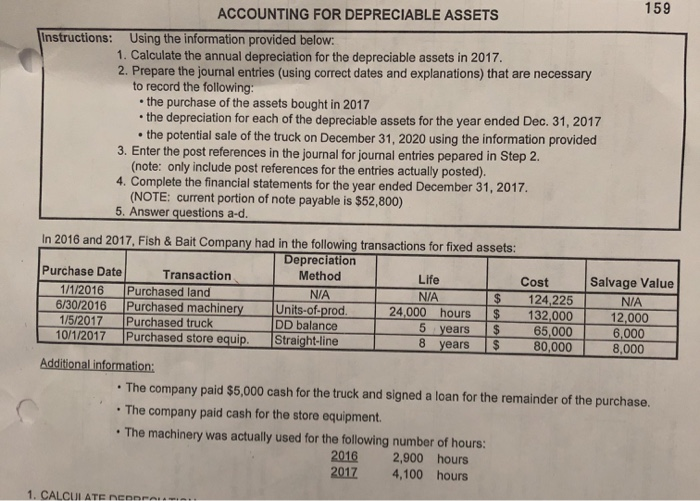

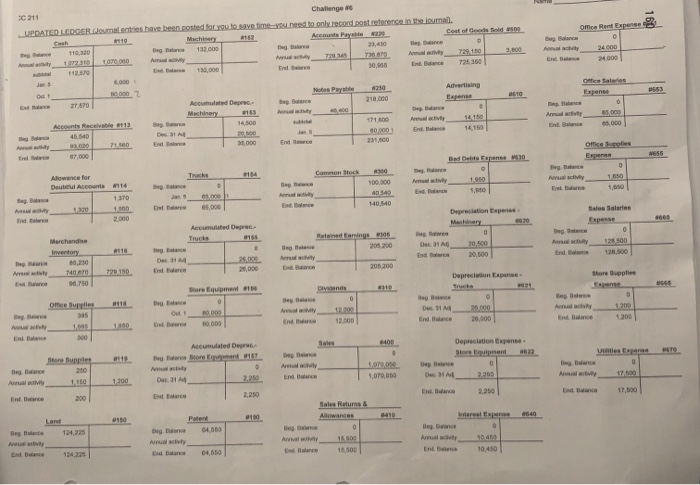

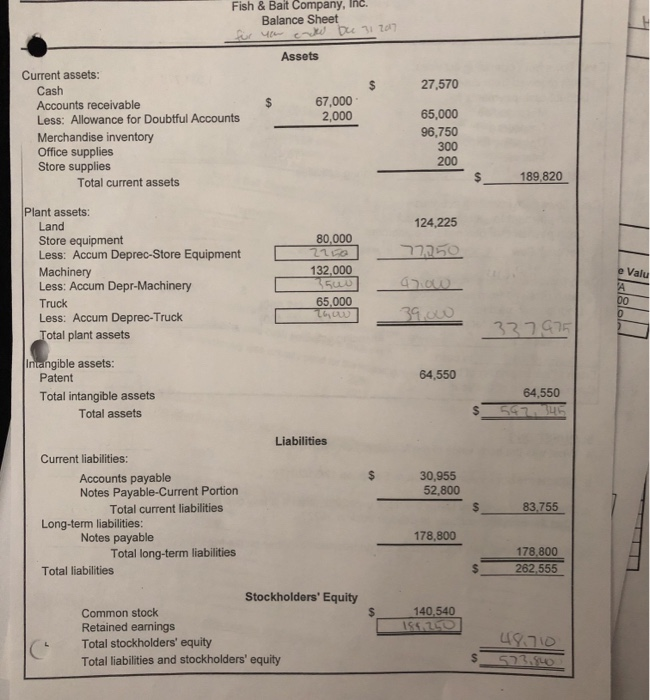

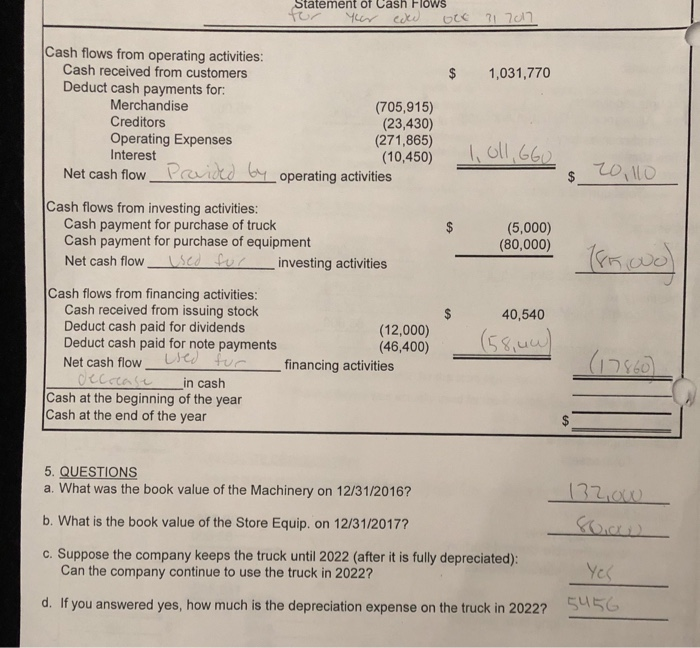

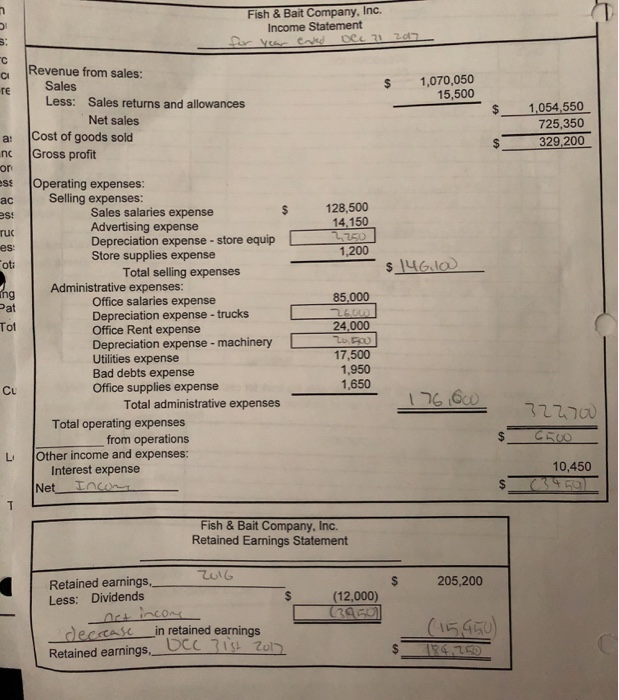

159 ACCOUNTING FOR DEPRECIABLE ASSETS Instructions: Using the information provided below: 1. Calculate the annual depreciation for the depreciable assets in 2017. 2. Prepare the journal entries (using correct dates and explanations) that are necessary to record the following: the purchase of the assets bought in 2017 the depreciation for each of the depreciable assets for the year ended Dec. 31, 2017 the potential sale of the truck on December 31, 2020 using the information provided 3. Enter the post references in the journal for journal entries pepared in Step 2. (note: only include post references for the entries actually posted). 4. Complete the financial statements for the year ended December 31, 2017 (NOTE: current portion of note payable is $52,800) 5. Answer questions a-d. Life In 2016 and 2017, Fish & Bait Company had in the following transactions for fixed assets: Depreciation Purchase Date Transaction Method Cost 1/1/2016 Purchased land NA N/A $ 124,225 6/30/2016 Purchased machinery Units-of-prod. 24,000 hours $ 132,000 1/5/2017 Purchased truck DD balance 5 years I $ 65,000 10/1/2017 Purchased store equip. Straight-line 1 8 years $ 