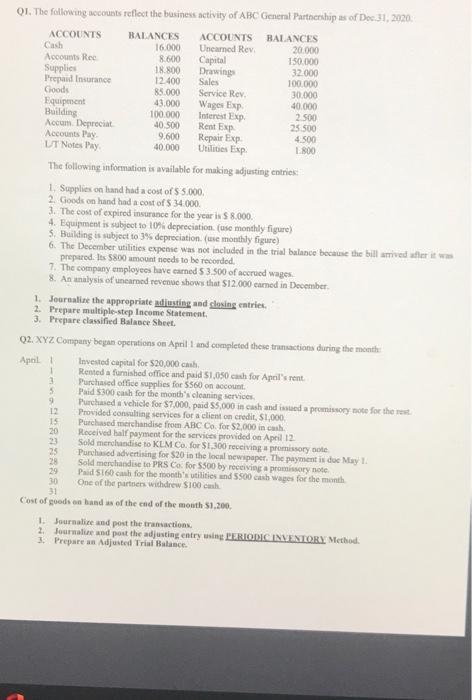

150.000 01. The following counts reflect the business activity of ABC General Partnership as of Dec.31, 2020, ACCOUNTS BALANCES ACCOUNTS BALANCES Cash 16.000 Uneamed Rev 20.000 Account Ree 8.600 Capital Supplies 18.800 Drawings 32.000 Prepaid Insurance 12.400 Sales 100.000 Goods 85.000 Service Rev 30.000 Equipment 43.000 Wages Exp 40.000 Building 100.000 Interest Exp 2.500 Accum Depreciat 40.500 Rent Exp 25 500 Accounts Pay 9.600 Repair Exp 4.500 UT Notes Pay 40.000 Utilities Exp L800 The following information is available for making adjusting entries 1. Supplies on and had a cost of $ 5.000. 2. Goods on hand had a cost of $ 34.000 3. The cost of expired insurance for the year is $8.000. 4. Equipment is subject to 10% depreciation (use monthly figure) 5. Building is subject to 3% depreciation (use monthly figure) 6. The December utilities expense was not included in the trial balance because the billeder it prepared. Its 5800 amount needs to be recorded. 7. The company employees have carned $3.500 of accrued wages 8. An analysis of unearned revenue shows that $12.000 camned in December 1. Journaline the appropriate adjusting and closing entries 2. Prepare multiple-step Income Statement. 3. Prepare classified Balance Sheet Q2.XYZ Company began operations on April 1 and completed the transactions during the month Apol Invested capital for $20,000 cash Rented a furnished office and paid $1,050 cash for Apel's rent 3 Purchased office supplies for 5560 on account 5 Paid $300 cash for the month's cleaning services 9 Purchased a vehicle for $7,000, paid $5,000 in cash and issued a promissory note for the rest 12 Provided consulting services for a client on credit, $1,000 15 Purchased merchandise from ABC Co. for $2,000 inch 20 Received half payment for the services provided on April 12 Sold merchandise to KLM Co. for $1.300 receiving promissory note 25 Purchased advertising for $20 in the local newspaper. The payment is due May 1 28 Sold merchandise to PRS C for $500 by receiving a promissory note 29 Paid S160 cash for the month's utilities and 5500 cash wages for the month 30 One of the partners withdrew S100 cash 31 Cost of goods anhand of the end of the mouth $1.200 1. Journalive and post the transactions 2. Journal and post the adjusting entry I PERIODIC INVENTORY Method 3. Prepare an Adjusted Trial Balance