Answered step by step

Verified Expert Solution

Question

1 Approved Answer

= 1/4, valid = Consider a two-step binomial model with dates t = 0,1,2, simple interest rate r for both time periods, and a

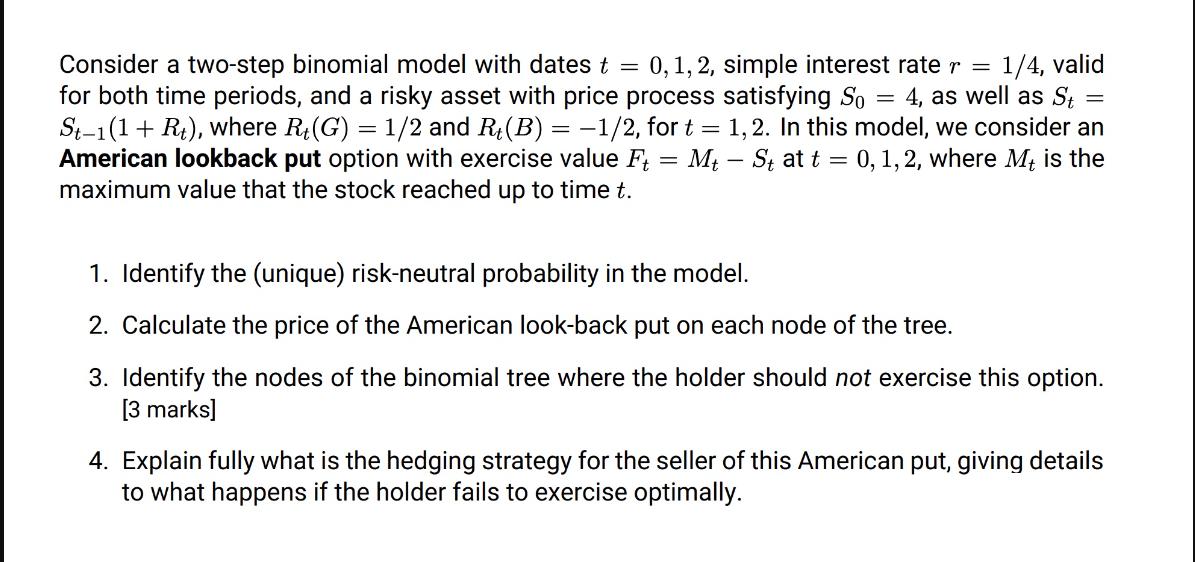

= 1/4, valid = Consider a two-step binomial model with dates t = 0,1,2, simple interest rate r for both time periods, and a risky asset with price process satisfying So 4, as well as St St-1(1+ Rt), where Rt (G) 1/2 and R(B): -1/2, for t = 1,2. In this model, we consider an American lookback put option with exercise value Ft = Mt St at t = 0, 1, 2, where Mt is the maximum value that the stock reached up to time t. = 1. Identify the (unique) risk-neutral probability in the model. 2. Calculate the price of the American look-back put on each node of the tree. 3. Identify the nodes of the binomial tree where the holder should not exercise this option. [3 marks] 4. Explain fully what is the hedging strategy for the seller of this American put, giving details to what happens if the holder fails to exercise optimally.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started