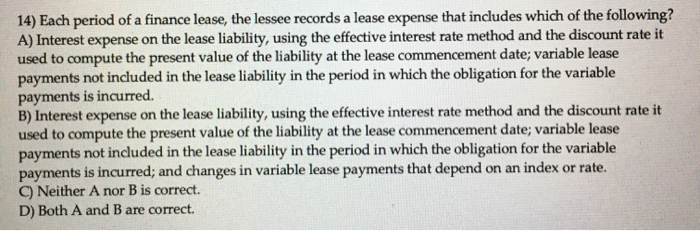

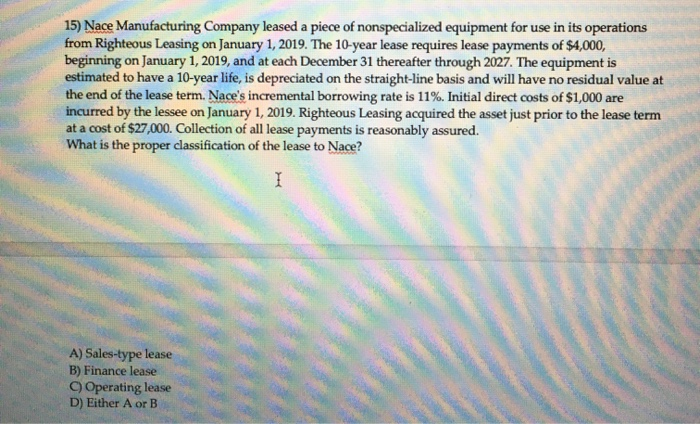

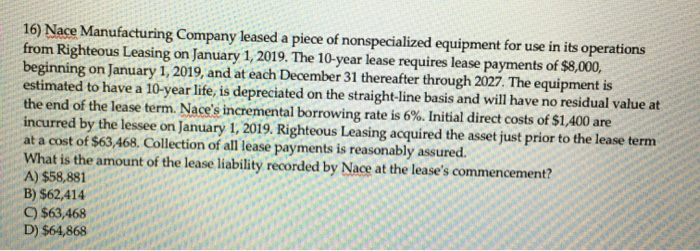

14) Each period of a finance lease, the lessee records a lease expense that includes which of the following? A) Interest expense on the lease liability, using the effective interest rate method and the discount rate it used to compute the present value of the liability at the lease commencement date; variable lease payments not included in the lease liability in the period in which the obligation for the variable payments is incurred. B) Interest expense on the lease liability, using the effective interest rate method and the discount rate it used to compute the present value of the liability at the lease commencement date; variable lease payments not included in the lease liability in the period in which the obligation for the variable payments is incurred; and changes in variable lease payments that depend on an index or rate. Neither A nor B is correct. D) Both A and B are correct. 15) Nace Manufacturing Company leased a piece of nonspecialized equipment for use in its operations from Righteous Leasing on January 1, 2019. The 10-year lease requires lease payments of $4,000, beginning on January 1, 2019, and at each December 31 thereafter through 2027. The equipment is estimated to have a 10-year life, is depreciated on the straight-line basis and will have no residual value at the end of the lease term. Nace's incremental borrowing rate is 11%. Initial direct costs of $1,000 are incurred by the lessee on January 1, 2019. Righteous Leasing acquired the asset just prior to the lease term at a cost of $27,000. Collection of all lease payments is reasonably assured. What is the proper classification of the lease to Nace? I A) Sales-type lease B) Finance lease Operating lease D) Either A or B 16) Nace Manufacturing Company leased a piece of nonspecialized equipment for use in its operations from Righteous Leasing on January 1, 2019. The 10-year lease requires lease payments of $8,000, beginning on January 1, 2019, and at each December 31 thereafter through 2027. The equipment is estimated to have a 10-year life, is depreciated on the straight-line basis and will have no residual value at the end of the lease term. Nace's incremental borrowing rate is 6%. Initial direct costs of $1,400 are incurred by the lessee on January 1, 2019. Righteous Leasing acquired the asset just prior to the lease term at a cost of $63,468. Collection of all lease payments is reasonably assured. What is the amount of the lease liability recorded by Nace at the lease's commencement? A) $58,881 B) $62,414 $63,468 D) $64,868 Show Caleulation