Question

Answer the following questions based on the prospectus of Kraft Foods Inc.'s bond issue. Are the notes issued at a premium or discount? How do

Answer the following questions based on the prospectus of Kraft Foods Inc.'s bond issue.

Are the notes issued at a premium or discount? How do you know?

What is the coupon interest rate on the 2013 Notes?

What is the market rate of interest rate (also known as effective interest rate) on the 2013 Notes?

Show the journal entry for the 2013 Notes on May 8, 2010.

5. Construct an amortization schedule that shows premium/discount amortization over the life of the 2013 Notes

Show the journal entries for the 2013 Notes on November 8, 2010.

Assume the fiscal year ends on December 31, 2010. Show the appropriate adjusting entries related to the 2013 Notes

Show the entries on May 8, 2011 (related to the 2013 Notes), assuming the financial statements were correct on December 31, 2010

Show the entries on November 8, 2011 (related to the 2013 Notes).

Assume 60% of the 2013 Notes are redeemed early on May 8, 2012 for $595,000,000 in cash. Provide all the journal entries required on this date related to the 2013 Notes, assuming the financial statements were correct on December 31, 2011.

Does the early redemption affect the income statement? If so, what is the effect?

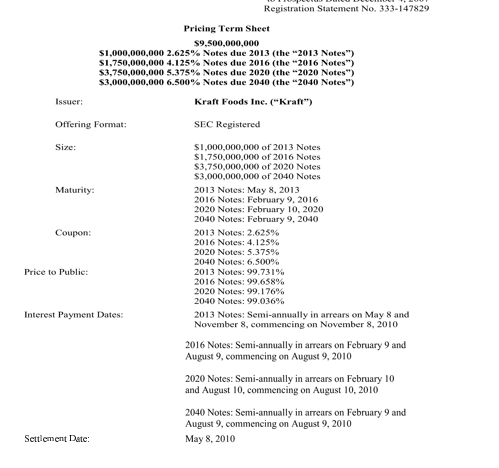

Registration Statement No. 333-147829 Pricing Term Sheet S9,500,000,000 $1.000.000.000 2.625% Notes due 2013 (the "2013 Notes") S1,750,000,000 4.125% Notes due 2016 (the "2016 Notes") S3,750,000,000 5.375% Notes due 2020 (the "2020 Notes") S3.000,000,000 6.500% Notes due 2040 (the "2040 Notes Kraft Foods Inc. ("Kraft") SEC Registered Offering Format: Size $1,000,000,000 of 2013 Notes $1.750.000.000 of 2016 Notes $3.750.000.000 of 2020 Notes $3,000,000,000 of 2040 Notes Maturity: 2013 Notes: May 8. 2013 2016 Notes: February 9, 2016 2020 Notes: February 10, 2020 2040 Notes: February 9, 2040 Coupon 2013 Notes: 2.625% 2016 Notes: 4.125% 2020 Notes: 5.375% 2040 Notes: 6.500% Price to Public: 2013 Notes: 99.731% 2016 Notes: 99.658% 2020 Notes: 99.176% 2040 Notes: 99.036% Interest Payment Dates: 2013 Notes: Semi-annually in a on May 8 and November 8, commencing on November 8, 2010 2016 Notes: Semi-annually in arrears on February 9 and August 9, commencing on August 9, 2010 2020 Notes: Semi-annually in arrears on February 10 and August 10, commencing on August 10, 2010 2040 Notes: Semi-annually in a on February 9 and mears August 9, commencing on August 9, 2010 Settlement Date May 8, 2010

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started