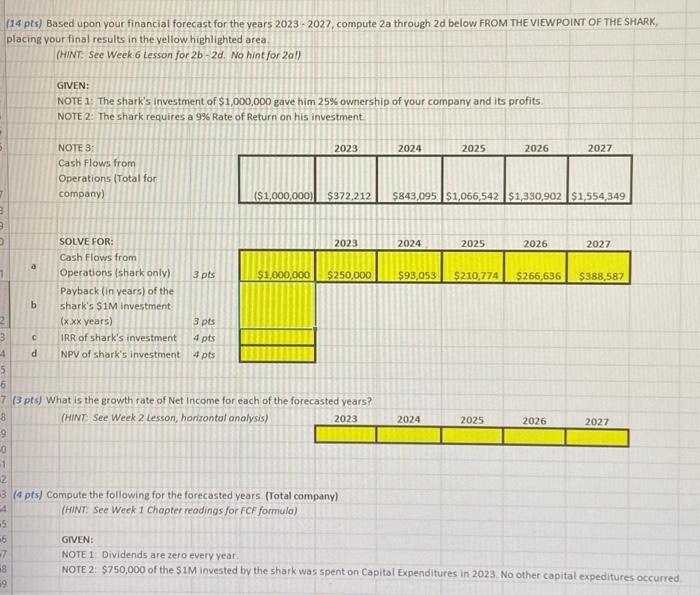

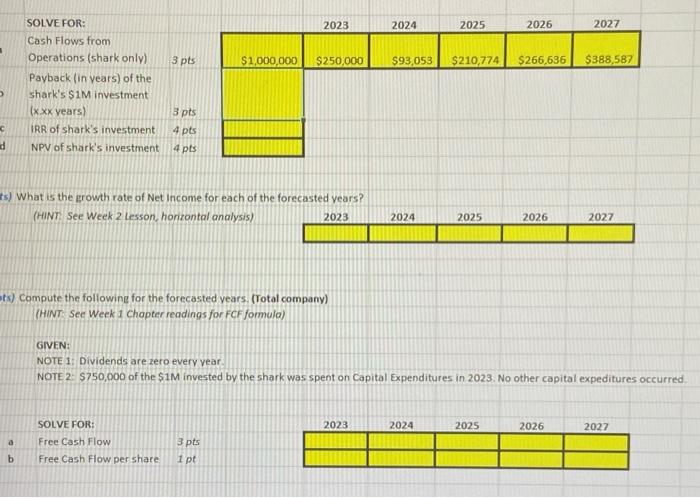

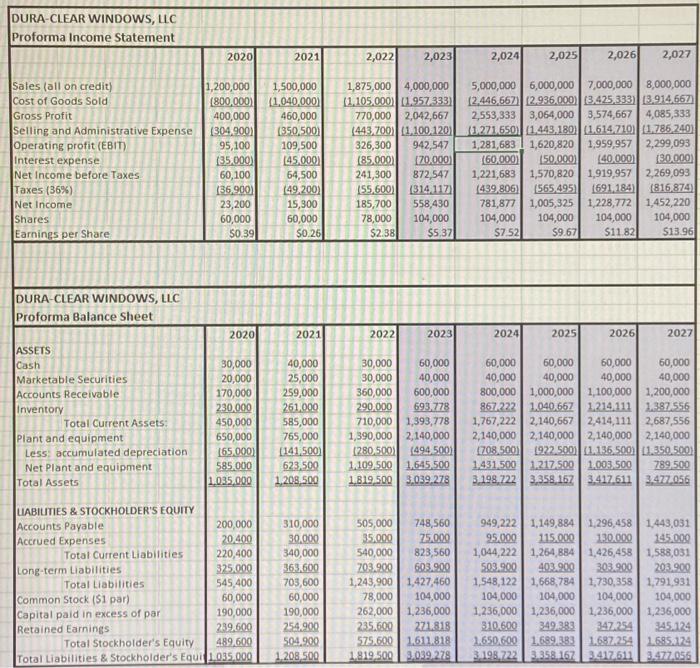

(14 pts) Based upon your financial forecast for the years 2023 - 2027, compute 2 a through 2d below FROM THE VIEWPOINT OF THE SHARK, placing vour final results in the yellow highlighted area. (HINT: See Week 6 tesson for 2b2d. No hint for 2al) GIVEN: NOTE 1: Dividends are zero every year NOTE 2: $750,000 of the $1M invested by the shark was spent on Capital Expenditures in 2023. No other capital expeditures occurred \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{9}{|l|}{ DURA-CLEAR WINDOWS, LIC } \\ \hline \multicolumn{9}{|l|}{ Proforma Income Statement } \\ \hline & 2020 & 2021 & 2,022 & 2,023 & 2,024 & 2,025 & 2,026 & 2,027 \\ \hline Sales (all on credit) & 1,200,000 & 1,500,000 & 1,875,000 & 4,000,000 & 5,000,000 & 6,000,000 & 7,000,000 & 8,000,000 \\ \hline Cost of Goods Sold & (800,000) & (1,040,000) & (1,105,000) & 0.957,333) & (2,446,667) & (2,936,000) & (3,425,333) & (3,914,667 \\ \hline Gross Profit & 400,000 & 460,000 & 770,000 & 2,042,667 & 2,553,333 & 3,064,000 & 3,574,667 & 4,085,333 \\ \hline Selling and Administrative Expense & (304,900) & (350,500) & (443,700) & (1,100,120) & (1,271,650) & (1,443,180) & (1,614,710) & (1,786,240) \\ \hline Operating profit (EBIT) & 95,100 & 109,500 & 326,300 & 942,547 & 1,281,683 & 1,620,820 & 1,959,957 & 2,299,093 \\ \hline Interest expense & (35,000) & (45,000) & (85,000) & (70,000) & (60,000) & (50,0001 & (40,000) & {[30,000} \\ \hline Net Income before Taxes & 60,100 & 64,500 & 241,300 & 872,547 & 1,221,683 & 1,570,820 & 1,919,957 & 2,269,093 \\ \hline Taxes (36%) & (36,900) & (49,200) & 155,600) & (314.1177 & (439,806) & (5,65,495) & (691,184) & (816,874) \\ \hline Net income & 23,200 & 15,300 & 185,700 & 558,430 & 781,877 & 1,005,325 & 1,228,772 & 1,452,220 \\ \hline Shares & 60,000 & 60,000 & 78,000 & 104,000 & 104,000 & 104,000 & 104,000 & 104,000 \\ \hline Earnings per Share & 50.39 & 50.26 & $2.38 & $5.37 & $7.52 & $9.67 & $11.82 & 513.96 \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline \multicolumn{9}{|l|}{ DURA-CLEAR WINDOWS, LIC } \\ \hline \multicolumn{9}{|l|}{ Proforma Balance Sheet } \\ \hline & 2020 & 2021 & 2022 & 2023 & 2024 & 2025 & 2026 & 2027 \\ \hline \multicolumn{9}{|l|}{ ASSETS } \\ \hline Cash & 30,000 & 40,000 & 30,000 & 60,000 & 60,000 & 60,000 & 60,000 & 60,000 \\ \hline Marketable