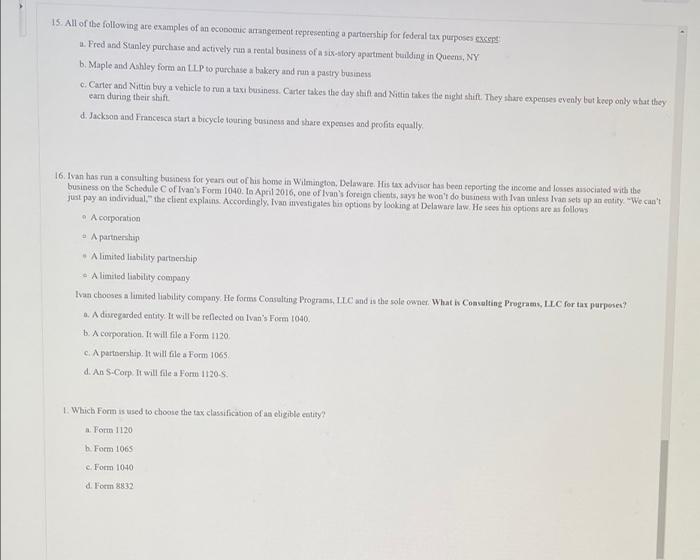

15. All of the following are examples of an economic arrangement representing a partnership for federal tax purposes se 1. Fred and Stanley purchase and actively run a rental business of a six-story apartment building in Queens, NY b. Maple and Ashley form an LLP to purchase a bakery and run a pastry business c. Carter and Nittin buy a vehicle to run a taxi business Carter takes the day shift and Nottin takes the night shift. They share expenses evenly but keep only what they eam during their shift d. Jackson and Francesca start a bicycle touring business and share expenses and profits equally 16. Ivan has run a consulting business for years out of his home in Wilmington, Delaware. His tax advisor has been reporting the income and losses associated with the business on the Schedule of Ivan's Form 1040. In April 2016, one of Ivan's foreign clients, says he won't do business with an unless Ivan sets up an entity "We can't just pay an individual." the client explains. Accordingly, Ivao investigates his options by looking at Delaware law. He sees his options are follows A corporation A partnership A limited liability partnership - A limited liability company Ivan chooses a limited liability company. He forms Consulting Programs, LLC and in the sole owner. What is Consulting Programs, LLC for tax purposes? A disregarded entity. It will be reflected on Ivan's Form 1040 b. A corporation. It will file a Form 1120 c. A partnership. It will file a Form 1065 d. An S-Corp. It will file a Por 1120-5. 1. Which Fonn is used to choose the tax classification of an eligible entity 1. Porn 1120 Form 1065 Form 1010 d. Form 8832 15. All of the following are examples of an economic arrangement representing a partnership for federal tax purposes se 1. Fred and Stanley purchase and actively run a rental business of a six-story apartment building in Queens, NY b. Maple and Ashley form an LLP to purchase a bakery and run a pastry business c. Carter and Nittin buy a vehicle to run a taxi business Carter takes the day shift and Nottin takes the night shift. They share expenses evenly but keep only what they eam during their shift d. Jackson and Francesca start a bicycle touring business and share expenses and profits equally 16. Ivan has run a consulting business for years out of his home in Wilmington, Delaware. His tax advisor has been reporting the income and losses associated with the business on the Schedule of Ivan's Form 1040. In April 2016, one of Ivan's foreign clients, says he won't do business with an unless Ivan sets up an entity "We can't just pay an individual." the client explains. Accordingly, Ivao investigates his options by looking at Delaware law. He sees his options are follows A corporation A partnership A limited liability partnership - A limited liability company Ivan chooses a limited liability company. He forms Consulting Programs, LLC and in the sole owner. What is Consulting Programs, LLC for tax purposes? A disregarded entity. It will be reflected on Ivan's Form 1040 b. A corporation. It will file a Form 1120 c. A partnership. It will file a Form 1065 d. An S-Corp. It will file a Por 1120-5. 1. Which Fonn is used to choose the tax classification of an eligible entity 1. Porn 1120 Form 1065 Form 1010 d. Form 8832