14. Referring to Question 13, assume that the operating budget you prepared for the upcoming year has been adopted. After the first six months of the year, financial records reveal the following:

(Question 13 budget provided in picture)

Assuming that the trends evident in the first six months continue for the rest of the year and that both sales and costs are equally divided between the two halves of the year, prepare a revision of the budget for the second six-month period.

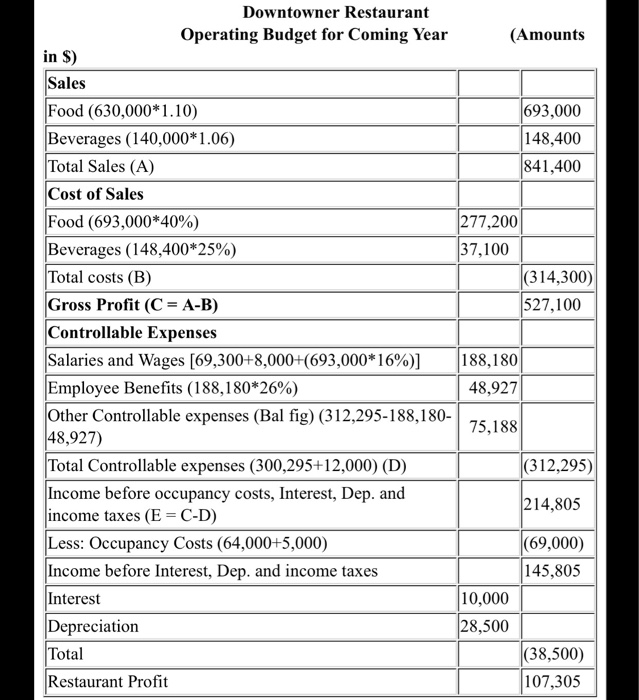

14. Referring to Question 13, assume that the operating budget you pre- for the upcoming year has been adopted. After the first six pared months of the year, financial records reveal the following a. Food sales have increased by 12 percent rather than by the 10 per- cent anticipated. b. Beverage sales have increased by 5 percent rather than by 6 percent. c. Food cost percent is 1 percent lower than budgeted, but beverage cost percent is 2 percent higher d. Variable salaries and wages are 14 percent of food sales, rather than the 16 percent anticipated Assuming that the trends evident in the first six months continue for the rest of the year and that both sales and costs are equaily divided between the two halves of the year prepare a revision of the budget for the second six-month period Downtowner Restaurant Operating Budget for Coming Year (Amounts in $) Sales Food (630,000*1.10) Beverages (140,000 1.06) Total Sales (A) Cost of Sales Food (693,000*40%) Beverages ( 148,400+25%) Total costs (B) Gross Profit (C-A-B) Controllable Expenses Salaries and Wages [69,300+8,000+(693,000*16%] |188, 180 Employee Benefits ( 1 88, 1 80*26%) Other Controllable expenses (Bal fig) (312,295-188,180- 48,927) Total Controllable expenses (300,295+12,000) (D) Income before occupancy costs, Interest, Dep. and income taxes (E - C-D) Less: Occupancy Costs (64,000+5,000) Income before Interest, Dep. and income taxes Interest Depreciation Total Restaurant Profit 693,000 148,400 841,400 277,200 37,100 (314,300) 527,100 48,927 (312,295) 214,805 (69,000) 145,805 10,000 8,500 (38,500) 107,305 14. Referring to Question 13, assume that the operating budget you pre- for the upcoming year has been adopted. After the first six pared months of the year, financial records reveal the following a. Food sales have increased by 12 percent rather than by the 10 per- cent anticipated. b. Beverage sales have increased by 5 percent rather than by 6 percent. c. Food cost percent is 1 percent lower than budgeted, but beverage cost percent is 2 percent higher d. Variable salaries and wages are 14 percent of food sales, rather than the 16 percent anticipated Assuming that the trends evident in the first six months continue for the rest of the year and that both sales and costs are equaily divided between the two halves of the year prepare a revision of the budget for the second six-month period Downtowner Restaurant Operating Budget for Coming Year (Amounts in $) Sales Food (630,000*1.10) Beverages (140,000 1.06) Total Sales (A) Cost of Sales Food (693,000*40%) Beverages ( 148,400+25%) Total costs (B) Gross Profit (C-A-B) Controllable Expenses Salaries and Wages [69,300+8,000+(693,000*16%] |188, 180 Employee Benefits ( 1 88, 1 80*26%) Other Controllable expenses (Bal fig) (312,295-188,180- 48,927) Total Controllable expenses (300,295+12,000) (D) Income before occupancy costs, Interest, Dep. and income taxes (E - C-D) Less: Occupancy Costs (64,000+5,000) Income before Interest, Dep. and income taxes Interest Depreciation Total Restaurant Profit 693,000 148,400 841,400 277,200 37,100 (314,300) 527,100 48,927 (312,295) 214,805 (69,000) 145,805 10,000 8,500 (38,500) 107,305