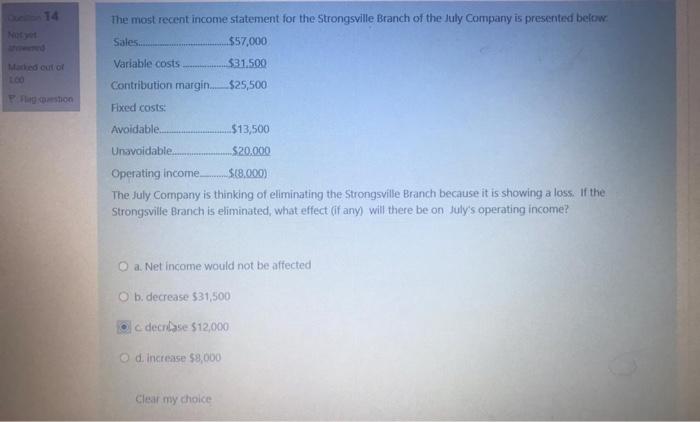

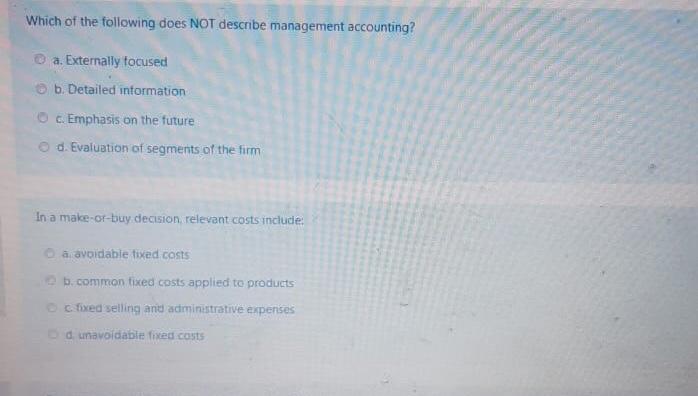

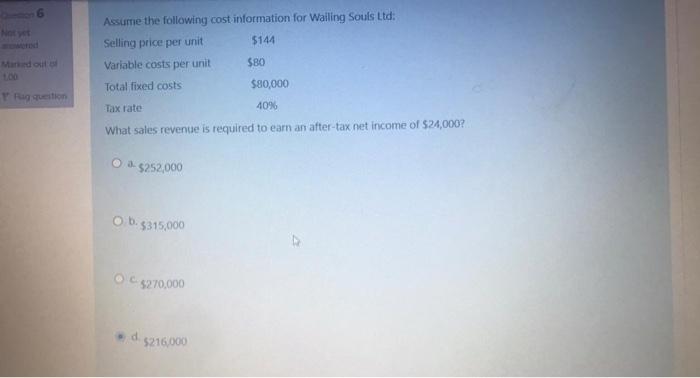

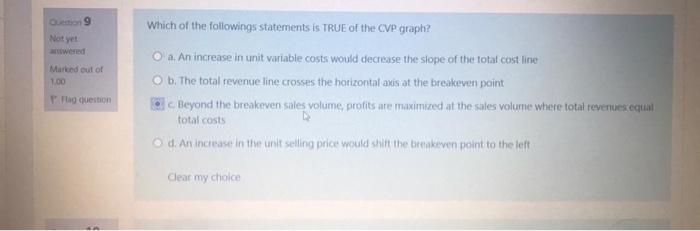

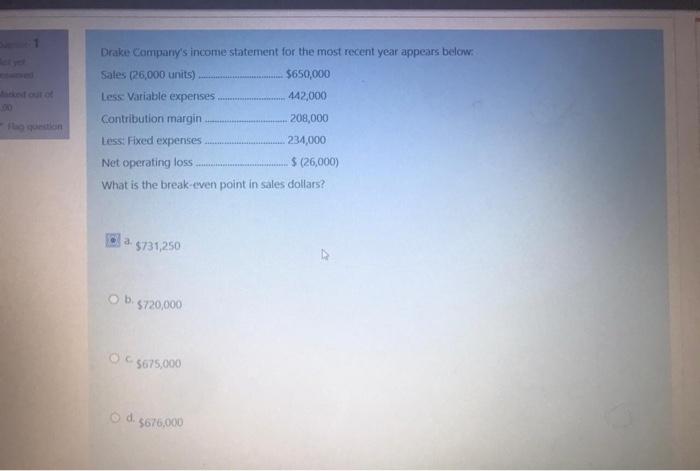

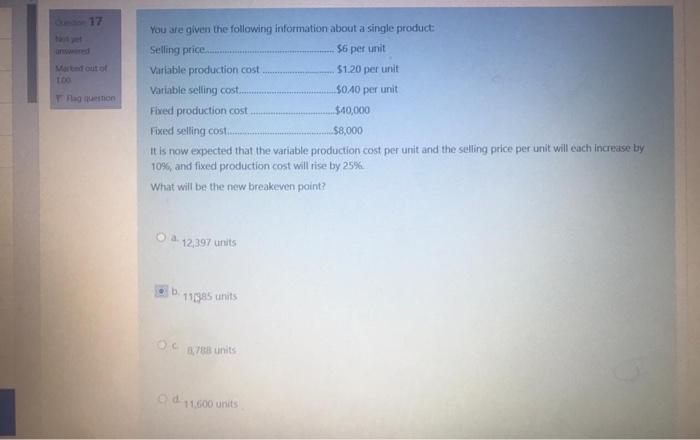

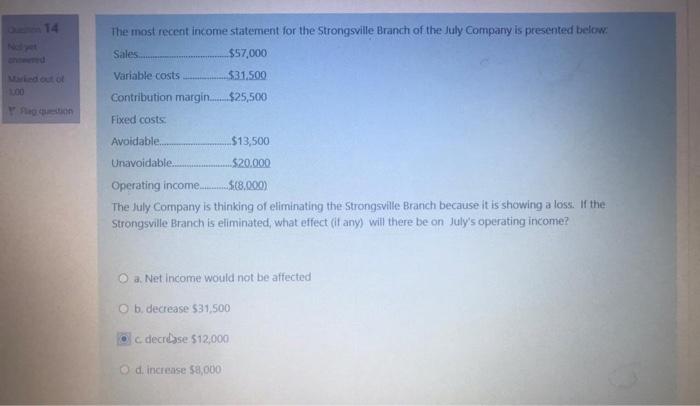

14 The most recent income statement for the Strongsville Branch of the July Company is presented below Sales... $57,000 Marked out of Variable costs $31.500 Phon Contribution margin. $25,500 Fixed costs Avoidable $13,500 Unavoidable $20.000 Operating income $18,000) The July Company is thinking of eliminating the Strongsville Branch because it is showing a loss. If the Strongsville Branch is eliminated, what effect (if any) will there be on July's operating income? O a. Net income would not be affected O b. decrease $31,500. decrbase $12,000 d. Increase $8,000 Clear my choice Which of the following does NOT describe management accounting? a. Externally focused b. Detailed information O c. Emphasis on the future d. Evaluation of segments of the firm In a make-or-buy decision relevant costs include: avoidable fixed costs b.common fixed costs applied to products fixed selling and administrative expenses dunavoidable fixed costs Assume the following cost information for Wailing Souls Ltd: Selling price per unit 5144 Variable costs per unit $80 Total fixed costs $80,000 Tax rate 4096 What sales revenue is required to earn an after-tax net income of $24,000? Trg question O $252,000 O 0.5315,000 C$270,000 d $216,000 Which of the followings statements is TRUE of the CVP graph? Not yes wered Marked out of 1.00 Pig Question a. An increase in unit variable costs would decrease