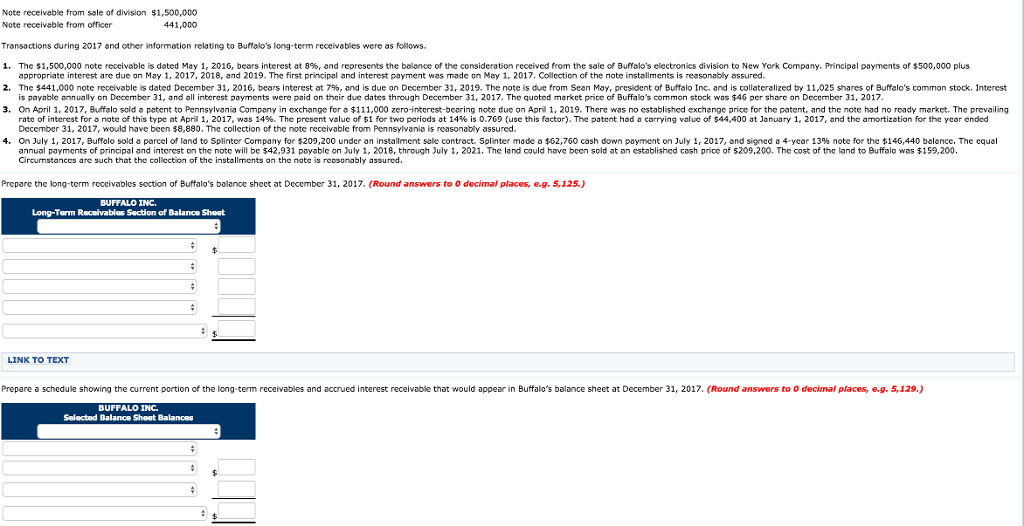

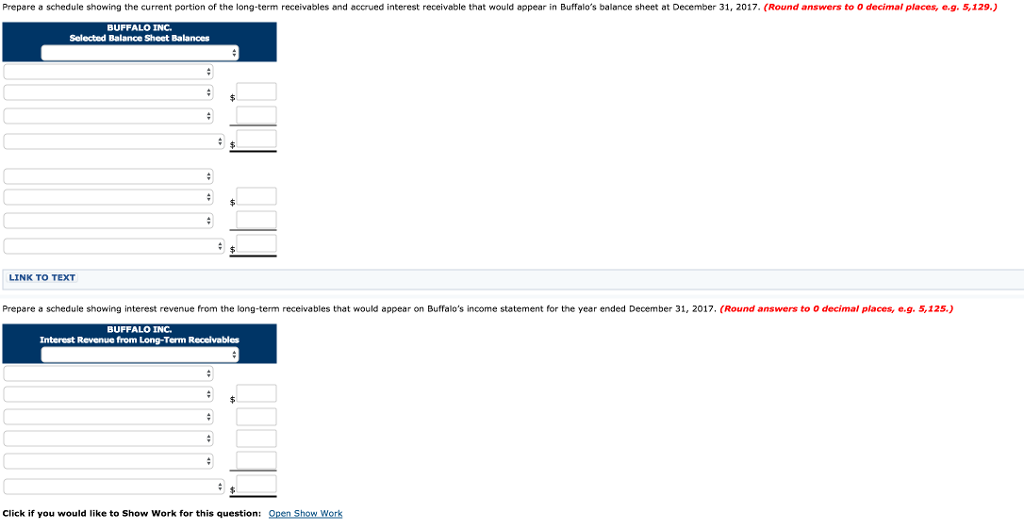

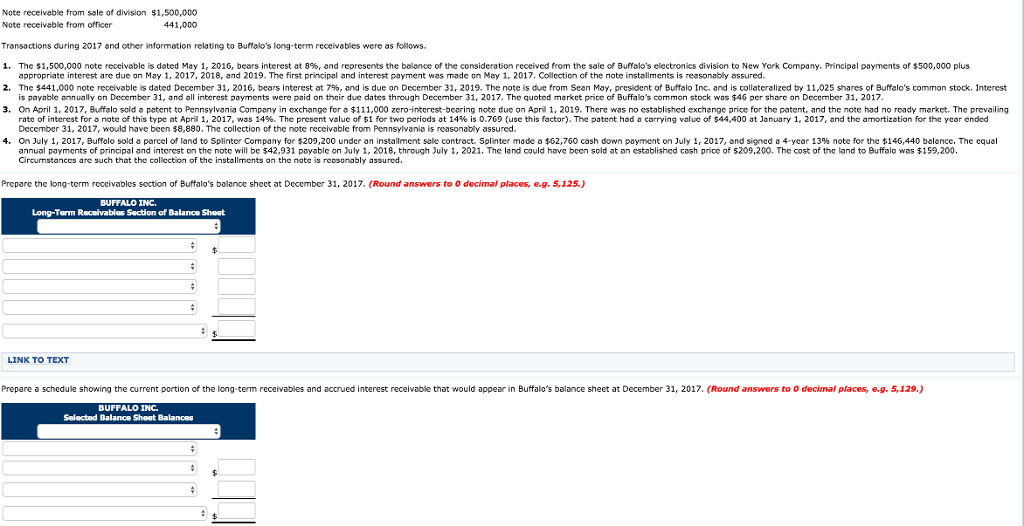

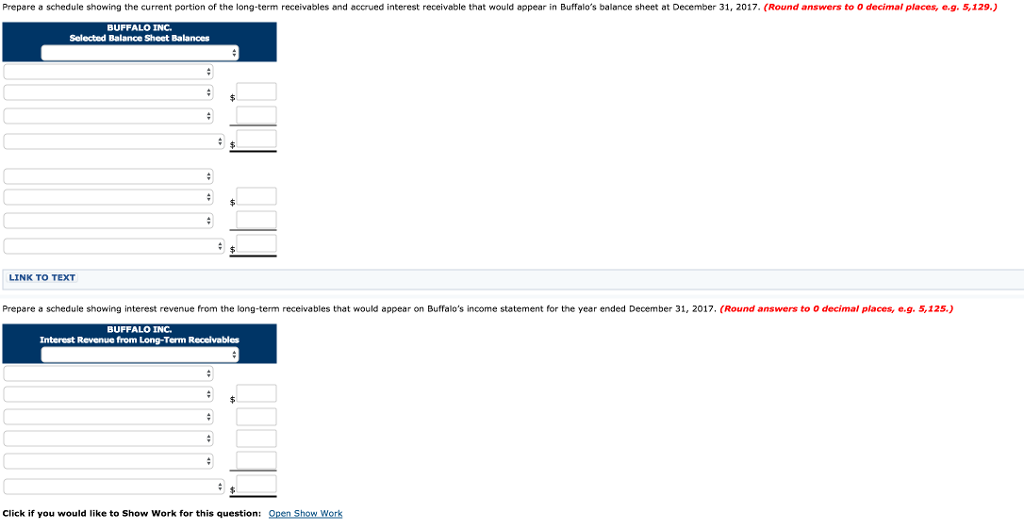

1,500,000 441,000 Note receivable from sale of division Note receivable from officer Transactions during 2017 and other information relating to Buffelo's long-term receivables were as follows. 1. The $1,500,000 note eceivable is dated May 1 2016 bears interest at 8% and represents the balance of the consideration received from the sale of Buffalo's electronics division to New York Company. Principal payments of $500,000 plus 2. The $441,000 note eceivable is dated December 31, 2016, bears interest at 7% and is due on December 31, 2019. The note is due from Sean May president of Buffalo Inc. and is collateralized by 11,025 shares of Buffalo's common stock Interest 3. On April 1, 2017, Buffalo sold a patent to Pennsylvania Company in exchange for a $111,000 zero-interest-bearing note due on April 1, 2019. There was no established exchange price for the patent, and the note had no ready market. The prevailing appropriate interest are due on May 1, 2017, 2018, and 2019. The first principal and interest payment was made on May 1 2017. Collection of the note installments is reasonably assured. is payable annually on December 31, and all interest payments were paid on their due dates through December 31, 2017. The quoted market price of Buffalo's common stock was $46 per share on December 31, 2017 rate of interest for a note of this type at April 1, 2017, was 14% The present value of $1 for two periods at 14% IS 0,769 use this factor Tn patent had carrying value of $44,400 at January 1 2017, and the amortization for the year onded December 31, 2017, would have been $8,880. The collection of the note receivable from Pennsylvania is reasonably assured. on July 1 2017, Buffalo sold a parcel of land to Splinter Company