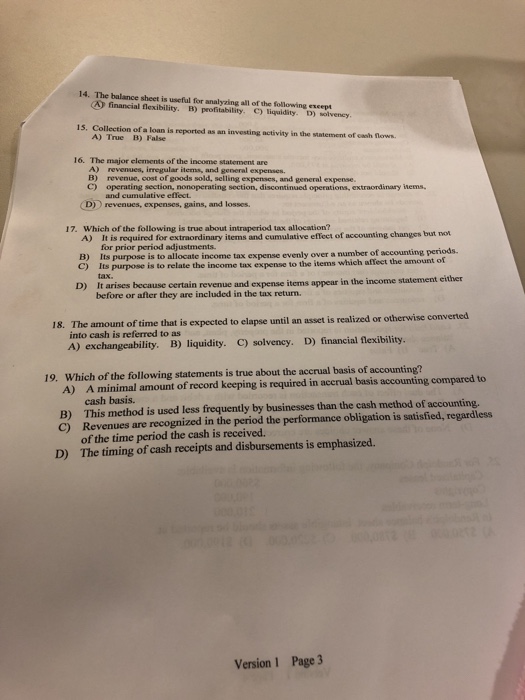

14. The balance sheet is useful for analyzing all of the following except financial flexibility. B) profitability. C) liquidity. D) solveney. 15. Collection of a loan is reported as an investing activity in the statement of A) True B) False cash flows 16. The major elements of the income statement are A) B) revenues, irregular items, and general expenses. revenue, cost of goods sold, selling expenses, and general expense. C) operating section, nonoperating section, discontinued operations, extraordinary inems D revenues, expenses, gains, and losses. and cumulative effect. 17. Which of the following is true about intraperiod tax allocation? A) It is required for extraordinary items and cumulative effect of accounting changes but not. for prior period adjustments. is to allocate income tax expense evenly over a number of accounting periods C) Its purpose is to relate the income tax expense to the items which affect the amount revenue and expense items appear in the income statement either before or after they are included in the tax return. 18. The amount of time that is expected to elapse until an asset is realized or otherwise converted into cash is referred to as A) exchangeability. B) liquidity. C) solvency. D) financial flexibility. 19. Which of the following statements is true about the accrual basis of accounting? A) A minimal amount of record keeping is required in accrual basis accounting compared to B) This method is used less frequently by businesses than the cash method of accounting C) Revenues are recognized in the period the performance obligation is satisfied, regardless cash basis. of the time period the cash is received. The timing of cash receipts and disbursements is emphasized. D) Version I Page 3 14. The balance sheet is useful for analyzing all of the following except financial flexibility. B) profitability. C) liquidity. D) solveney. 15. Collection of a loan is reported as an investing activity in the statement of A) True B) False cash flows 16. The major elements of the income statement are A) B) revenues, irregular items, and general expenses. revenue, cost of goods sold, selling expenses, and general expense. C) operating section, nonoperating section, discontinued operations, extraordinary inems D revenues, expenses, gains, and losses. and cumulative effect. 17. Which of the following is true about intraperiod tax allocation? A) It is required for extraordinary items and cumulative effect of accounting changes but not. for prior period adjustments. is to allocate income tax expense evenly over a number of accounting periods C) Its purpose is to relate the income tax expense to the items which affect the amount revenue and expense items appear in the income statement either before or after they are included in the tax return. 18. The amount of time that is expected to elapse until an asset is realized or otherwise converted into cash is referred to as A) exchangeability. B) liquidity. C) solvency. D) financial flexibility. 19. Which of the following statements is true about the accrual basis of accounting? A) A minimal amount of record keeping is required in accrual basis accounting compared to B) This method is used less frequently by businesses than the cash method of accounting C) Revenues are recognized in the period the performance obligation is satisfied, regardless cash basis. of the time period the cash is received. The timing of cash receipts and disbursements is emphasized. D) Version I Page 3