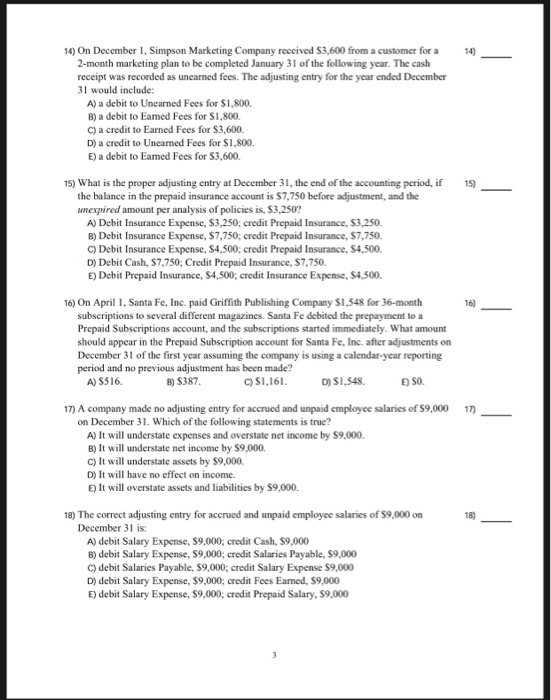

14) On December 1, Simpson Marketing Company reccived S3,600 from a customer for a 14) 2-month marketing plan to be completed January 31 of the following year. The cash receipt was recorded as unearned fees. The adjusting entry for the year ended December 31 would include: A) a debit to Unearned Fees for $1,800. B) a debit to Eamed Fees for $1,800 C) a credit to Earned Fees for $3,600. D) a credit to Unearned Fees for $1,800. E) a debit to Eamed Fees for S3,600. 15) What is the proper adjusting entry at December 31, the end of the accounting period, if 15) the balance in the prepaid insurance account is $7,750 before adjustment, and the unexpired amount per analysis of policies is, $3,250? A) Debit Insurance Expense, $3,250, credit Prepaid Insurance, $3,250 B) Debit Insurance Expense, $7,750; credit Prepaid Insurance, $7,750. C) Debit Insurance Expense, $4,500; credit Prepaid Insurance, $4,500. D) Debit Cash, S7,750; Credit Prepaid Insurance, $7,750. E) Debit Prepaid Insurance, $4,500; credit Insurance Expense, $4,500. 16) On April 1, Santa Fe, Inc. paid Griffith Publishing Company $1,548 for 36-month 16) subscriptions to several different magazines. Santa Fe debited the prepayment to a Prepaid Subscriptions account, and the subscriptions started immediately. What amount should appear in the Prepaid Subscription account for Santa Fe, Inc. after adjustments on December 31 of the first year assuming the company is using a calendar-year reporting period and no previous adjustment has been made? A) S516 B) S387 C) S1,161. D) $1,548. E) SO. 17) A company made no adjusting entry for accrued and unpaid employee salaries of S9,000 17) on December 31. Which of the following statements is true? A) It will understate expenses and overstate net income by S9,000. B) It will understate net income by $9,000. C) It will understate assets by $9,000. D) It will have no effect on income. E) It will overstate assets and liabilities by $9,000 18) The correct adjusting entry for accrued and unpaid employee salaries of $9,000 on 18) December 31 is: A) debit Salary Expense, S9,000; credit Cash, $9,000 B) debit Salary Expense, $9,000; credit Salaries Payable, $9,000 C) debit Salaries Payable, $9,000; credit Salary Expense S9,000 D) debit Salary Expense, $9,000; credit Fees Earned, $9,000 E) debit Salary Expense, $9,000; credit Prepaid Salary, $9,000