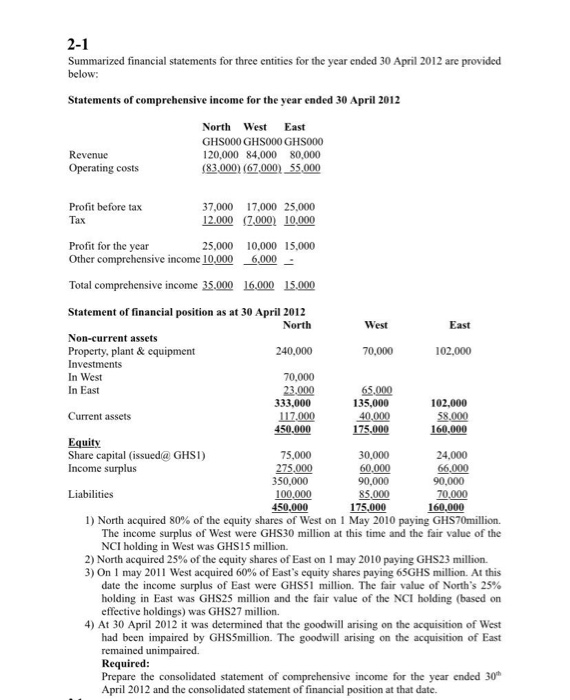

2-1 Summarized financial statements for three entities for the year ended 30 April 2012 are provided below: Statements of comprehensive income for the year ended 30 April 2012 North West East GHSOOO GHSOOO GHS000 Revenue 120,000 84.000 80.000 Operating costs (83.000) (67,000) 55,000 70.000 Profit before tax 37,000 17,000 25,000 Tax 12.000 (2.000) 10,000 Profit for the year 25,000 10,000 15,000 Other comprehensive income 10,000 6,000 - Total comprehensive income 35.000 16.000 15.000 Statement of financial position as at 30 April 2012 North West East Non-current assets Property, plant & equipment 240.000 102,000 Investments In West 70.000 In East 23.000 65.000 333,000 135,000 102,000 Current assets 117.000 40.000 58.000 450.000 175,000 160,000 Equity Share capital (issued GHSI) 75,000 30,000 24,000 Income surplus 275.000 60.000 66,000 350,000 90,000 90,000 Liabilities 100.000 85.000 70,000 450.000 175,000 160,000 1) North acquired 80% of the equity shares of West on 1 May 2010 paying GHS70million. The income surplus of West were GHS30 million at this time and the fair value of the NCI holding in West was GHS15 million. 2) North acquired 25% of the equity shares of East on 1 may 2010 paying GHS23 million 3) On 1 may 2011 West acquired 60% of East's equity shares paying 65GHS million. At this date the income surplus of East were GHS51 million. The fair value of North's 25% holding in East was GHS25 million and the fair value of the NCI holding (based on effective holdings) was GHS27 million. 4) At 30 April 2012 it was determined that the goodwill arising on the acquisition of West had been impaired by GHS5million. The goodwill arising on the acquisition of East remained unimpaired Required: Prepare the consolidated statement of comprehensive income for the year ended 30 April 2012 and the consolidated statement of financial position at that date. 2-1 Summarized financial statements for three entities for the year ended 30 April 2012 are provided below: Statements of comprehensive income for the year ended 30 April 2012 North West East GHSOOO GHSOOO GHS000 Revenue 120,000 84.000 80.000 Operating costs (83.000) (67,000) 55,000 70.000 Profit before tax 37,000 17,000 25,000 Tax 12.000 (2.000) 10,000 Profit for the year 25,000 10,000 15,000 Other comprehensive income 10,000 6,000 - Total comprehensive income 35.000 16.000 15.000 Statement of financial position as at 30 April 2012 North West East Non-current assets Property, plant & equipment 240.000 102,000 Investments In West 70.000 In East 23.000 65.000 333,000 135,000 102,000 Current assets 117.000 40.000 58.000 450.000 175,000 160,000 Equity Share capital (issued GHSI) 75,000 30,000 24,000 Income surplus 275.000 60.000 66,000 350,000 90,000 90,000 Liabilities 100.000 85.000 70,000 450.000 175,000 160,000 1) North acquired 80% of the equity shares of West on 1 May 2010 paying GHS70million. The income surplus of West were GHS30 million at this time and the fair value of the NCI holding in West was GHS15 million. 2) North acquired 25% of the equity shares of East on 1 may 2010 paying GHS23 million 3) On 1 may 2011 West acquired 60% of East's equity shares paying 65GHS million. At this date the income surplus of East were GHS51 million. The fair value of North's 25% holding in East was GHS25 million and the fair value of the NCI holding (based on effective holdings) was GHS27 million. 4) At 30 April 2012 it was determined that the goodwill arising on the acquisition of West had been impaired by GHS5million. The goodwill arising on the acquisition of East remained unimpaired Required: Prepare the consolidated statement of comprehensive income for the year ended 30 April 2012 and the consolidated statement of financial position at that date