Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15:52 Files recommend plans to restructure the capital in order to avoid liquidation 4G 194 TOTAL Please Note: 100% The assessments are subject to

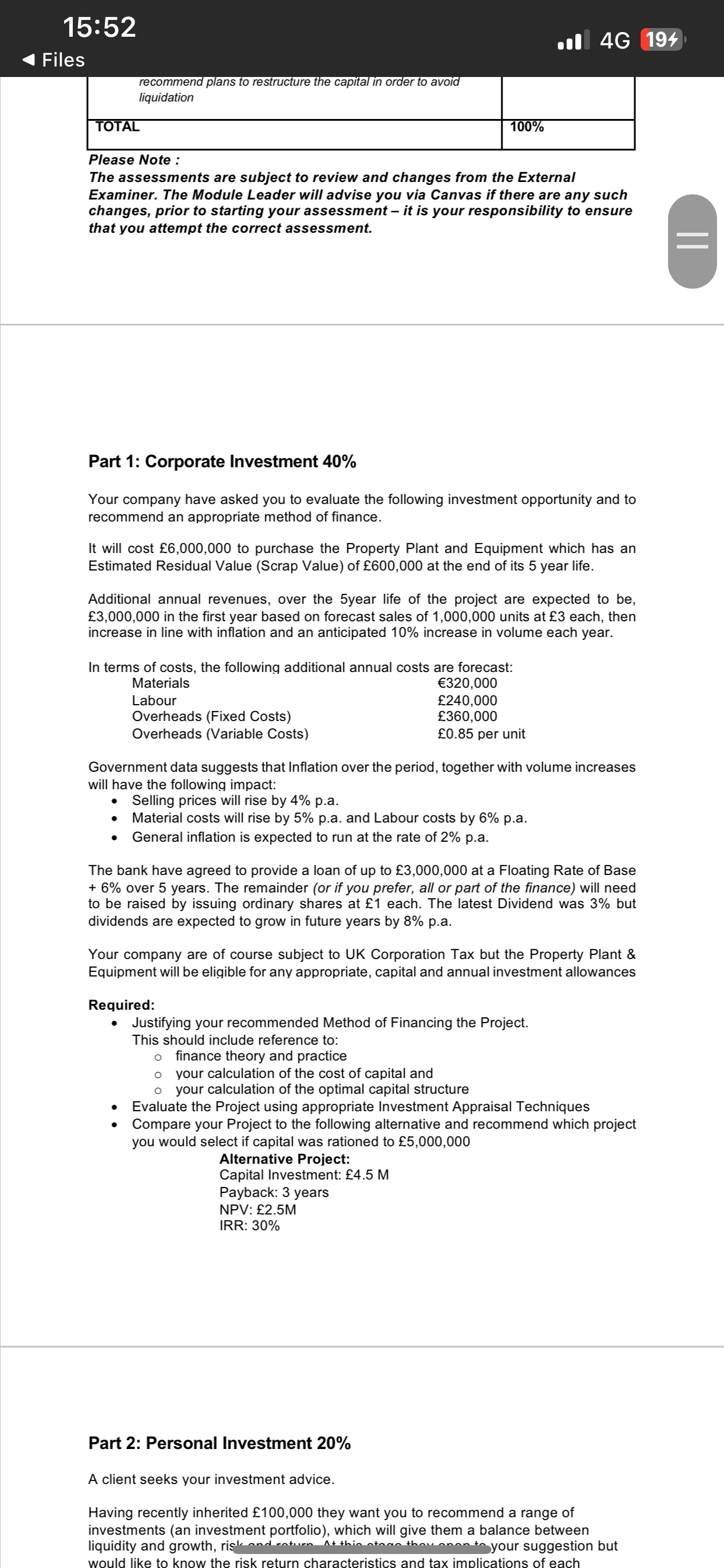

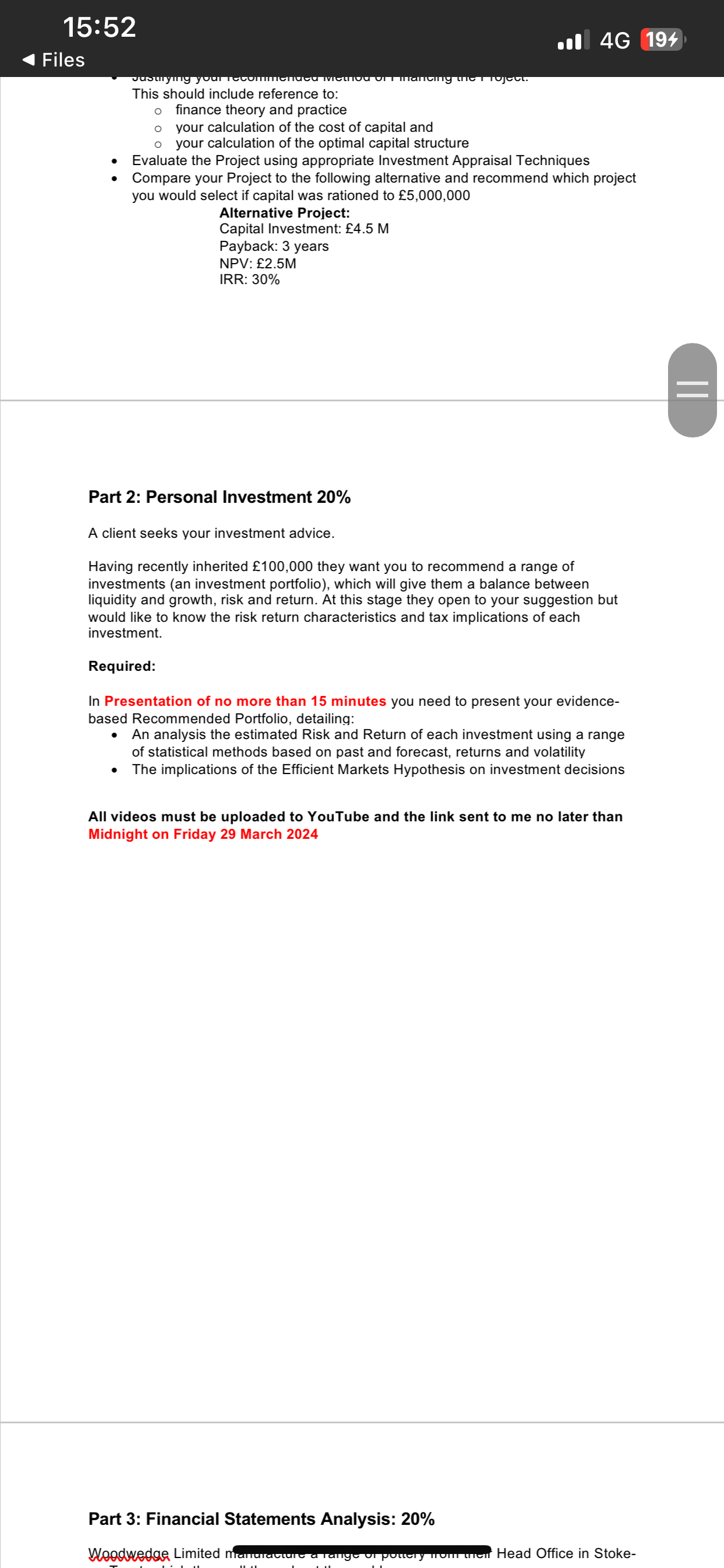

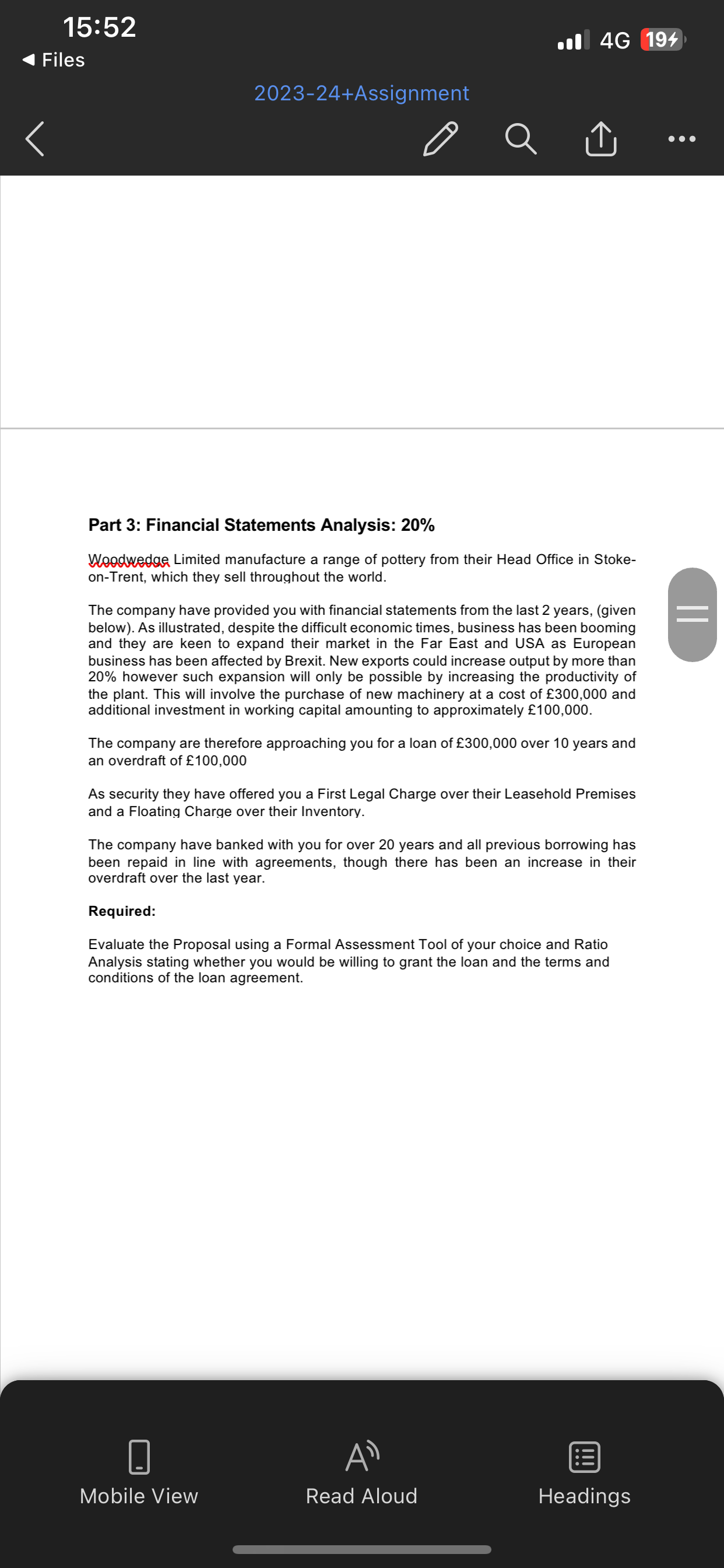

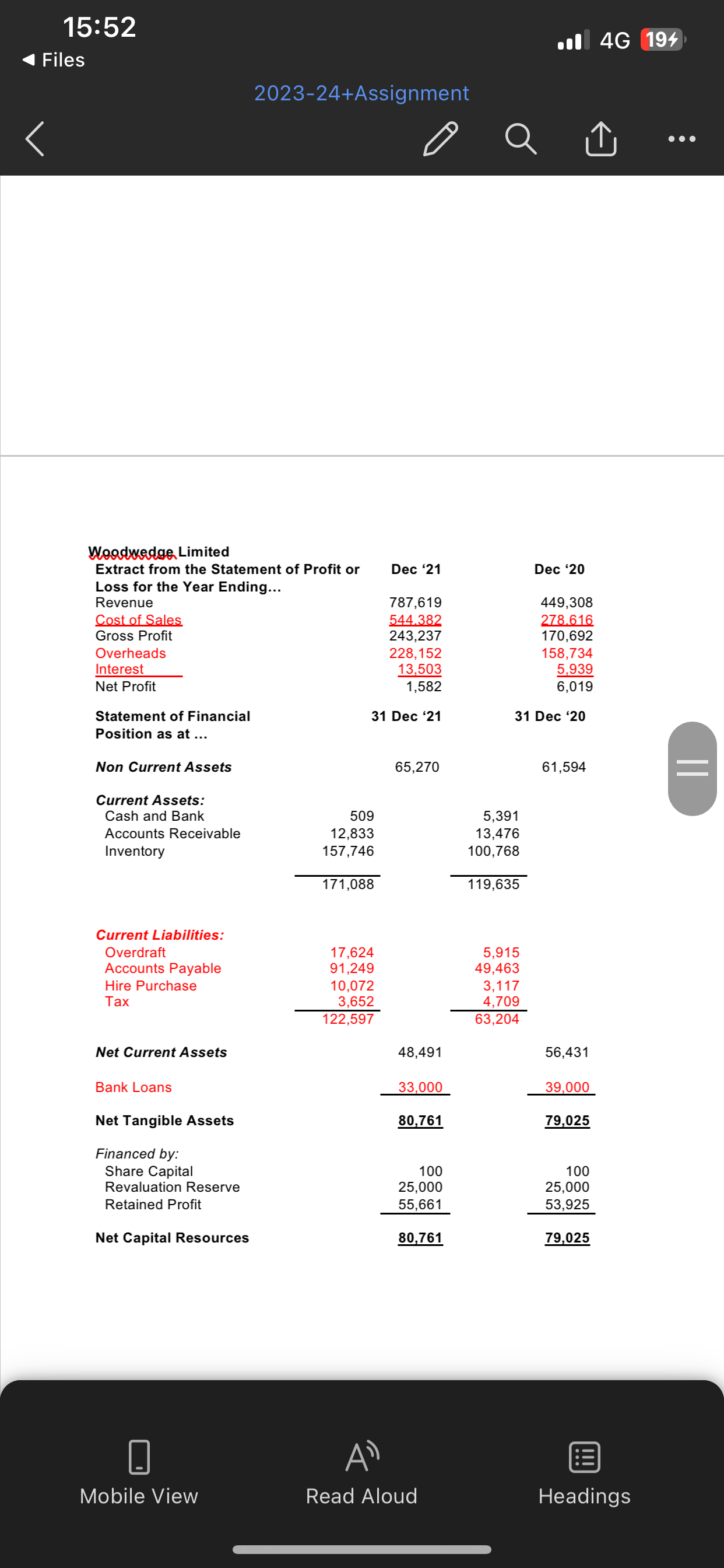

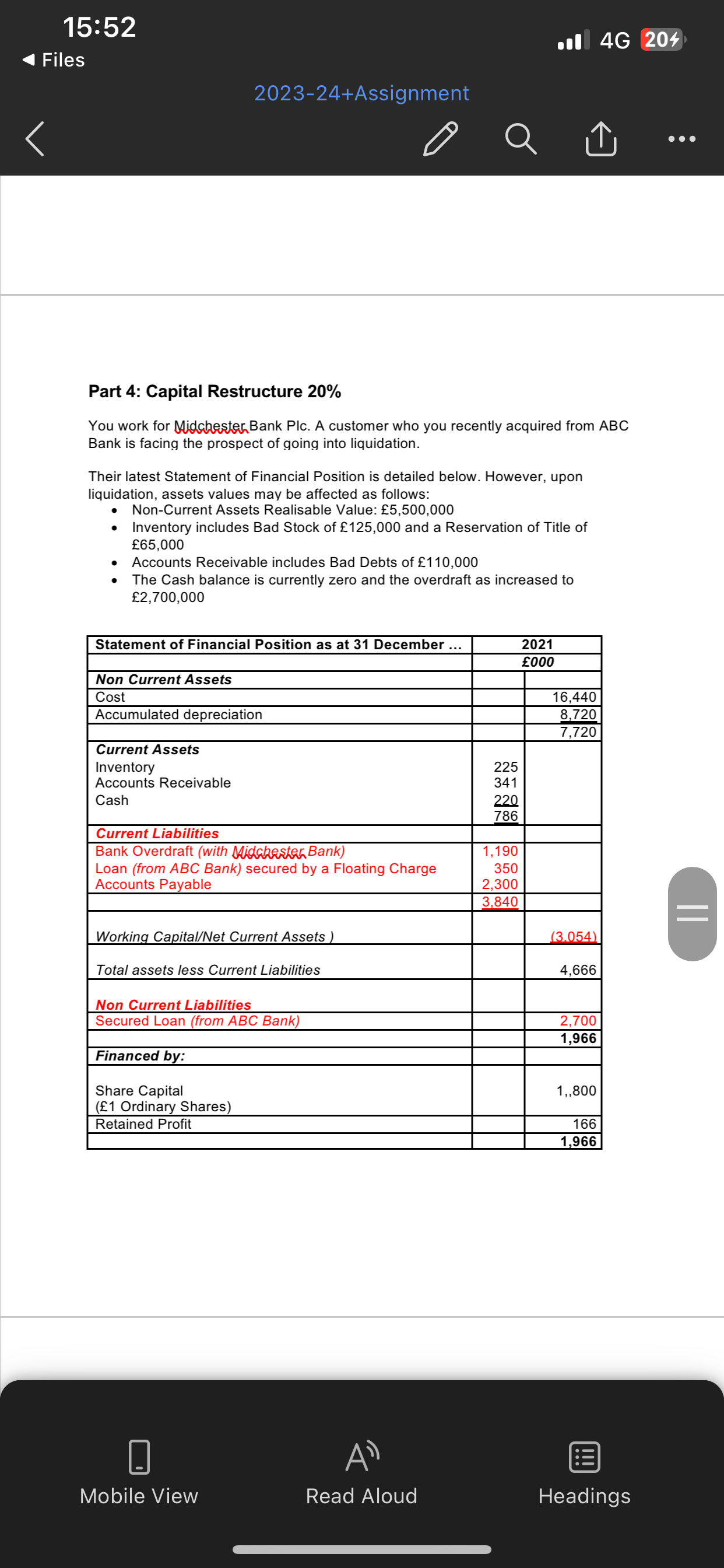

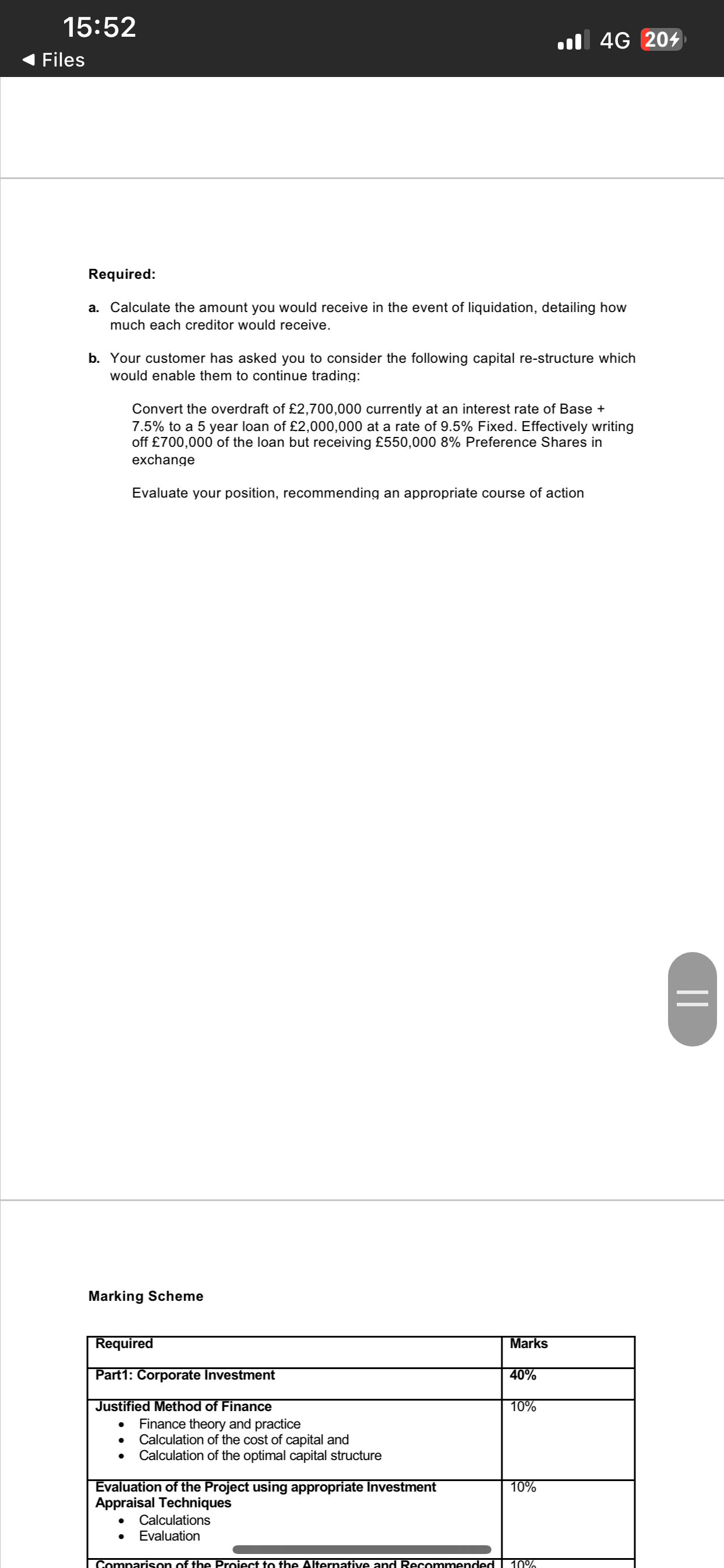

15:52 Files recommend plans to restructure the capital in order to avoid liquidation 4G 194 TOTAL Please Note: 100% The assessments are subject to review and changes from the External Examiner. The Module Leader will advise you via Canvas if there are any such changes, prior to starting your assessment it is your responsibility to ensure that you attempt the correct assessment. Part 1: Corporate Investment 40% Your company have asked you to evaluate the following investment opportunity and to recommend an appropriate method of finance. It will cost 6,000,000 to purchase the Property Plant and Equipment which has an Estimated Residual Value (Scrap Value) of 600,000 at the end of its 5 year life. Additional annual revenues, over the 5year life of the project are expected to be, 3,000,000 in the first year based on forecast sales of 1,000,000 units at 3 each, then increase in