Securities & 20,000 & 25,000 & 30,000 & 40,000 & 40,000 & 40,000 & 40,000 & 40,000 \\ \hline Accounts Receivable & 170,000 & 259,000 & 360,000 & 600,000 & 800,000 & 1,000,000 & 1,100,000 & 1,200,000 \\ \hline inventory & 230,000 & 261,000 & 290,000 & 693,778 & 867.222 & 1.040,657 & 1.214 .111 & 2.387 .556 \\ \hline Total Current Assets: & 450,000 & 585,000 & 710,000 & 1,393,778 & 1,767,222 & 2,140,667 & 2,414,111 & 2,687,556 \\ \hline \multirow{2}{*}{\begin{tabular}{l} Plant and equipment \\ Less: accumulated depreciation \end{tabular}} & 650,000 & 765,000 & 1,390,000 & 2,140,000 & 2,140,000 & 2,140,000 & 2,140,000 & 2,140,000 \\ \hline & (65.000) & (141,500) & (280,500) & (494.500) & (708.500) & (922.500 & (1,136.500) & 01.350 .500 \\ \hline \multirow{2}{*}{\begin{tabular}{l} Net Plant and equipment \\ Total Assets \end{tabular}} & 585,000 & 623,500 & 1,109,500 & 1,645,500 & 1,431.500 & 1,217.500 & 1,003,500 & 789.500 \\ \hline & 1.035,000 & 1,208,500 & 1,819,500 & 3,039,278 & 3.198 .722 & 3,358,167 & 3,417.611 & 3,477,056 \\ \hline \multicolumn{9}{|l|}{ LABIUTIES \& STOCKHOLDER'S EQUITY } \\ \hline Accounts Payable & 200,000 & 310,000 & 505,000 & 748,560 & 949,222 & 1,149,884 & 1,296,458 & 1,443,031 \\ \hline Accrued Expenses & 20,400 & 30,000 & 35,000 & 75,000 & 25,000 & 115.000 & 130,000 & 145,000 \\ \hline Total Current Liabilities & 220,400 & 340,000 & 540,000 & 823,560 & 1,044,222 & 1,264,884 & 1,426,458 & 1,588,031 \\ \hline Long-term Liabilities & 325,000 & 363.600 & 203.900 & 603.900 & 503.900 & 403.900 & 303.900 & 203.900 \\ \hline Total Liabilities & 545,400 & 703,600 & 1,243,900 & 1,427,460 & 1,548,122 & 1,668,784 & 1,730,358 & 1,791,931 \\ \hline Common Stock (\$1 par) & 60,000 & 60,000 & 78,000 & 104,000 & 104,000 & 104,000 & 104,000 & 104,000 \\ \hline Capital paid in excess of par & 190,000 & 190,000 & 262,000 & 1,236,000 & 1,236,000 & 1,236,000 & 1,236,000 & 1,236,000 \\ \hline \multirow{2}{*}{\begin{tabular}{l} Retained Earnings \\ Total Stockholder's Equity \end{tabular}} & 239,600 & 254.900 & 235.600 & 271.818 & 310,600 & 349.383 & 347,254 & 345.124 \\ \hline & 489,600 & 504.900 & 575.600 & 1.611 .818 & 1.650 .600 & 1,689.383 & 1.687 .254 & 1.685 .124 \\ \hline Total Liabilities \& Stockholder's Equi & 1.035 .000 & 1,208,500 & 1819500 & 3,039.278 & 3,198,722 & 3.358 .167 & 3,417.611 & 3.472 .056 \\ \hline \end{tabular} NOTE 2: \$750,000 of the \$1M invested by the shark was spent on Capital