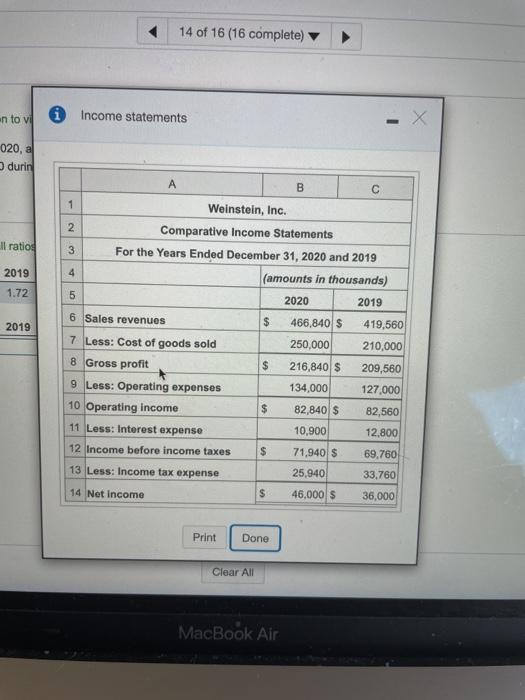

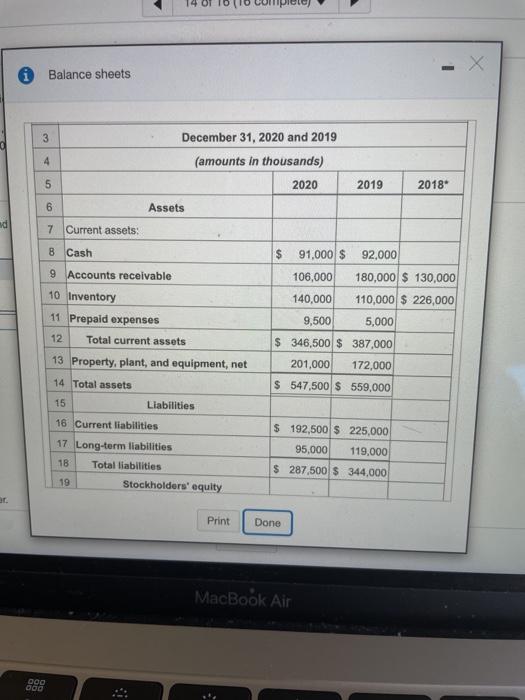

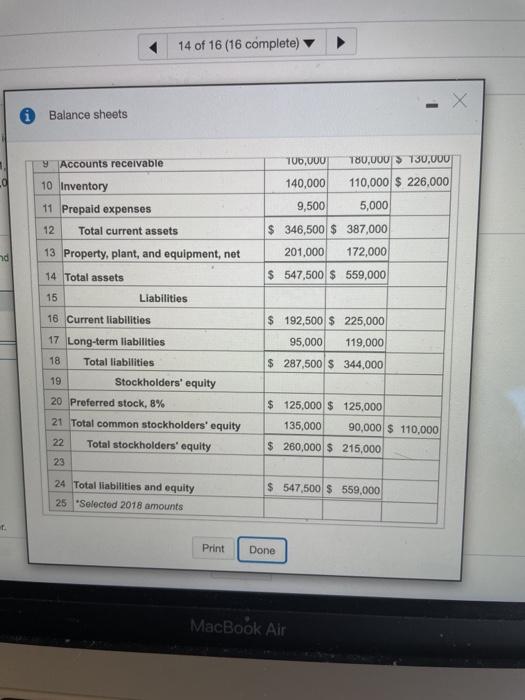

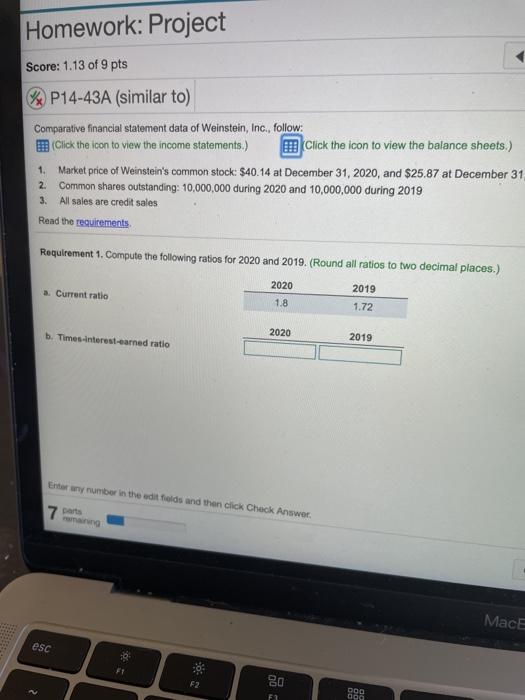

14 of 16 (16 complete) en to vi i Income statements 020, durin B Il ratio 2019 1.72 2019 1 Weinstein, Inc. 2 Comparative Income Statements 3 For the Years Ended December 31, 2020 and 2019 4 (amounts in thousands) 5 2020 2019 6 Sales revenues $ 466,840 S 419,560 7 Less: Cost of goods sold 250,000 210,000 8 Gross profit $ 216,840 $ 209,560 9 Less: Operating expenses 134,000 127,000 10 Operating Income $ 82,840 $ 82,560 11 Less: Interest expense 10.900 12,800 12 Income before income taxes $ 71.940 $ 69,760 13 Less: Income tax expense 25,940 33,760 14 Net Income $ 46.000 $ 36,000 Print Done Clear All MacBook Air - Balance sheets 3 December 31, 2020 and 2019 (amounts in thousands) 4 5 2020 2019 2018" 6 Assets w 7 Current assets: 8 Cash 9 Accounts receivable $ 91,000 $ 106,000 140,000 92,000 180,000 $ 130,000 110,000 $ 226,000 5,000 9,500 10 Inventory 11 Prepaid expenses 12 Total current assets 13 Property, plant, and equipment, net $ 346,500 $ 387.000 201,000 172,000 14 Total assets $ 547,500 $ 559,000 15 Liabilities $ 192,500 $ 225,000 16 Current liabilities 17 Long-term liabilities 18 Total liabilities 19 Stockholders' equity 95,000 119,000 $ 287,500 $ 344,000 ar. Print Done Done MacBook Air 000 090 14 of 16 (16 complete) Balance