Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15 -15 If the firm's opportunity cost is 99 , would it be economically advisable fo b hr days)des the firm currently have? firm to

15-15

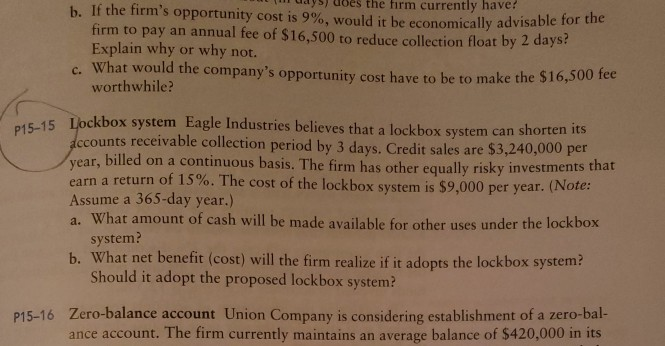

If the firm's opportunity cost is 99 , would it be economically advisable fo b hr days)des the firm currently have? firm to pay an annual fee of $16,500 to reduce collection float by 2 day s? Explain why or why not. worthwhile? ckbo c. What would the company's opportunity cost have to be to make the $16 ,500 fee x system Eagle Industries believes that a lockbox system can shorten its 000 per P15-15 Loc ccounts receivable collection period by 3 days. Credit sales are $3,240, year, billed on a continuous basis. The firm has other equally risky investments that a return of 15%. The cost of the lockbox systemis $ earn 9,000 per year. (Note: Assume a 365-day year.) a. What amount of cash will be made available for other uses under the lockbox system? b. What net benefit (cost) will the firm realize if it adopts the lockbox system? Should it adopt the proposed lockbox system? Zero-balance account Union Company is considering establishment of a zero-bal- ance account. The firm currently maintains an average balance of $420,000 in its P15-16Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started