Expenditures in 2023. No other capital expeditures occurred (14 pts) Based upon your financial forecast for the years 2023 - 2027, compute 2 a through 2d below FROM THE VIEWPOINT OF THE SHARK, placing vour final results in the yellow highlighted area. (HINT: See Week 6 tesson for 2b2d. No hint for 2al) GIVEN: NOTE 1: Dividends are zero every year NOTE 2: $750,000 of the $1M invested by the shark was spent on Capital Expenditures in 2023. No other capital expeditures occurred \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{9}{|l|}{ DURA-CLEAR WINDOWS, LIC } \\ \hline \multicolumn{9}{|l|}{ Proforma Income Statement } \\ \hline & 2020 & 2021 & 2,022 & 2,023 & 2,024 & 2,025 & 2,026 & 2,027 \\ \hline Sales (all on credit) & 1,200,000 & 1,500,000 & 1,875,000 & 4,000,000 & 5,000,000 & 6,000,000 & 7,000,000 & 8,000,000 \\ \hline Cost of Goods Sold & (800,000) & (1,040,000) & (1,105,000) & 0.957,333) & (2,446,667) & (2,936,000) & (3,425,333) & (3,914,667 \\ \hline Gross Profit & 400,000 & 460,000 & 770,000 & 2,042,667 & 2,553,333 & 3,064,000 & 3,574,667 & 4,085,333 \\ \hline Selling and Administrative Expense & (304,900) & (350,500) & (443,700) & (1,100,120) & (1,271,650) & (1,443,180) & (1,614,710) & (1,786,240) \\ \hline Operating profit (EBIT) & 95,100 & 109,500 & 326,300 & 942,547 & 1,281,683 & 1,620,820 & 1,959,957 & 2,299,093 \\ \hline Interest expense & (35,000) & (45,000) & (85,000) & (70,000) & (60,000) & (50,0001 & (40,000) & {[30,000} \\ \hline Net Income before Taxes & 60,100 & 64,500 & 241,300 & 872,547 & 1,221,683 & 1,570,820 & 1,919,957 & 2,269,093 \\ \hline Taxes (36%) & (36,900) & (49,200) & 155,600) & (314.1177 & (439,806) & (5,65,495) & (691,184) & (816,874) \\ \hline Net income & 23,200 & 15,300 & 185,700 & 558,430 & 781,877 & 1,005,325 & 1,228,772 & 1,452,220 \\ \hline Shares & 60,000 & 60,000 & 78,000 & 104,000 & 104,000 & 104,000 & 104,000 & 104,000 \\ \hline Earnings per Share & 50.39 & 50.26 & $2.38 & $5.37 & $7.52 & $9.67 & $11.82 & 513.96 \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline \multicolumn{9}{|l|}{ DURA-CLEAR WINDOWS, LIC } \\ \hline \multicolumn{9}{|l|}{ Proforma Balance Sheet } \\ \hline & 2020 & 2021 & 2022 & 2023 & 2024 & 2025 & 2026 & 2027 \\ \hline \multicolumn{9}{|l|}{ ASSETS } \\ \hline Cash & 30,000 & 40,000 & 30,000 & 60,000 & 60,000 & 60,000 & 60,000 & 60,000 \\ \hline Marketable Securities & 20,000 & 25,000 & 30,000 & 40,000 & 40,000 & 40,000 & 