15

15

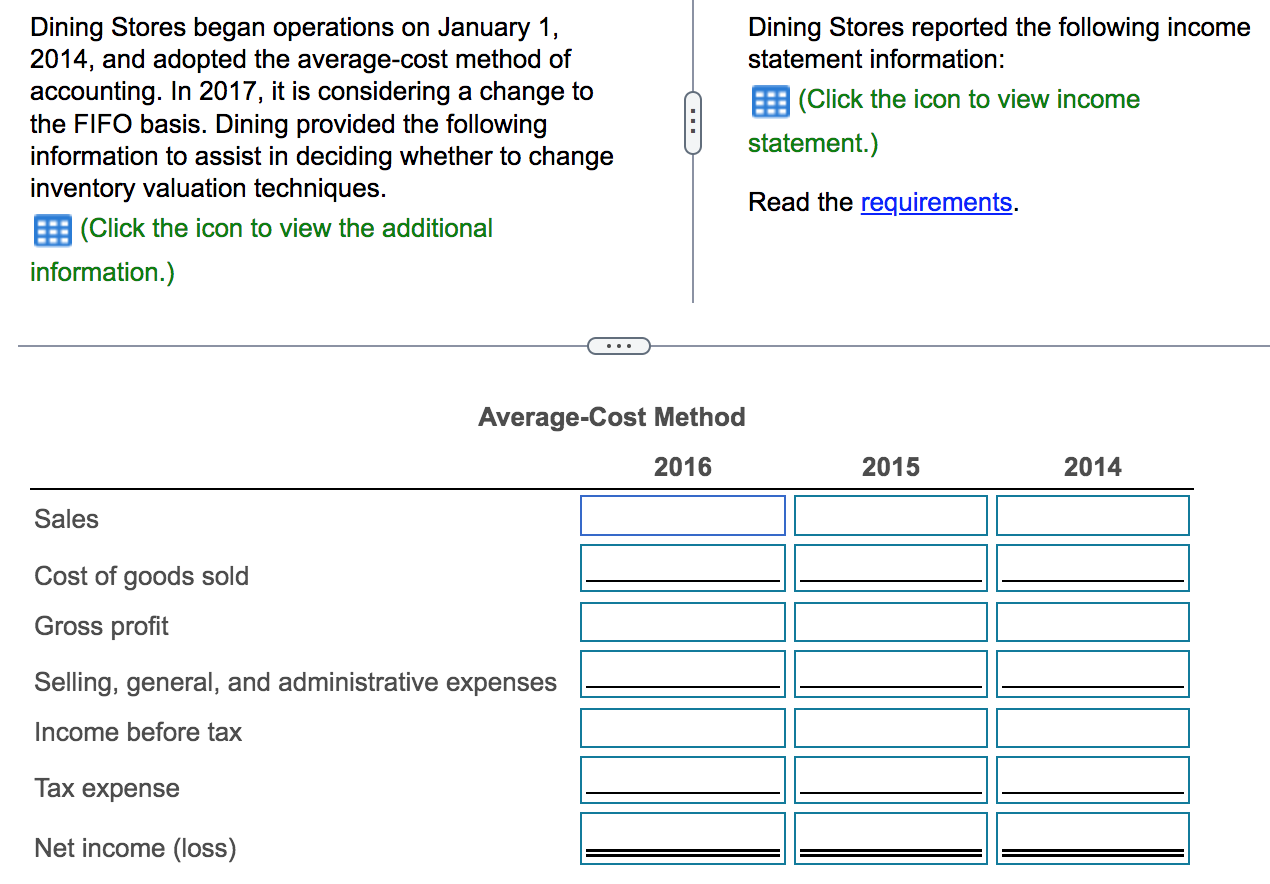

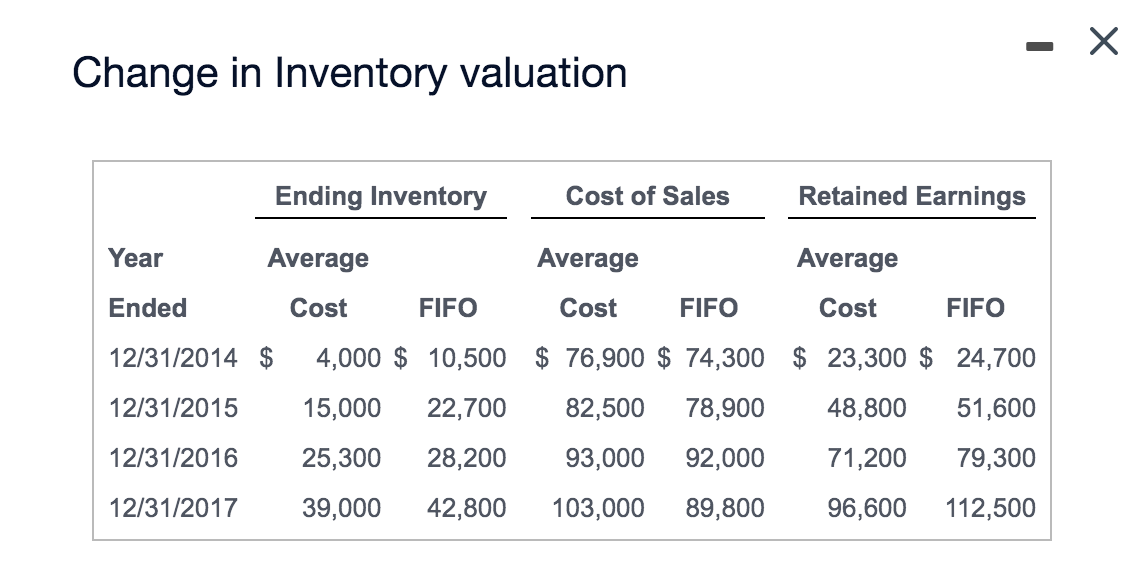

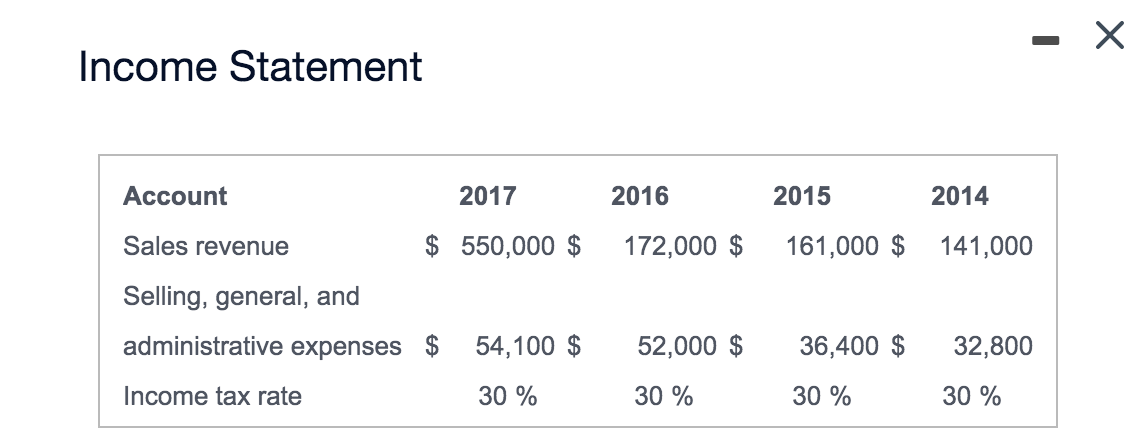

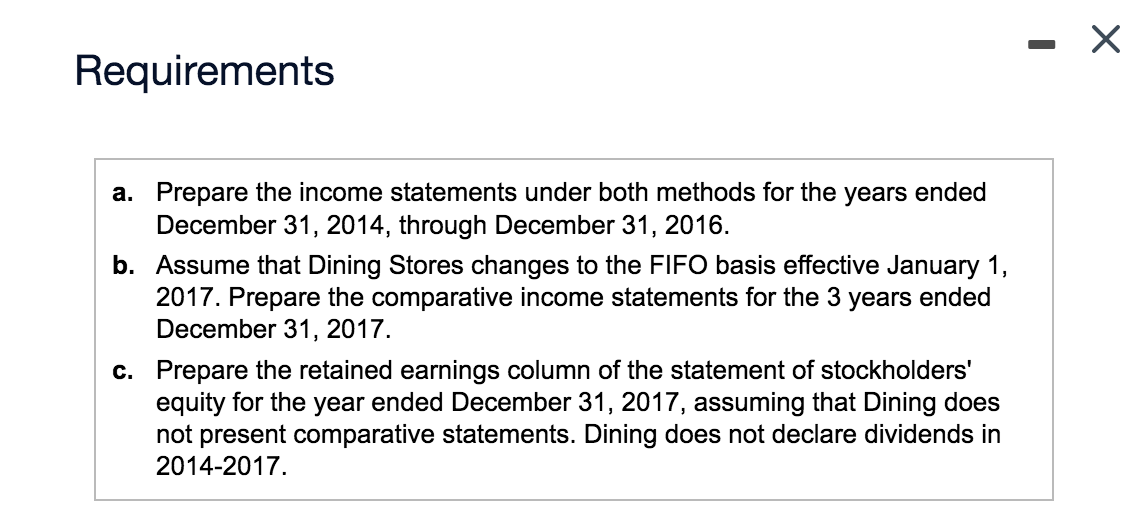

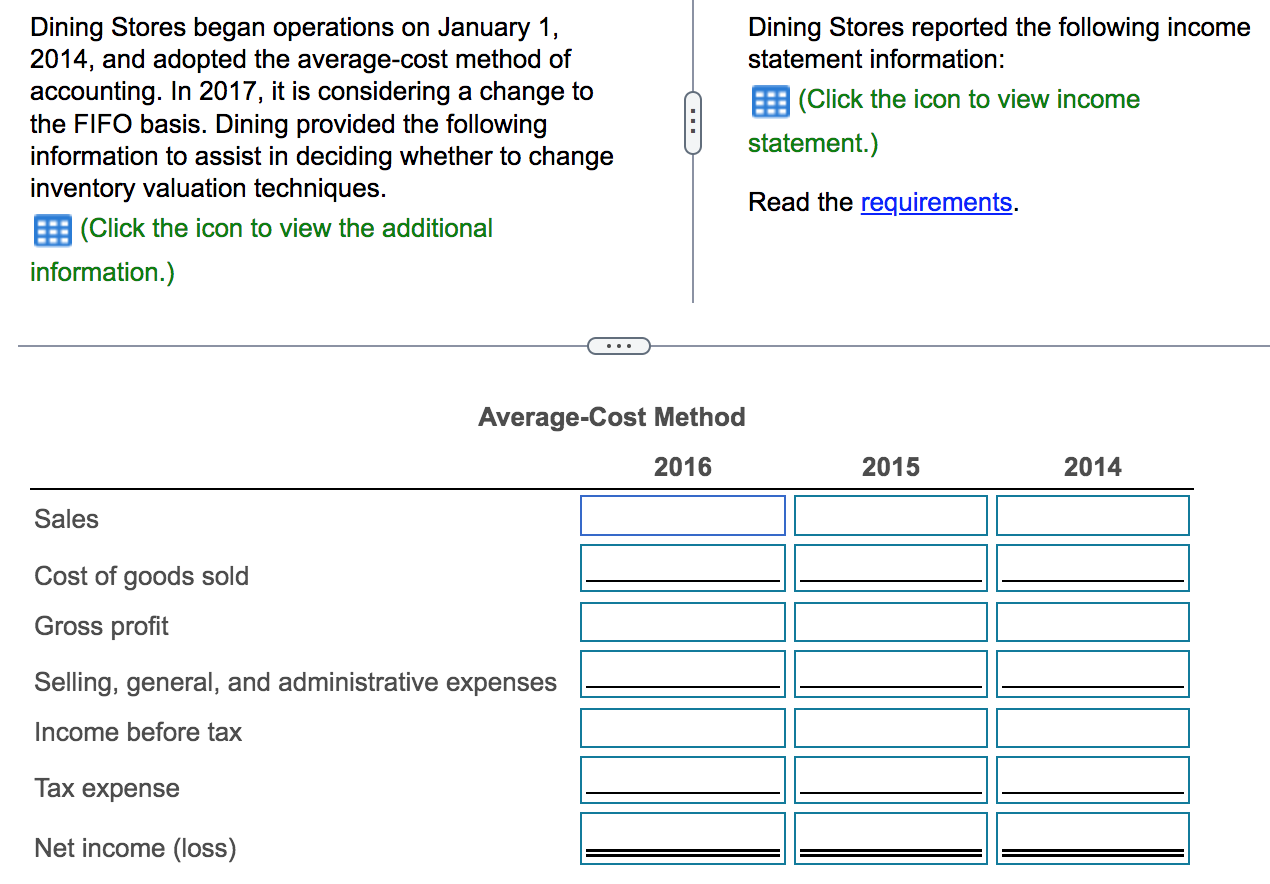

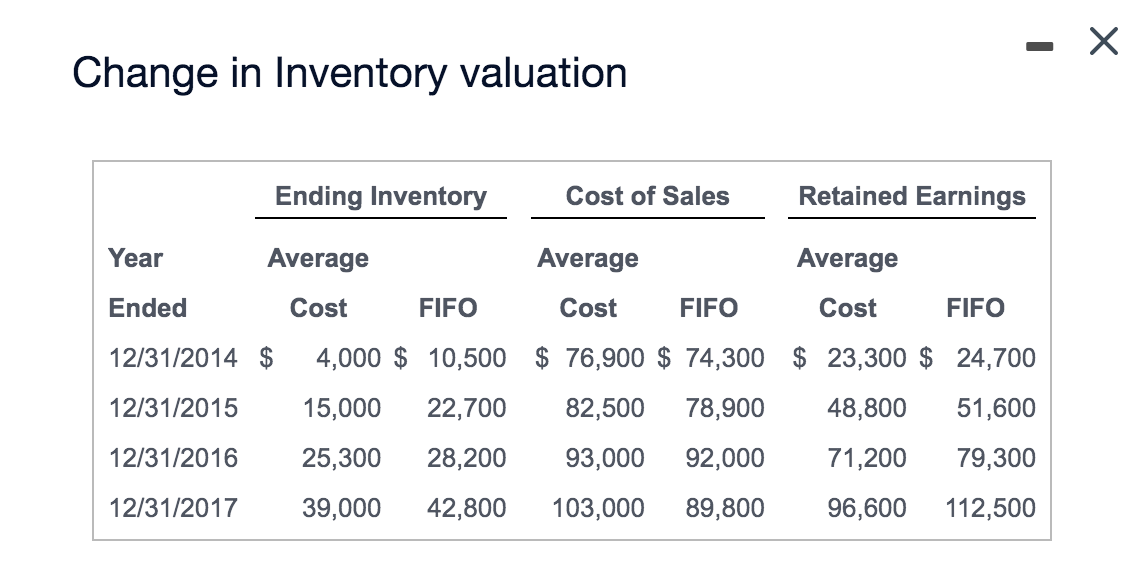

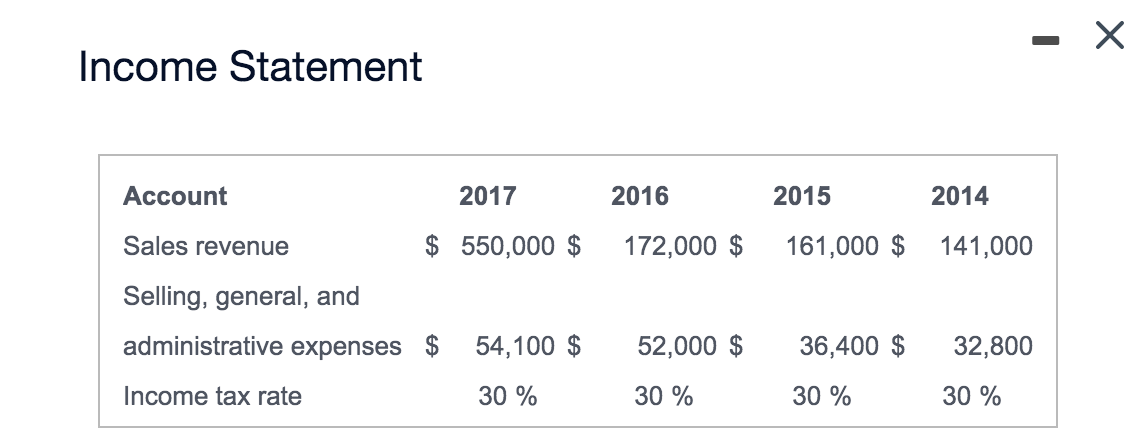

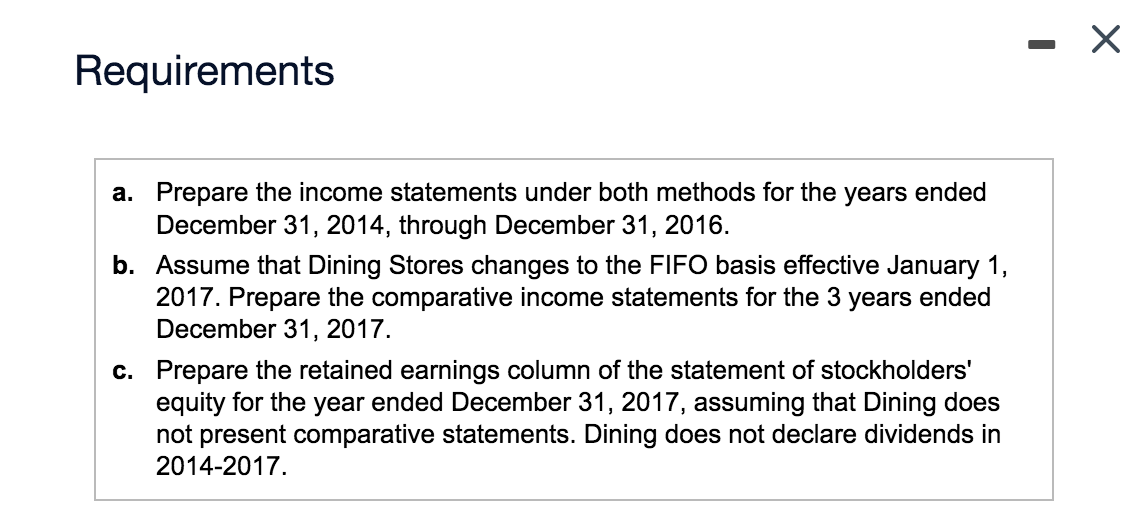

Dining Stores began operations on January 1, 2014, and adopted the average-cost method of accounting. In 2017, it is considering a change to the FIFO basis. Dining provided the following information to assist in deciding whether to change inventory valuation techniques. B (Click the icon to view the additional information.) Dining Stores reported the following income statement information: (Click the icon to view income