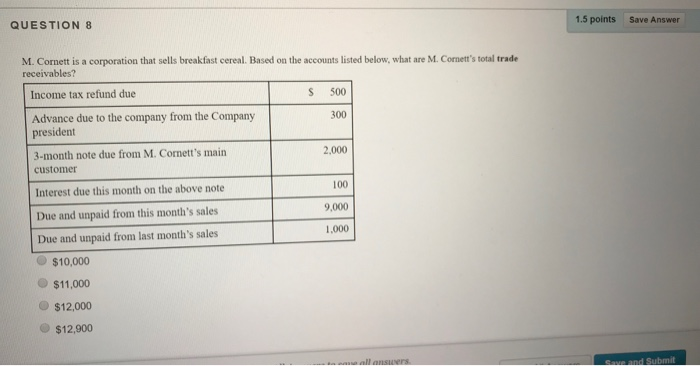

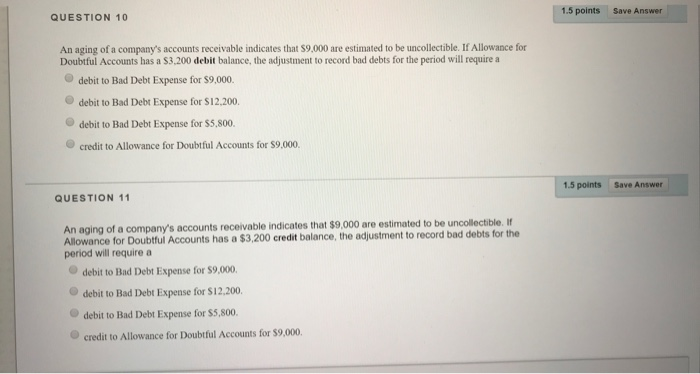

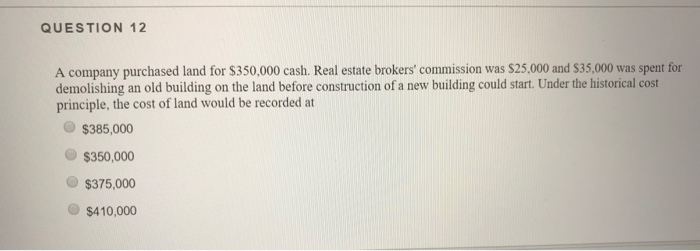

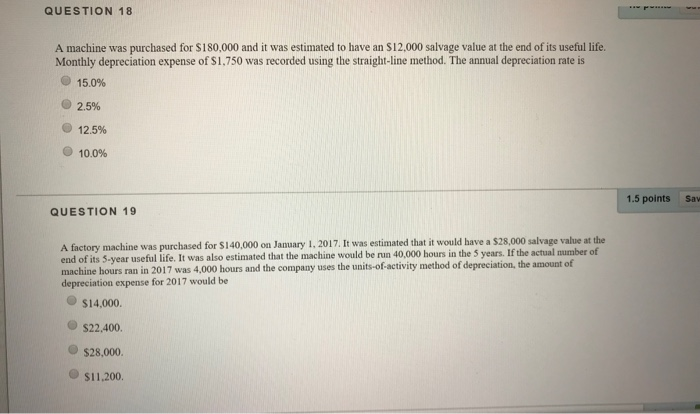

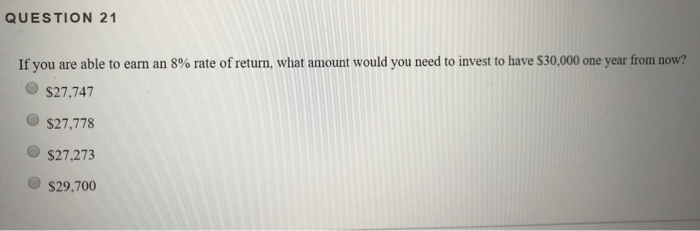

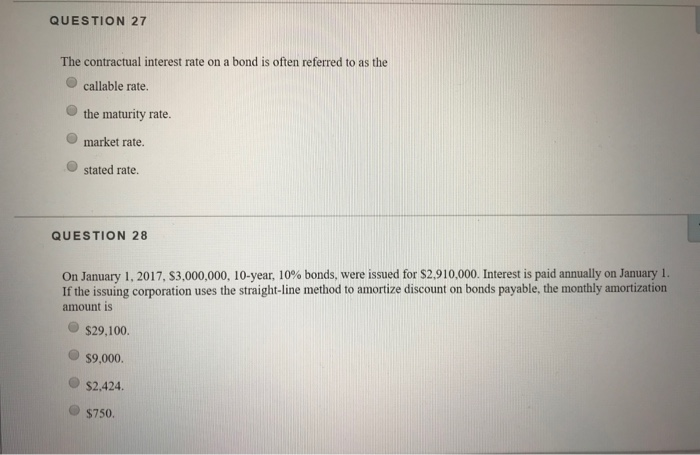

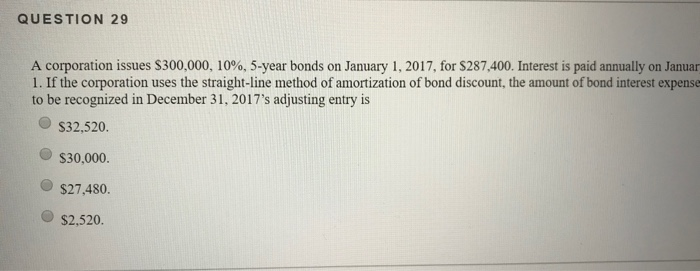

1.5 pointsSave Answer QUESTION 8 M. Cornett is a corporation that sells breakfast cereal. Based on the accounts listed below, what are M. Cornett's total trade receivables? S 500 Income tax refund due 300 Advance due to the company from the Company president 2,000 3-month note due from M. Cornett's main customer Interest due this month on the above note Due and unpaid from this month's sales Due and unpaid from last month's sales 100 9,000 1,000 $10,000 $11,000 $12,000 $12,900 1.5 points Save Answer QUESTION 10 An aging of a company's accounts receivable indicates that $9,000 are estimated to be uncollectible. If Allowance for Doubtful Accounts has a S3,200 debit balance, the adjustment to record bad debts for the period will require a O debit to Bad Debt Expense for $9,000. debit to Bad Debt Expense for $12.200 O debit to Bad Debt Expense for $5,s00. credit to Allowance for Doubtful Accounts for $9,000 1.5 points Save Answer QUESTION 11 An aging of a company's accounts receivable indicates that $9,000 are estimated to be uncollectible. If Allowance for Doubtful Accounts has a $3,200 credit balance, the adjustment to record bad debts for the period will require a Odebit to Bad Debt Expense for $9,000 debit to Bad Debt Expense for $12,200 debit to Bad Debt Expense for $5,800 credit to Allowance for Doubtful Accounts for $9,000 QUESTION 12 A company purchased land for $350,000 cash. Real estate brokers' commission was $25,000 and $35,000 was spent for demolishing an old building on the land before construction of a new building