40,000 & 40,000 \\ \hline Accounts Receivable & 170,000 & 259,000 & 360,000 & 600,000 & 800,000 & 1,000,000 & 1,100,000 & 1,200,000 \\ \hline inventory & 230,000 & 261,000 & 290,000 & 693,778 & 867.222 & 1.040,657 & 1.214 .111 & 2.387 .556 \\ \hline Total Current Assets: & 450,000 & 585,000 & 710,000 & 1,393,778 & 1,767,222 & 2,140,667 & 2,414,111 & 2,687,556 \\ \hline \multirow{2}{*}{\begin{tabular}{l} Plant and equipment \\ Less: accumulated depreciation \end{tabular}} & 650,000 & 765,000 & 1,390,000 & 2,140,000 & 2,140,000 & 2,140,000 & 2,140,000 & 2,140,000 \\ \hline & (65.000) & (141,500) & (280,500) & (494.500) & (708.500) & (922.500 & (1,136.500) & 01.350 .500 \\ \hline \multirow{2}{*}{\begin{tabular}{l} Net Plant and equipment \\ Total Assets \end{tabular}} & 585,000 & 623,500 & 1,109,500 & 1,645,500 & 1,431.500 & 1,217.500 & 1,003,500 & 789.500 \\ \hline & 1.035,000 & 1,208,500 & 1,819,500 & 3,039,278 & 3.198 .722 & 3,358,167 & 3,417.611 & 3,477,056 \\ \hline \multicolumn{9}{|l|}{ LABIUTIES \& STOCKHOLDER'S EQUITY } \\ \hline Accounts Payable & 200,000 & 310,000 & 505,000 & 748,560 & 949,222 & 1,149,884 & 1,296,458 & 1,443,031 \\ \hline Accrued Expenses & 20,400 & 30,000 & 35,000 & 75,000 & 25,000 & 115.000 & 130,000 & 145,000 \\ \hline Total Current Liabilities & 220,400 & 340,000 & 540,000 & 823,560 & 1,044,222 & 1,264,884 & 1,426,458 & 1,588,031 \\ \hline Long-term Liabilities & 325,000 & 363.600 & 203.900 & 603.900 & 503.900 & 403.900 & 303.900 & 203.900 \\ \hline Total Liabilities & 545,400 & 703,600 & 1,243,900 & 1,427,460 & 1,548,122 & 1,668,784 & 1,730,358 & 1,791,931 \\ \hline Common Stock (\$1 par) & 60,000 & 60,000 & 78,000 & 104,000 & 104,000 & 104,000 & 104,000 & 104,000 \\ \hline Capital paid in excess of par & 190,000 & 190,000 & 262,000 & 1,236,000 & 1,236,000 & 1,236,000 & 1,236,000 & 1,236,000 \\ \hline \multirow{2}{*}{\begin{tabular}{l} Retained Earnings \\ Total Stockholder's Equity \end{tabular}} & 239,600 & 254.900 & 235.600 & 271.818 & 310,600 & 349.383 & 347,254 & 345.124 \\ \hline & 489,600 & 504.900 & 575.600 & 1.611 .818 & 1.650 .600 & 1,689.383 & 1.687 .254 & 1.685 .124 \\ \hline Total Liabilities \& Stockholder's Equi & 1.035 .000 & 1,208,500 & 1819500 & 3,039.278 & 3,198,722 & 3.358 .167 & 3,417.611 & 3.472 .056 \\ \hline \end{tabular} NOTE 2: \$750,000 of the \$1M invested by the shark was spent on Capital Expenditures in 2023. No other capital expeditures occurred