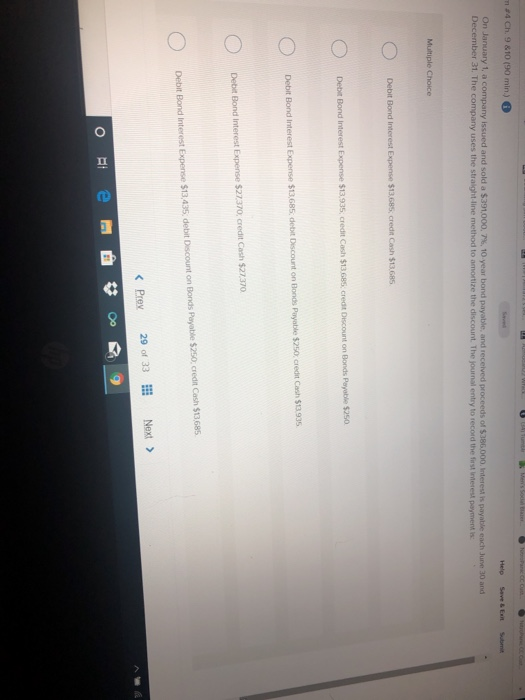

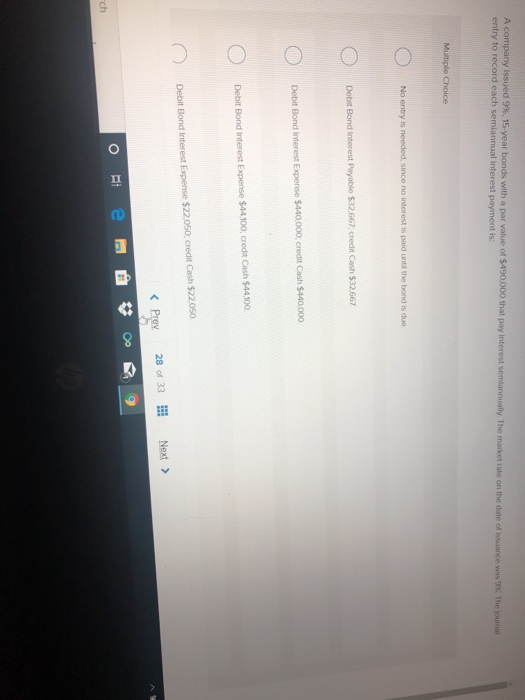

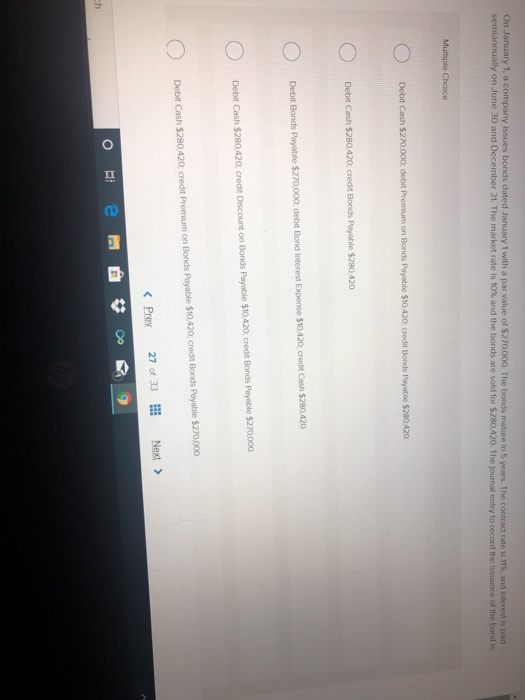

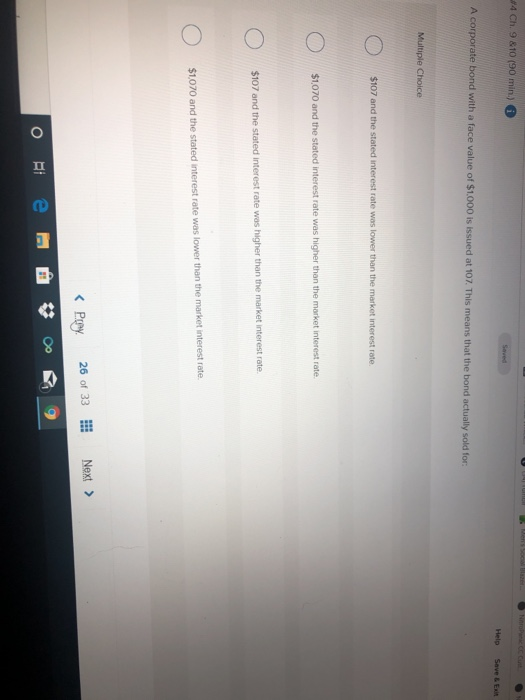

14 Ch. 9 8 10 90 min.) Help Save & Ex Submit On January 1, a company issued and sold a $391,000,7%, 10 year bond payable and received proceeds of $386.000. Interesi payable each Jurve 30 and December 31. The company uses the straight line method to amortize the discount. The journal entry to record the first interest payment is Multiple Choice Debit Bond Interest Expense $13,685 Credit Cash $13.685 Debit Dond Interest Expense 5130 Credit Cash $13689 Credit Discount on Bonds Payable $250 Debit Bond Interest Expense $13,685, debit Discount on Bonds Payable $250. Credit Cash 1195 Oo oo Debet Bond Interest Expense $27370. Credit Cash $27370 Debit Bond Interest Expense $13.435. debit Discount on Bonds Payable $250. Credit Cash $13,685 A company issued 9%, 15-year bonds with a par value of $490.000 that pay interest semiannually. The market rate on the date of issuance was 9. The Journal entry to record each semiannual interest payment is Multiple Choice No entry is needed, since no interest is paid until the bond is due 0 0 Debit Bond Interest Payable $32.667, credit Cash $32,667 0 Debit Bond Interest Expense $440,000 credit Cash $140,000 O Debit Bond Interest Expense $44100, Credit Cash $44100 o C / Debit Bond Interest Expense $22.050. Credit Cash $22.050 ch On January 1, a company issues bonds dated January 1 with a par value of $270,000. The bonds mature in 5 years. The contract rate is 196, and interest is paid semiannually on June 30 and December 31. The market