the slope of the total cost line O b. The total revenue line crosses the horizontal axis at the breakeven point Beyond the breakeven sales volume, profits are maximized at the sales volume where total revenues equal total costs d. An increase in the unit selling price would shift the breakiven point to the left Clear my choice Drake Company's income statement for the most recent year appears below: Sales (26,000 units) $650,000 Less: Variable expenses... 442,000 Contribution margin 208,000 Less: Fixed expenses 234,000 Net operating loss $ (26,000) What is the break-even point in sales dollars? wa $731,250 b. $720,000 Oc5675,000 O d. 5676,000 Marted out of ago You are given the following information about a single product: Selling price 56 per unit Variable production cost 51.20 per unit Variable seling cost. $040 per unit Fixed production cost $40,000 Fixed selling cost. $8,000 it is now expected that the variable production cost per unit and the selling price per unit will each increase by 10%, and fixed production cost will rise by 25% What will be the new breakeven paint? O2 12,397 units . 11985 units OG 1,788 units od 11.600 units The most recent income statement for the Strongsville Branch of the July Company is presented below. Sales $57.000 Variable costs $31.500 Contribution margin...$25,500 Fixed costs Avoidable. $13,500 Unavoidable. $20.000 Operating income The July Company is thinking of eliminating the Strongsville Branch because it is showing a loss. If the Strongsville Branch is eliminated, what effect (if any) will there be on July's operating income? a. Net Income would not be affected b. decrease 531,500 oc decrease $12,000 d. increase 58,000