statement.) Read the requirements. Average-Cost Method 2016 2015 2014 Sales Cost of goods sold Gross profit Selling, general, and administrative expenses Income before tax Tax expense Net income (loss) - X Change in Inventory valuation Ending Inventory Cost of Sales Retained Earnings Year Average Average Average Ended Cost FIFO Cost FIFO Cost FIFO 12/31/2014 $ 4,000 $ 10,500 $ 76,900 $ 74,300 $ 23,300 $ 24,700 15,000 22,700 82,500 78,900 48,800 51,600 12/31/2015 12/31/2016 25,300 28,200 93,000 92,000 71,200 79,300 112,500 12/31/2017 39,000 42,800 103,000 89,800 96,600 - Income Statement 2016 2015 2014 172,000 $ 161,000 $ 141,000 Account 2017 Sales revenue $ 550,000 $ Selling, general, and administrative expenses $ 54,100 $ 52,000 $ 36,400 $ 32,800 Income tax rate 30 % 30 % 30 % 30 % Requirements a. Prepare the income statements under both methods for the years ended December 31, 2014, through December 31, 2016. b. Assume that Dining Stores changes to the FIFO basis effective January 1, 2017. Prepare the comparative income statements for the 3 years ended December 31, 2017. c. Prepare the retained earnings column of the statement of stockholders' equity for the year ended December 31, 2017, assuming that Dining does not present comparative statements. Dining does not declare dividends in 2014-2017. Dining Stores began operations on January 1, 2014, and adopted the average-cost method of accounting. In 2017, it is considering a change to the FIFO basis. Dining provided the following information to assist in