rate is 10% and the bonds are sold for $280.420. The journal entry to record the issuance of the bond is: Multiple Choice O Debit Cash $270.000, debit Premium on Bonds Payable $10.420, credit Bonds Payable $280.420 c) Debit Cash $280.420, credit Bonds Payable $280420 Debit Bonds Payable $270.000 debit Bond Interest Expense $10.420 Credit Cash $280,420 O Debit Cash $280,420, credit Discount on Bonds Payable $10,420, credit Bonds Payable $270,000 Debit Cash $280.420. credit Premium on Bonds Payable $10.420, credit Bonds Payable $270,000 O R9 ote 4 Ch. 9 &10 (90 min.) 0 Help Save & Exit A corporate bond with a face value of $1,000 is issued at 107. This means that the bond actually sold for Multiple Choice 0 $107 and the stated interest rate was lower than the market interest rate $1070 and the stated interest rate was higher than the market interest rate. $107 and the stated interest rate was higher than the market interest rate a $1,070 and the stated interest rate was lower than the market interest rate. Adonis Corporation issued 10 year, 9% bonds with a par value of $120,000. Interest is paid semiannually. The market rate on the issue date was 8%. Adonis received $128.156 in cash proceeds. Which of the following statements is true? Multiple Choice O Adonis must pay $120.000 at maturity and no interest payments o o Adonis must pay $128.156 at maturity and no interest payments Adonis must pay $128.156 at maturity plus 20 interest payments of $5400 each o O Adonis must pay $120.000 at maturity plus 20 interest payments of $5,400 each O Adonis must pay $120,000 at maturity plus 20 interest payments of $4800 each OO 9 Oie rch