Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14. In the month of lowest production volume, 500 units were produced, and total utilities costs were $2,800. In the month of highest production volume,

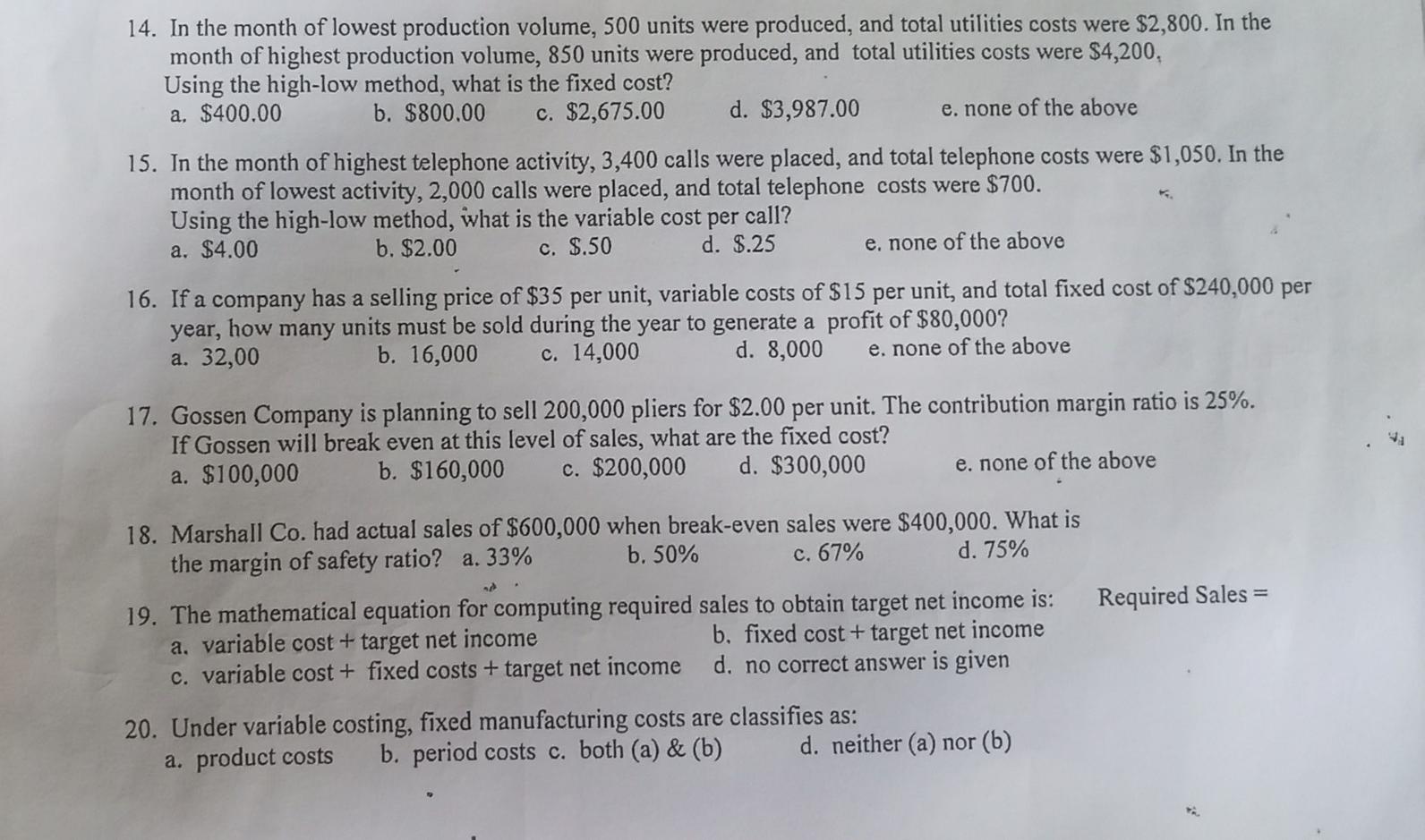

14. In the month of lowest production volume, 500 units were produced, and total utilities costs were $2,800. In the month of highest production volume, 850 units were produced, and total utilities costs were $4,200, Using the high-low method, what is the fixed cost? a. $400.00 b. $800.00 c. $2,675.00 d. $3,987.00 e. none of the above 15. In the month of highest telephone activity, 3,400 calls were placed, and total telephone costs were $1,050. In the month of lowest activity, 2,000 calls were placed, and total telephone costs were $700. Using the high-low method, what is the variable cost per call? a. $4.00 b. $2.00 d. $.25 e, none of the above c. $.50 16. If a company has a selling price of $35 per unit, variable costs of $15 per unit, and total fixed cost of $240,000 per year, how many units must be sold during the year to generate a profit of $80,000? a. 32,00 b. 16,000 c. 14,000 d. 8,000 e. none of the above 17. Gossen Company is planning to sell 200,000 pliers for $2.00 per unit. The contribution margin ratio is 25%. If Gossen will break even at this level of sales, what are the fixed cost? a. $100,000 b. $160,000 c. $200,000 d. $300,000 e. none of the above 18. Marshall Co. had actual sales of $600,000 when break-even sales were $400,000. What is the margin of safety ratio? a. 33% b. 50% d. 75% c. 67% Required Sales = 19. The mathematical equation for computing required sales to obtain target net income is: a. variable cost + target net income b. fixed cost + target net income c. variable cost + fixed costs + target net income d. no correct answer is given 20. Under variable costing, fixed manufacturing costs are classifies as: a. product costs b. period costs c. both (a) & (b) d. neither (a) nor (6)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started