Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14,15 QUESTION 14 A British investor buys a stock listed on the NYSE at the beginning of the year for $60. At the end of

14,15

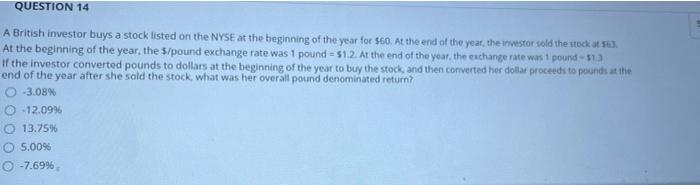

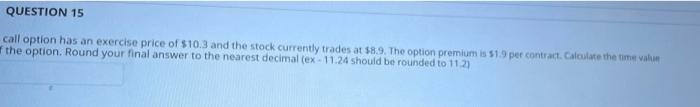

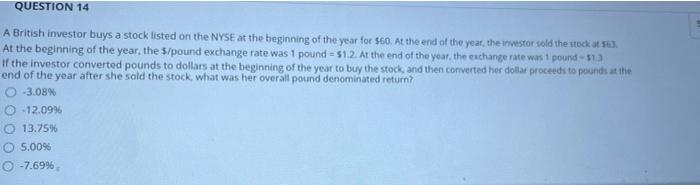

QUESTION 14 A British investor buys a stock listed on the NYSE at the beginning of the year for $60. At the end of the year, the investor sold the stock at 30. At the beginning of the year, the 5/pound exchange rate was 1 pound = 51.2. At the end of the year, the exchange rate was 1 pound 513 if the investor converted pounds to dollars at the beginning of the year to buy the stock, and then converted her dollar proceeds to pounds at the end of the year after she sold the stock, what was her overall pound denominated return? 0 -3.08% O -12.09% 13.75% 5.00% 0 -7.69% QUESTION 15 call option has an exercise price of $10.3 and the stock currently trades at $8.9. The option premium is 51.9 per contract. Calculate the time valu the option. Round your final answer to the nearest decimal (ex - 11.24 should be rounded to 112) QUESTION 14 A British investor buys a stock listed on the NYSE at the beginning of the year for $60. At the end of the year, the investor sold the stock at 30. At the beginning of the year, the 5/pound exchange rate was 1 pound = 51.2. At the end of the year, the exchange rate was 1 pound 513 if the investor converted pounds to dollars at the beginning of the year to buy the stock, and then converted her dollar proceeds to pounds at the end of the year after she sold the stock, what was her overall pound denominated return? 0 -3.08% O -12.09% 13.75% 5.00% 0 -7.69% QUESTION 15 call option has an exercise price of $10.3 and the stock currently trades at $8.9. The option premium is 51.9 per contract. Calculate the time valu the option. Round your final answer to the nearest decimal (ex - 11.24 should be rounded to 112)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started