could start. Under the historical cost principle, the cost of land would be recorded at $385,000 $350,000 $375,000 $410,000 QUESTION 18 A machine was purchased for $180,000 and it was estimated to have an $12,000 salvage value at the end of its useful life. Monthly depreciation expense of $1,750 was recorded using the straight-line method. The annual depreciation rate is @ 15.0% 2.5% @ 12.5% 10.0% 1.5 points Saw QUESTION 19 A factory machine was purchased for $140,000 on January 1, 2017. It was estimated that it would have a $28,000 salvage value at the end of its 5-year useful life. It was also estimated that the machine would be run 40,000 hours in the 5 years. If the actual number of machine hours ran in 2017 was 4,000 hours and the company uses the units-of activity method of depreciation, the amount of depreciation expense for 2017 would be O $14,000. s22.400. $28,000. $11,200. QUESTION 21 If you are able to earn an 8% rate of return, what amount would you need to invest to have S30.000 one year from now? $27,747 O $27,778 s27.273 $29,700 QUESTION 27 The contractual interest rate on a bond is often referred to as the O callable rate the maturity rate. O market rate. O stated rate. QUESTION 28 On January 1, 2017, S3,000,000. 10-year, 10% bonds, were issued for S291 0,000. Interest is paid annually on January 1. If the issuing corporation uses the straight-line method to amortize discount on bonds payable, the monthly amortization amount is $29,100 O $9,000. O $2.424 $750. QUESTION 29 A corporation issues S300.000, 10%, 5-year bonds on January 1, 2017, for S287400. Interest is paid annually on Januar 1. If the corporation uses the straight-line method of amortization of bond discount, the amount of bond interest expense to be recognized in December 31, 2017's adjusting entry is s32520. O $30,000. $27.480. O $2,520