line with inflation and an anticipated 10% increase in volume each year. In terms of costs, the following additional annual costs are forecast: Materials Labour Overheads (Fixed Costs) Overheads (Variable Costs) 320,000 240,000 360,000 0.85 per unit Government data suggests that Inflation over the period, together with volume increases will have the following impact: Selling prices will rise by 4% p.a. Material costs will rise by 5% p.a. and Labour costs by 6% p.a. General inflation is expected to run at the rate of 2% p.a. || The bank have agreed to provide a loan of up to 3,000,000 at a Floating Rate of Base + 6% over 5 years. The remainder (or if you prefer, all or part of the finance) will need to be raised by issuing ordinary shares at 1 each. The latest Dividend was 3% but dividends are expected to grow in future years by 8% p.a. Your company are of course subject to UK Corporation Tax but the Property Plant & Equipment will be eligible for any appropriate, capital and annual investment allowances Required: Justifying your recommended Method of Financing the Project. This should include reference to: finance theory and practice your calculation of the cost of capital and your calculation of the optimal capital structure Evaluate the Project using appropriate Investment Appraisal Techniques Compare your Project to the following alternative and recommend which project you would select if capital was rationed to 5,000,000 Alternative Project: Capital Investment: 4.5 M Payback: 3 years NPV: 2.5M IRR: 30% Part 2: Personal Investment 20% A client seeks your investment advice. Having recently inherited 100,000 they want you to recommend a range of investments (an investment portfolio), which will give them a balance between liquidity and growth, risk and return. At this store they open to your suggestion but would like to know the risk return characteristics and tax implications of each 15:52 Files Justifying your recommended Metrou of i mancing the 1 Toject. This should include reference to: finance theory and practice your calculation of the cost of capital and your calculation of the optimal capital structure ... 4G 194 Evaluate the Project using appropriate Investment Appraisal Techniques Compare your Project to the following alternative and recommend which project you would select if capital was rationed to 5,000,000 Alternative Project: Capital Investment: 4.5 M Payback: 3 years NPV: 2.5M IRR: 30% || Part 2: Personal Investment 20% A client seeks your investment advice. Having recently inherited 100,000 they want you to recommend a range of investments (an investment portfolio), which will give them a balance between