for $209,200 under an installment s le contract. Splinter made a $62,760 cash down payment on July 1 2017, and signed a 4-year 13% note for the146 440 balance. The equal annual payments of principal and interest on the note will be $42,931 payablc on July 1, 2018, throughJuly 1, 2021. The land could have been sold at an established cash price of $209,200. The cost of the land to Buffalo was $159,200. Circunstances are such that the collection of the installments on the note is reasonably assured. 4 1. 2018, through Jul ments of pice of s209200. The cost of th Prepare the long-term reccivables section of Buffalo's balance shect at December 31, 2017. (Round answers to 0 decimal places, e.g. 5,125.) Round BUFFALO INC. Long-Term Section of Balance Sheat LINK TO TEXT Prepare a schedule showing the current portion of the long-term receivables and accrued interest receivable that would appear in Buffalo's balance sheet at December 31, 2017. (Round answers to O dec mal places, e g5,129.) BUFFALO INC. Selected Balance Sheat Balances 1,500,000 441,000 Note receivable from sale of division Note receivable from officer Transactions during 2017 and other information relating to Buffelo's long-term receivables were as follows. 1. The $1,500,000 note eceivable is dated May 1 2016 bears interest at 8% and represents the balance of the consideration received from the sale of Buffalo's electronics division to New York Company. Principal payments of $500,000 plus 2. The $441,000 note eceivable is dated December 31, 2016, bears interest at 7% and is due on December 31, 2019. The note is due from Sean May president of Buffalo Inc. and is collateralized by 11,025 shares of Buffalo's common stock Interest 3. On April 1, 2017, Buffalo sold a patent to Pennsylvania Company in exchange for a $111,000 zero-interest-bearing note due on April 1, 2019. There was no established exchange price for the patent, and