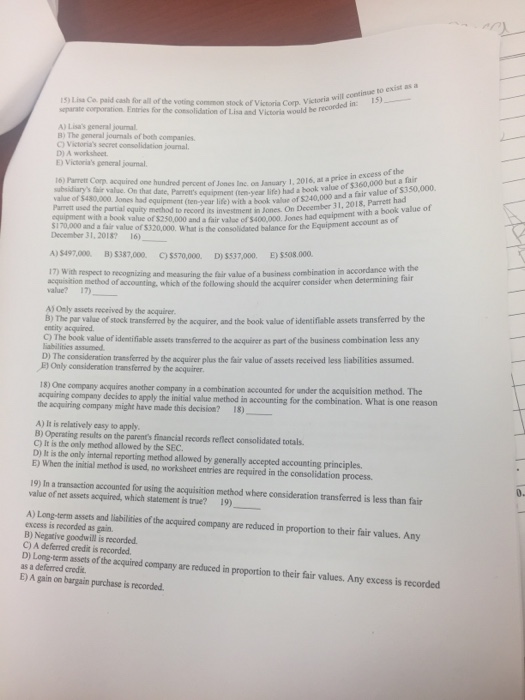

15) Lisa Co paid cash for all of the voting common stock of Victoria Corp. Victoria separate corporation Entries for the consolidation of Lisa and Victoria would be idanion en sosk of Vistoria Cop. Victoria will continue to exisr as a A) Lisa's general journal B) The goneral journals of both companies c Victoria's secret consolidation journal D) A worksheet E) Victoria's peneral joumal of the Iten-year life) had a book value of $360,000 but a fair with a book value of $240,000 and a fair value of $350,000 6) Paett Corp acquired s fair value. On that date Parrett's value of $480,000. Jones had equipment (ten-year life) Parrett used the partial equity method to record its investment in Jones. On equipment with a book value of $250,000 and a fair valae of $400,000. Jones had equipment with a book value of of S170,000 and a fair value of $320,000. What is the consolidated balance for the Eqipm ent account as December 31, 2018? 16) )497,000 B) 5387,000 C)5570,000. D) 537,000. E)S508.000 17) With respect to recognizing and measurine the tair vakue of a business combinati ion in accordance with the acquisition method of accounting, which of the following should the acquirer consider when determin value? 17) A) Only assets received by the acquirer B) The par value of stock transferred by the acquirer, and the book value of identifiable assets transferred by the entity acquired. C) The book value of identifiable assets transferred to the acquirer as part of the business combination less any iabilities assumed D) The consideration transferred by the acquirer plus the fair value of assets received less liabilities assumed. EOnly consideration transferred by the acquirer. S) One company acquires another company in a combination accounted for under the acquisition method. The acquiring company decides to appl the acquiring company might have made this decision? 18) ly the initial value method in accounting for the combination. What is one reason A) It is relatively easy to apply B) Operating results on the parent's financial records reflect consolidated totals. C) It is the only method allowed by the SEC Dj lt is the only internal reporting method allowed by generally accepted accounting principles E) When the initial method is used, no worksheet entries are required in the consolidation process. 19) In a transaction accounted for using the acquisition method where consideration transferred is less than fair value of net assets acquired, which statement is true? 19) 0. A) Long-term assets and lisbilitis of the acquired company are reduced in proportion to their fair values. Any excess is recorded as gairn. B) Negative goodwill is recorded C) A deferred credit is recorded D) Long-term assets of the acquired company are reduced in proportion to their fair values. Any excess is recorded as a deferred credit. E)A gain on bargain purchase is recorded