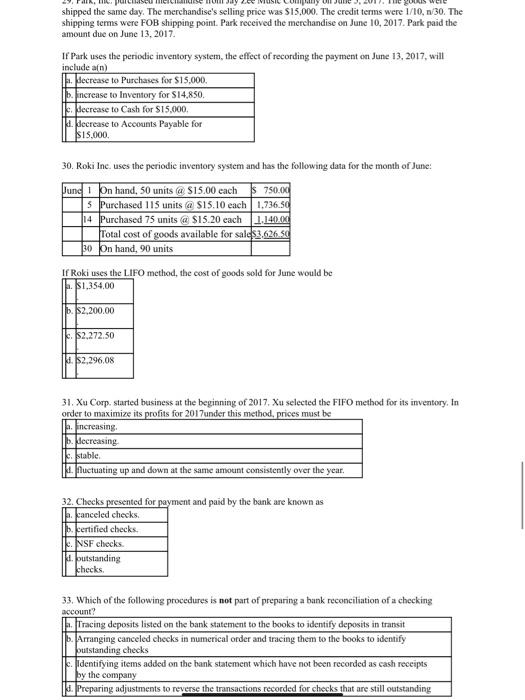

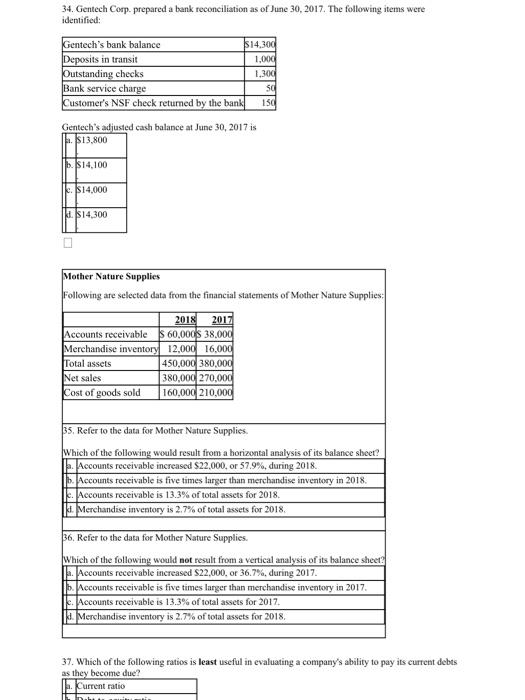

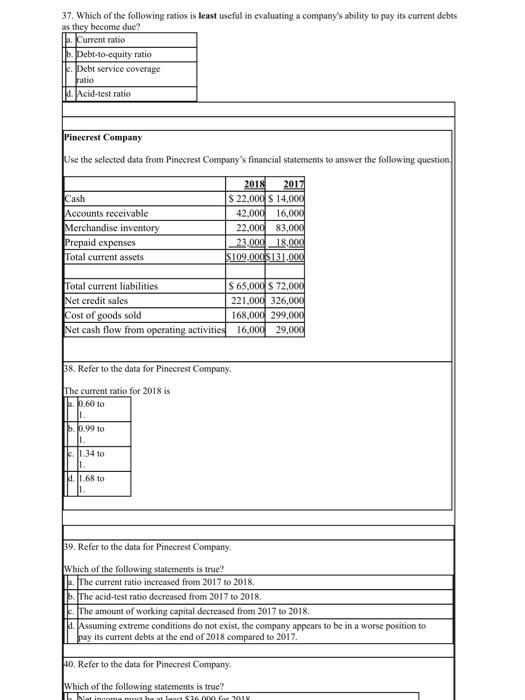

14. Blake and Ryan each invest $30,000 in a business and are given shares of stock in Jones Industries as evidence of their ownership interests. For this transaction, identify the effect on the accounting equation. 16. The following transactions occurred during March, the first month of operations for Canyon Products, Inc.: 1. Issued 50,000 shares of capital stock in exchange for $600,000 cash. 2. Purchased land for $400,000, using a $150,000 cash down payment and signing a note payable for the balance. 3. Made a $60,000 cash payment on the note payable from the purchase of land. 4. Purchased equipment on credit from Burton, Inc. for $63,000. 34. Gentech Corp. prepared a bank reconciliation as of June 30, 2017. The following items were identified: Gentech's adiusted cash balance at June 30,2017 is Mother Nature Supplies Following are selected data from the financial statements of Mother Nature Supplies: 35. Refer to the data for Mother Nature Supplies. Which of the following would not result from a vertical analysis of its balance sheet? a. Accounts receivable increased $22,000, of 36.7%, during 2017. b. Accounts receivable is five times larger than merchandise inventory in 2017. c. Accounts receivable is 13.3% of total assets for 2017 . d. Merchandise inventory is 2.7% of total assets for 2018 . 37. Which of the following ratios is least useful in evaluating a company's ability to pay its current debts as they become due? 4. Marcos Company reported the following items on its financial statements for the year ending December 31, 2017: How much will be reported as net income on Marcos' balance sheet at December 31,2017 , if this is the first vear of onerations? 5. On January 1,2017, A-Best Company's balance in retained earnings was $80,000. At the end of the year, December 31, 2017, the balance in retained earnings was \$94,000. During 2017, the company earned net income of $40,000. How much were dividends? 6. Sawyer Corporation purchased land in 2009 for $490,000. In 2015, it purchased a nearly identical parcel of land for $660,000. In its 2015 balance sheet, Sawyer valued these two parcels of land at a combined value of $1,320,000. By reporting the land in this manner, Sawyer Corporation has violated which of the following? 8. An accountant is uncertain about the best estimate of an amount for a business transaction. If two amounts are about equally likely, the amount least likely to overstate assets and income is selected. Which of the following qualities is characterized by this action? 9. For several years, Bosco Corporation has had a current ratio that was consistent with other companies in its industry. For the most recent year, Bosco's current ratio was significantly higher than that for the industry. What is the best possible explanation for this situation? 3. The other companies in the industry were not as peofitable. b. Bosco's liquidity has improved or is not leveraging financial resources effectively. c. Bosco has less property, plant, and equipment than other companies. d. Bosco has too much debt. 10. Which of the following would appear on a multiple-step income statement but not on a single-step income statement? 