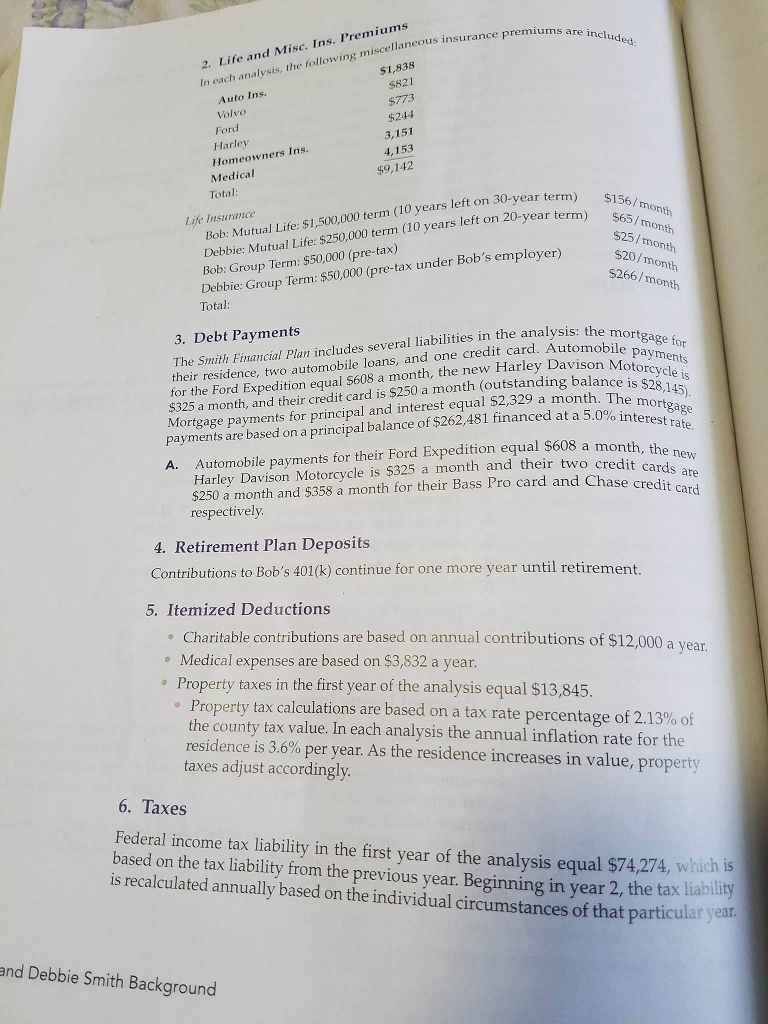

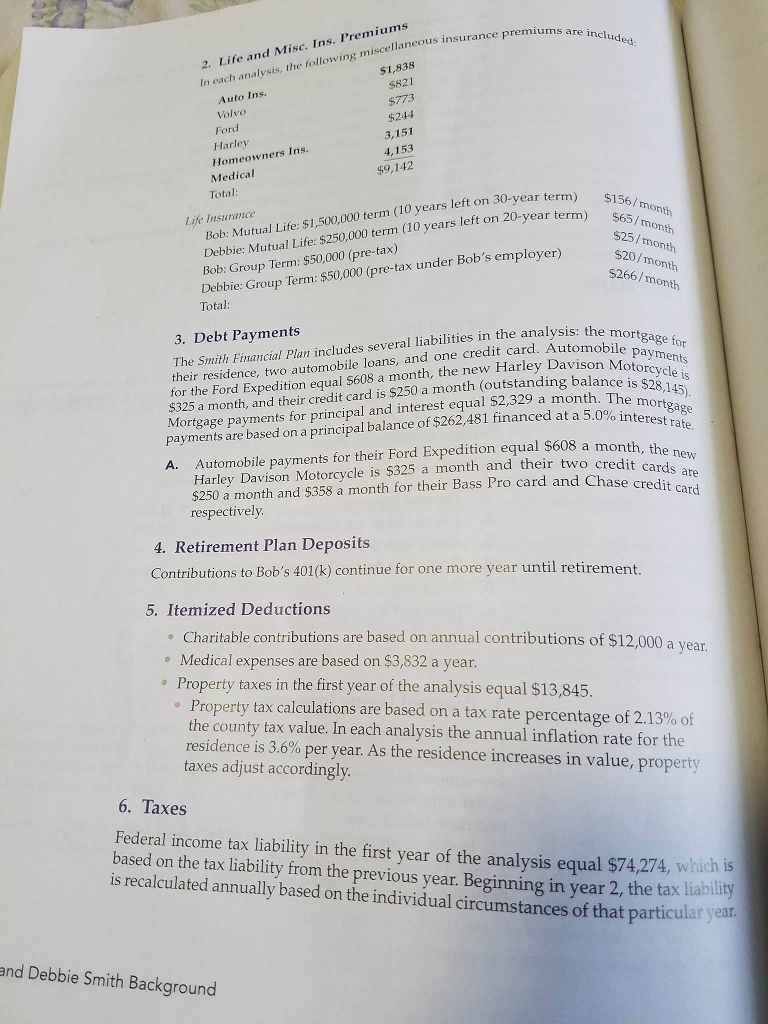

The Smith Financial Plan includes several liabilities in the analysis: the mortgage for their residence, two automobile loans, and one credit card. Automobile for the Ford Expedition equal 5608 a month, the new Harley Davison Motorcycle is $325 a month, and their credit card is $250 a month (outstanding balance is $28, 145). Mortgage payments for principal and interest equal $2, 329 a month. The mortgage payments are based on a principal balance of $262, 481 financed at a 5.0% increase rate. Automobile payments for their Ford Expedition equal $608 a month, the new Harley Davison Motorcycle is $325 a month and their two credit cards are $250 a month and $358 a month for their Bass Pro card and Chase credit card respectively. Contributions to Bob's 401(K) continue for one more year until retirement. Charitable contributions are based on annual contributions of $12,000 a year. Medical expenses are based on $3, 832 a year. Property taxes in the first year of the analysis equal $13, 845. Property tax calculations are based on a tax rate percentage of 2.13% of the county tax value. In each analysis the annual inflation rate for the residence is 3.6% per year. As the residence increases in value, property taxes adjust accordingly. Federal income tax liability in the first year of the analysis equal $74, 274, which is based on the tax liability from the previous year. Beginning in year 2, the tax liability is recalculated annually based on the individual circumstances of that particularly year. The Smith Financial Plan includes several liabilities in the analysis: the mortgage for their residence, two automobile loans, and one credit card. Automobile for the Ford Expedition equal 5608 a month, the new Harley Davison Motorcycle is $325 a month, and their credit card is $250 a month (outstanding balance is $28, 145). Mortgage payments for principal and interest equal $2, 329 a month. The mortgage payments are based on a principal balance of $262, 481 financed at a 5.0% increase rate. Automobile payments for their Ford Expedition equal $608 a month, the new Harley Davison Motorcycle is $325 a month and their two credit cards are $250 a month and $358 a month for their Bass Pro card and Chase credit card respectively. Contributions to Bob's 401(K) continue for one more year until retirement. Charitable contributions are based on annual contributions of $12,000 a year. Medical expenses are based on $3, 832 a year. Property taxes in the first year of the analysis equal $13, 845. Property tax calculations are based on a tax rate percentage of 2.13% of the county tax value. In each analysis the annual inflation rate for the residence is 3.6% per year. As the residence increases in value, property taxes adjust accordingly. Federal income tax liability in the first year of the analysis equal $74, 274, which is based on the tax liability from the previous year. Beginning in year 2, the tax liability is recalculated annually based on the individual circumstances of that particularly year