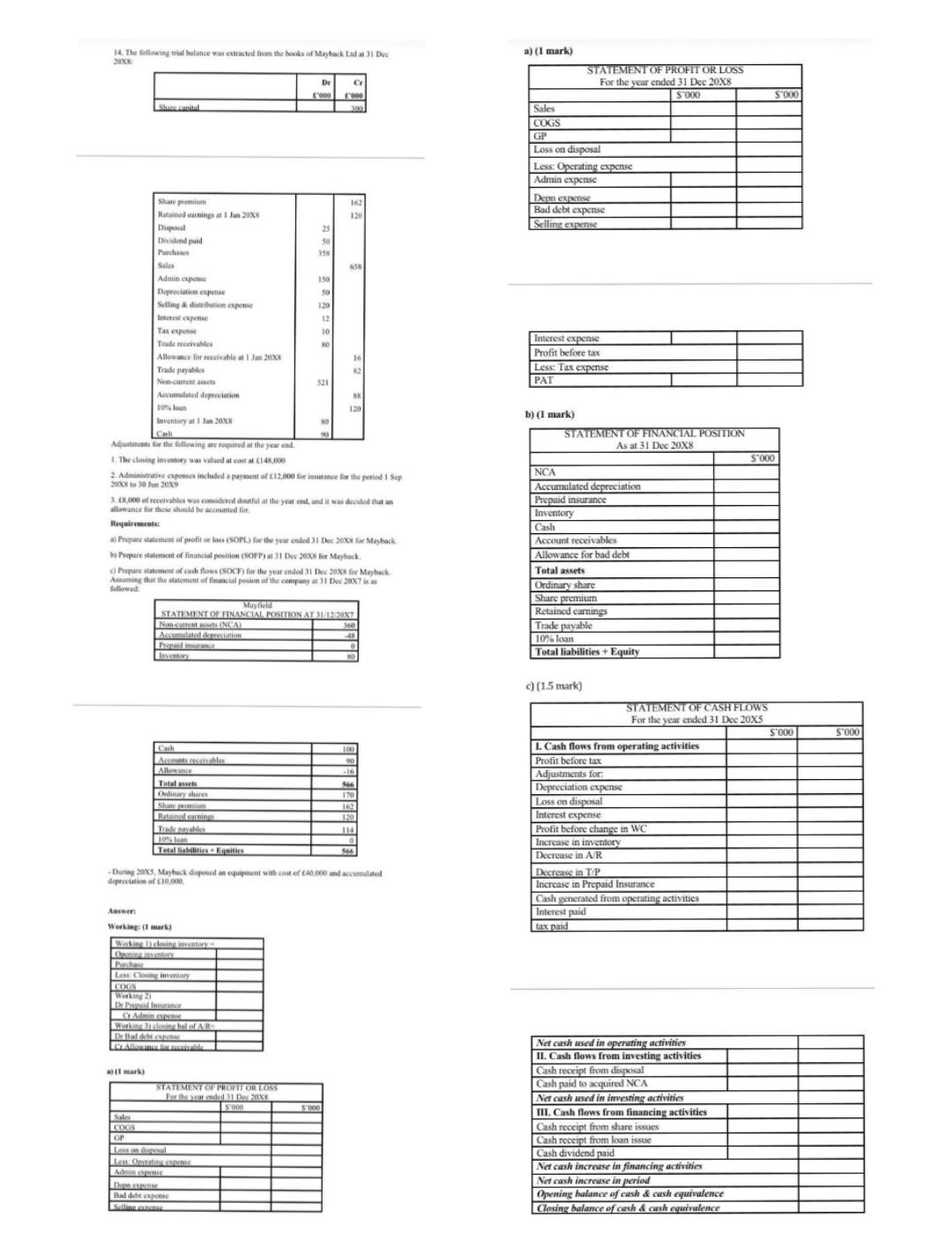

14. The following trial balance was extracted from the books of Mayback Lad at 31 Dec 20XK Cr C000 a) (1 mark) STATEMENT OF

14. The following trial balance was extracted from the books of Mayback Lad at 31 Dec 20XK Cr C000 a) (1 mark) STATEMENT OF PROFIT OR LOSS For the year ended 31 Dec 20X8 S'000 Shane canital Share premium 162 Retained earnings at 1 Jan 20X 120 Disposal 25 Dividend paid Purchases Sales Admin expense 358 65K 150 Depreciation expense Selling & distribution expense 120 Interest expense Tax expense Trade receivables Allowance for receivable at 1 Jan 20X Trade payables Non-current assets Accumulated depreciation 10% loan Inventory at 1 Jan 20XX Cash Sales COGS GP Loss on disposal Less: Operating expense Admin expense Depn expense Bad debt expense Selling expense Interest expense Profit before tax 16 N2 521 Less: Tax expense PAT NO b) (1 mark) STATEMENT OF FINANCIAL POSITION As at 31 Dec 20X8 Adjustments for the following are required at the year end. 1. The closing inventory was valued at cost at 148,000 2. Administrative expomes included a payment of 12,000 for insurance for the period 1 Sep 2008 to 30 Jun 20X9 3. EX,000 of receivables was considered doutful at the year end, and it was decided that an allowance for these should be accounted for. Requirements: a) Prepare statement of profit or loss (SOPL) for the year ended 31 Dec 20XX for Mayback bi Prepare statement of financial position (SOFP) at 31 Dec 2005 for Mayback OP Prepare statement of cash flows (SOCF) for the year ended 31 Dec 20X8 for Mayback Assuming that the statement of financial posion of the company at 31 Dec 20X7 is as followed Mayfield STATEMENT OF FINANCIAL POSITION AT 31/12/20X7 Non-current assets (NCA) Accumulated depreciation Propail insurance NCA Accumulated depreciation Prepaid insurance Inventory Cash Account receivables Allowance for bad debt Total assets Ordinary share Share premium Retained earnings Trade payable 10% loan Total liabilities + Equity Inventory S'000 $'000 c) (1.5 mark) STATEMENT OF CASH FLOWS For the year ended 31 Dec 20X5 S000 S'000 Cash 100 Accounts receivables I. Cash flows from operating activities Profit before tax Allowance Total assets 566 Ordinary shares 170 162 120 114 Share promium Retained earnings Trak payables 10% lean Total liabilities Equities During 20X5, Mayback disposed an equipment with cost of 40.000 and accumulated depreciation of 10,000 Adjustments for Depreciation expense Loss on disposal Interest expense Profit before change in WC Increase in inventory Decrease in A/R Decrease in T/P Increase in Prepaid Insurance Cash generated from operating activities Interest paid tax paid Answer Working: (I mark) Working 1) closing inventory Opming inventory Purchase Les Closing inventory COGS Working 21 Dr Prepaid Insurance Admin expense Working closing bal of AR Dr Bad debt expense CrAllows for receivable STATEMENT OF PROFIT OR LOSS For the year ended 31 Dec 20X8 Sales COGS GP Loss on disposal Les Opitating ENDOME Admin expense Den expense Bal debt expense Selling 5000 Net cash used in operating activities II. Cash flows from investing activities Cash receipt from disposal Cash paid to acquired NCA Net cash used in investing activities III. Cash flows from financing activities Cash receipt from share issues Cash receipt from loan issue Cash dividend paid Net cash increase in financing activities Net cash increase in period Opening balance of cash & cash equivalence || Closing balance of cash & cash equivalence

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started