11. A question asked by stockholders is, "How much profit did the company make?" What should the stockholder examine to get the most information that will help evaluate the answer to this question? 12. 37. Which of the following ratios is least useful in evaluating a company's ability to pay its current debts as they become due? \begin{tabular}{||l|l|} \hline a. & Current ratio \\ \hline b. & Debt-to-equity ratio \\ \hline c. & Debt service coverage \\ \hline fatio \\ \hline d. & Acid-test ratio \\ \hline \end{tabular} Pinecrest Company Use the selected data from Pinecrest Company's financial statements to answer the following question. \begin{tabular}{|l|r|r|} \hline & 2018 & 2017 \\ \hline Cash & $22,000 & $14,000 \\ \hline Accounts receivable & 42,000 & 16,000 \\ \hline Merchandise inventory & 22,000 & 83,000 \\ \hline Prepaid expenses & 23,000 & 18,000 \\ \hline Total current assets & $109,000 & $1,31,000 \\ \hline & & \\ \hline Total current liabilities & $65,000 & $72,000 \\ \hline Net credit sales & 221,000 & 326,000 \\ \hline Cost of goods sold & 168,000 & 299,000 \\ \hline Net cash flow from operating activities & 16,000 & 29,000 \\ \hline \end{tabular} 38. Refer to the data for Pinecrest Company. The current ratio for 2018 is 2. 0.60 to 1. b. 0.99 to c. 1.34 to 4. 1.68 to I. 39. Refer to the data for Pinecrest Company. Which of the following statements is true? 2. The current ratio increased from 2017 to 2018. b. The acid-test ratio decreased from 2017 to 2018 . c. The amount of working capital decreased from 2017 to 2018. d. Assuming extreme cobditions do not exist, the company appears to be in a worse position to pay its current debts at the end of 2018 compared to 2017. 40. Refer to the data for Pinecrest Company. Which of the following statements is true? shipped the same day. The merchandise's selling price was $15,000. The credit terms were 1/10,n/30. The shipping terms were FOB shipping point. Park received the merchandise on June 10, 2017. Park paid the amount due on June 13, 2017. If Park uses the periodic inventory system, the effect of recording the payment on June 13, 2017, will include afn) 30. Roki Inc. uses the periodic inventory system and has the following data for the month of June: If Roki uses the LIFO method, the cost of goods sold for June would be 31. Xu Corp. started business at the beginning of 2017. Xu selected the FIFO method for its inventory, In order to maximize its profits for 2017 under this method. prices must be 32. Checks presented for payment and paid by the bank are known as \begin{tabular}{|c|c|} \hline a. & canceled checks. \\ \hlineb, & certified checks. \\ \hline c. & NSF checks. \\ \hline i. & outslandingchecks. \\ \hline \end{tabular} 33. Which of the following procedures is not part of preparing a bank reconciliation of a checking 1. Harbor City Corporation's end-of-year balanee sheet consisted of the following amounts: What amount should Harbor City report on its balance sheet for total assets? 