Answered step by step

Verified Expert Solution

Question

1 Approved Answer

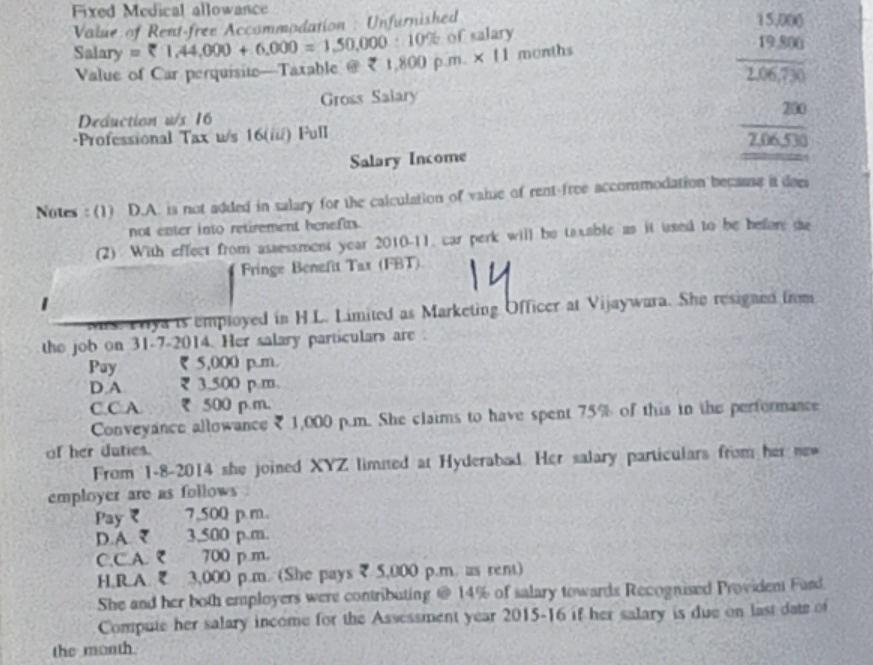

15.000 19 00 206,730 Fixed Medical allowance Value of Rend free Accommodation Unfurnished Salary - 1.44,000 + 6,000 = 150.000 : 10% of salary Value

15.000 19 00 206,730 Fixed Medical allowance Value of Rend free Accommodation Unfurnished Salary - 1.44,000 + 6,000 = 150.000 : 10% of salary Value of Car perquisito-Tatable 1.800 pm. x 11 months Gross Salary Deduction ws 16 - Professional Tax ws 16/11) Pull Salary Income Notes: (1) DA is not added in salary for the calculation of vahic of rent free accommodation because it do not enter into retirement henfis (2) With effect from sessment year 2010-11.ca perk will be table w i used to be helande Fringe Benefit Tax (FBT). 206530 1 14 . nyos employed in HL. Limited as Marketing brficer at Vijaywara. She resigned from the job on 31-7-2014. Her salary particulan are Pay 5,000 pm DA 23.500 pm CCA 500 pm Conveyance allowance ? 1,000 pun. She claims to have spent 75% of this to the performance or her duties From 1-8-2014 she joined XYZ limited at Hyderabad Her salary particulars from her employer are as follows 7.500 pm DA 3.500 pm C.CA 700 pm HRA3.000 pm. (She pays ? 5.000 pm us rent) She and her both employers were contributing 14% of salary towards Recognised Provident Fund Compute her salary income for the Assessment year 2015-16 if het alary is due on last date the month Pay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started