the note had no ready market. The prevailing appropriate interest are due on May 1, 2017, 2018, and 2019. The first principal and interest payment was made on May 1 2017. Collection of the note installments is reasonably assured. is payable annually on December 31, and all interest payments were paid on their due dates through December 31, 2017. The quoted market price of Buffalo's common stock was $46 per share on December 31, 2017 rate of interest for a note of this type at April 1, 2017, was 14% The present value of $1 for two periods at 14% IS 0,769 use this factor Tn patent had carrying value of $44,400 at January 1 2017, and the amortization for the year onded December 31, 2017, would have been $8,880. The collection of the note receivable from Pennsylvania is reasonably assured. on July 1 2017, Buffalo sold a parcel of land to Splinter Company for $209,200 under an installment s le contract. Splinter made a $62,760 cash down payment on July 1 2017, and signed a 4-year 13% note for the146 440 balance. The equal annual payments of principal and interest on the note will be $42,931 payablc on July 1, 2018, throughJuly 1, 2021. The land could have been sold at an established cash price of $209,200. The cost of the land to Buffalo was $159,200. Circunstances are such that the collection of the installments on the note is reasonably assured. 4 1. 2018, through Jul ments of pice of s209200. The cost of th Prepare the long-term reccivables section of Buffalo's balance shect at December 31, 2017. (Round answers to 0 decimal places, e.g. 5,125.) Round BUFFALO INC. Long-Term Section of Balance Sheat LINK TO TEXT Prepare a schedule showing the current portion of the long-term receivables and accrued interest receivable that would appear in Buffalo's balance sheet at December 31, 2017. (Round answers to O dec mal places, e g5,129.) BUFFALO INC. Selected Balance Sheat Balances