2. Harbor City Corporation's end-of-year balance sheet consisted of the following amounts: What is Harbor City's retained earnings balance at the end of the current year? 3. Murphy Corporation's end-of-year balance sheet consisted of the following amounts: What is Mumhv's owners' equity balance at the end of the current year? 25. Mitchell Company prepares monthly financial statements and will record a prepaid expense account for each of the following except 26. A customer returned damaged goods and was given an allowance, Which of the seller's accounts decreases? 27. Using the following information, what is the amount of cost of goods sold? 28. Anthony's Shoe Company uses a perpetual inventory system. The beginning balance in its Inventory account is $1,500, and the ending balance is $1,000, Cost of goods sold is $6,500. What was the amount of inventorv purchased during the year? 29. Park, Inc, purchased merchandise from Jay Zee Music Company on June 5, 2017. The goods were shipped the same day. The merchandise's selling price was $15,000. The credit terms were 1/10,n/30. The shipping terms were FOB shipping point. Park received the merchandise on June 10, 2017. Park paid the Wolfe Ine. Wolfe Inc, reports these account balances at January 1, 2017: See the account balances for Wolte Inc. above. In Wolfe's trial balance prepared on January 1,2017 , the total of the credit column is 18. A cancelled check would be a source document for which of the following? 19. Fox Auto sold merchandise to a customer for $3,000 on credit on March 10. The customer paid Fox Auto the amount due on March 31 . Under the acerual basis of accounting, which of the following statamante is mo? 20. Holten Farm sells new tractors and pays each salesperson a commission of $1,000 for each tractor sold. During the month of August, a salesperson, Fred, sold three new tractors. Holten Farm pays Fred on the 10th day of the month following the sale. Fred operates on the cash basis; Holten Farm operates on the aecrual basis. Which of the following statements is true? 21. On October 31, Michael Corporation signed a one-year contract to provide services to Love Company for $80,000 throughout the next year. Love will pay for the services on November 1 . Using the acerual basis of accounting, when should Michael Corporation recognize revenue? 22. Starlight Associates, Ine, recorded salary expense of $100,000 in 2017. However, additional salaries of $5,000 had been eamed, but not paid or recorded at December 31, 2017. After the adjustments are recorded and posted at December 31, 2017, what are the balances in the Salaries Expense and Salaries Payable accounts? Salaries Payable 23. A company forgot to record four adjustments during 2017 . Which one of the following omissions of adiustments will murstats asepts? 24. Carrington \& Ca. rented office space to a tenant on January 31 and received a total of $9,000 for the first three months of rent. The amount was recorded as Rent Collected in Advance when received. Adjustments are recorded only at the end of every quarter. What effeet does the adjustment at March 31 have on Carrington's net income for the quarter ending March 31? 25. Mitchell Company prepares monthly financial statements and will record a prepaid expense account for each of the following except