sheets 9 Accounts receivable T05,000 T80,000 130,000 10 Inventory 11 Prepaid expenses 12 Total current assets 140,000 110,000 $ 226,000 9,500 5,000 $ 346,500 $ 387,000 201,000 172,000 $ 547,500 $ 559,000 nd 13 Property, plant, and equipment, net 14 Total assets 15 Liabilities 16 Current liabilities $ 192,500 $ 225,000 95.000 119,000 $ 287,500 $ 344,000 17 Long-term liabilities 18 Total liabilities 19 Stockholders' equity 20 Preferred stock, 8% 21 Total common stockholders' equity 22 Total stockholders' equity 23 $ 125,000 $ 125,000 135,000 90,000 $ 110,000 $ 260,000 $ 215,000 24 Total liabilities and equity 25 "Selected 2018 amounts $ 547,500 $ 559,000 Print Done MacBook Air Homework: Project Score: 1.13 of 9 pts P14-43A (similar to) Comparative financial statement data of Weinstein, Inc., follow: Click the icon to view the income statements.) Click the icon to view the balance sheets.) Market price of Weinstein's common stock: $40.14 at December 31, 2020, and $25.87 at December 31 Common shares outstanding: 10,000,000 during 2020 and 10,000,000 during 2019 All sales are credit sales Read the requirements 1. 2. 3. Requirement 1. Compute the following ratios for 2020 and 2019. (Round all ratios to two decimal places.) a. Current ratio 2020 1.8 2019 1.72 2020 b. Times-interest-earned ratio 2019 Enter any number in the edit fields and then click Check Answer 7 mang MacE esc S F2 80 F DOO 000