liquidity and growth, risk and return. At this stage they open to your suggestion but would like to know the risk return characteristics and tax implications of each investment. Required: In Presentation of no more than 15 minutes you need to present your evidence- based Recommended Portfolio, detailing: An analysis the estimated Risk and Return of each investment using a range of statistical methods based on past and forecast, returns and volatility The implications of the Efficient Markets Hypothesis on investment decisions All videos must be uploaded to YouTube and the link sent to me no later than Midnight on Friday 29 March 2024 Part 3: Financial Statements Analysis: 20% Woodwedge Limited Manufacture a Tarige or pottery from men Head Office in Stoke- 15:52 Files 4G 194 2023-24+Assignment Q || Part 3: Financial Statements Analysis: 20% Woodwedge Limited manufacture a range of pottery from their Head Office in Stoke- on-Trent, which they sell throughout the world. The company have provided you with financial statements from the last 2 years, (given below). As illustrated, despite the difficult economic times, business has been booming and they are keen to expand their market in the Far East and USA as European business has been affected by Brexit. New exports could increase output by more than 20% however such expansion will only be possible by increasing the productivity of the plant. This will involve the purchase of new machinery at a cost of 300,000 and additional investment in working capital amounting to approximately 100,000. The company are therefore approaching you for a loan of 300,000 over 10 years and an overdraft of 100,000 As security they have offered you a First Legal Charge over their Leasehold Premises and a Floating Charge over their Inventory. The company have banked with you for over 20 years and all previous borrowing has been repaid in line with agreements, though there has been an increase in their overdraft over the last year. Required: Evaluate the Proposal using a Formal Assessment Tool of your choice and Ratio Analysis stating whether you would be willing to grant the loan and the terms and conditions of the loan agreement. A Mobile View Read Aloud Headings 15:52 Files 2023-24+Assignment 4G 194 Q Woodwedge Limited Extract from the Statement of Profit or Loss for the Year Ending... Revenue Cost of Sales Gross Profit Overheads Dec '21 Dec '20 787,619 449,308 544.382 278.616 243,237 170,692 228,152 158,734 Interest 13,503 5,939 Net Profit 1,582 6,019 Statement of Financial 31 Dec '21 31 Dec '20 Position as at ... Non Current Assets 65,270 Current Assets: Cash and Bank 509 5,391 Accounts Receivable 12,833 