Garden Depot has just paid an annual dividend of $3.5 per share. Analysts expect the firm's dividends to grow by 2% forever. Its stock price is $38.09 and its beta is 1.2. Its bonds have a yield to maturity of 6%, and the risk-premium of its stock over its bonds is 3%.

The risk-free rate is 4% and the expected return on the market portfolio is 6%.

The company is in the process of issuing new common stock, with flotation costs of 11% of the issue price.

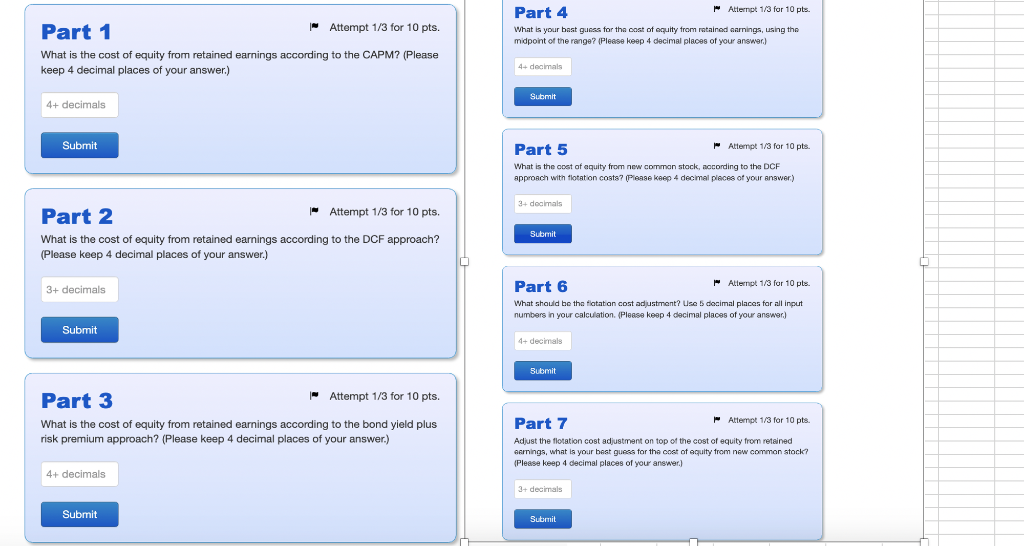

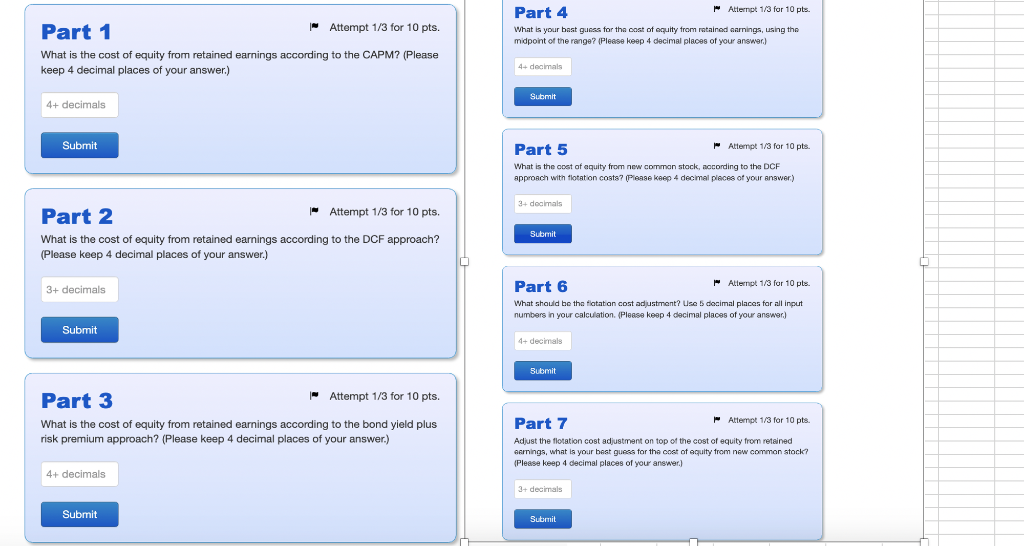

Part 4 Attempt 1/3 for 10 pts. What is your best guess for the cost of equity from retained earnings, using the midpoint of the range? (Please keep 4 decimal places of your answer.) Part 1 - Attempt 1/3 for 10 pts. What is the cost of equity from retained earnings according to the CAPM? (Please keep 4 decimal places of your answer.) 4+ decimals Submit 4+ decimals Submit Part 5 Attempt 1/3 for 10 pts. What is the cost of equity from now common stock, according to the DCE approach with flotation costs? Please keep 4 decimal places of your answer) 3+ decimals Part 2 Attempt 1/3 for 10 pts. . What is the cost of equity from retained earnings according to the DCF approach? (Please keep 4 decimal places of your answer.) Submit 3+ decimals Part 6 Allernpt 1/3 for 10 pts What should be the filatation cost adjustment? Use 5 decimal places for all input numbers in your calculation. Please keep 4 decimal places of your answer.) Submit 4-decimals Submit Part 3 - Attempt 1/3 for 10 pts. What is the cost of equity from retained earnings according to the bond yield plus risk premium approach? (Please keep 4 decimal places of your answer.) Part 7 | Attempt 1/3 for 10 pts. Adjust the flotation cost adjustment on top of the cost of equity from retained Aarnings, what is your best guess for the cost of equity from now common stock? (Please keep 4 decimal places of your answer.) 4+ decimals 3+ decimals Submit Submit Part 4 Attempt 1/3 for 10 pts. What is your best guess for the cost of equity from retained earnings, using the midpoint of the range? (Please keep 4 decimal places of your answer.) Part 1 - Attempt 1/3 for 10 pts. What is the cost of equity from retained earnings according to the CAPM? (Please keep 4 decimal places of your answer.) 4+ decimals Submit 4+ decimals Submit Part 5 Attempt 1/3 for 10 pts. What is the cost of equity from now common stock, according to the DCE approach with flotation costs? Please keep 4 decimal places of your answer) 3+ decimals Part 2 Attempt 1/3 for 10 pts. . What is the cost of equity from retained earnings according to the DCF approach? (Please keep 4 decimal places of your answer.) Submit 3+ decimals Part 6 Allernpt 1/3 for 10 pts What should be the filatation cost adjustment? Use 5 decimal places for all input numbers in your calculation. Please keep 4 decimal places of your answer.) Submit 4-decimals Submit Part 3 - Attempt 1/3 for 10 pts. What is the cost of equity from retained earnings according to the bond yield plus risk premium approach? (Please keep 4 decimal places of your answer.) Part 7 | Attempt 1/3 for 10 pts. Adjust the flotation cost adjustment on top of the cost of equity from retained Aarnings, what is your best guess for the cost of equity from now common stock? (Please keep 4 decimal places of your answer.) 4+ decimals 3+ decimals Submit Submit