deciding whether to change inventory valuation techniques. B (Click the icon to view the additional information.) Dining Stores reported the following income statement information: (Click the icon to view income statement.) Read the requirements. Average-Cost Method 2016 2015 2014 Sales Cost of goods sold Gross profit Selling, general, and administrative expenses Income before tax Tax expense Net income (loss) - X Change in Inventory valuation Ending Inventory Cost of Sales Retained Earnings Year Average Average Average Ended Cost FIFO Cost FIFO Cost FIFO 12/31/2014 $ 4,000 $ 10,500 $ 76,900 $ 74,300 $ 23,300 $ 24,700 15,000 22,700 82,500 78,900 48,800 51,600 12/31/2015 12/31/2016 25,300 28,200 93,000 92,000 71,200 79,300 112,500 12/31/2017 39,000 42,800 103,000 89,800 96,600 - Income Statement 2016 2015 2014 172,000 $ 161,000 $ 141,000 Account 2017 Sales revenue $ 550,000 $ Selling, general, and administrative expenses $ 54,100 $ 52,000 $ 36,400 $ 32,800 Income tax rate 30 % 30 % 30 % 30 % Requirements a. Prepare the income statements under both methods for the years ended December 31, 2014, through December 31, 2016. b. Assume that Dining Stores changes to the FIFO basis effective January 1, 2017. Prepare the comparative income statements for the 3 years ended December 31, 2017. c. Prepare the retained earnings column of the statement of stockholders' equity for the year ended December 31, 2017, assuming that Dining does not present comparative statements. Dining does not declare dividends in 2014-2017

15

15