13,476 Inventory 157,746 100,768 171,088 119,635 61,594 Current Liabilities: Overdraft 17,624 5,915 Accounts Payable 91,249 49,463 Hire Purchase 10,072 3,117 Tax 3,652 4,709 122,597 63,204 Net Current Assets 48,491 56,431 Bank Loans 33,000 39,000 Net Tangible Assets 80,761 79,025 Financed by: Share Capital 100 100 Revaluation Reserve 25,000 25,000 Retained Profit 55,661 53,925 Net Capital Resources 80,761 79,025 A Mobile View Read Aloud Headings || 15:52 4G 204 Files 2023-24+Assignment Q Part 4: Capital Restructure 20% You work for Midchester Bank Plc. A customer who you recently acquired from ABC Bank is facing the prospect of going into liquidation. Their latest Statement of Financial Position is detailed below. However, upon liquidation, assets values may be affected as follows: Non-Current Assets Realisable Value: 5,500,000 Inventory includes Bad Stock of 125,000 and a Reservation of Title of 65,000 Accounts Receivable includes Bad Debts of 110,000 The Cash balance is currently zero and the overdraft as increased to 2,700,000 Statement of Financial Position as at 31 December ... 2021 000 Non Current Assets Cost 16,440 Accumulated depreciation Current Assets Inventory 8,720 7,720 225 Accounts Receivable 341 Cash 220 786 Current Liabilities Bank Overdraft (with Midchester Bank) 1,190 Loan (from ABC Bank) secured by a Floating Charge 350 Accounts Payable 2,300 3,840 Working Capital/Net Current Assets ) Total assets less Current Liabilities (3.054) 4,666 Non Current Liabilities Secured Loan (from ABC Bank) Financed by: Share Capital (1 Ordinary Shares) Retained Profit A 2,700 1,966 1,,800 166 1,966 Mobile View Read Aloud Headings || 15:52 Files ... 4G 204 Required: a. Calculate the amount you would receive in the event of liquidation, detailing how much each creditor would receive. b. Your customer has asked you to consider the following capital re-structure which would enable them to continue trading: Convert the overdraft of 2,700,000 currently at an interest rate of Base + 7.5% to a 5 year loan of 2,000,000 at a rate of 9.5% Fixed. Effectively writing off 700,000 of the loan but receiving 550,000 8% Preference Shares in exchange Evaluate your position, recommending an appropriate course of action Marking Scheme Required | Part1: Corporate Investment Justified Method of Finance Marks 40% 10% Finance theory and practice Calculation of the cost of capital and Calculation of the optimal capital structure Evaluation of the Project using appropriate Investment Appraisal Techniques 10% Calculations Evaluation Comparison of the Project to the Alternative and Recommended 10% ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started