80,000 Salvage Value N/A 12.000 6,000 8,000 Additional information: The company paid $5,000 cash for the truck and signed a loan for the remainder of the purchase. The company paid cash for the store equipment. The machinery was actually used for the following number of hours: 2016 2,900 hours 2017 4,100 hours Challenge only record post reference in the UPDATED LEDGER Journal entries are been posted for you to save time you need Machinery 152 man Cost of the old 500 Om Rest Expense 23,40 2400D 000 Advertising TO! Expense Acom 218.000 1 3 Account Rec 45 540 TO 0.000 231,000 E 5.000 7 Om os Allowance for Dul Art 14 De 100.000 wwwy 1650 650 E En el 14040 Deprecate Acceder Trucks Merchandise De En 10,00 20500 Ende 126 500 0.710 Deprecated Sore Equipment Omul 2.000 Accumulated Depo Depreciation Expense De 1 D 220 Ende 200 2,250 3.250 17.000 Sales Returns Away be Any Amway Balance 15 500 15.500 En 10.450 Fish & Bait Company, Inc. Balance Sheet for you to be 31 2017 Assets 27,570 $ 67,000 2,000 Current assets: Cash Accounts receivable Less: Allowance for Doubtful Accounts Merchandise inventory Office supplies Store supplies Total current assets 65,000 96,750 300 200 189,820 124,225 77250 Plant assets: Land Store equipment Less: Accum Deprec-Store Equipment Machinery Less: Accum Depr-Machinery Truck Less: Accum Deprec-Truck Total plant assets 80,000 2160 132.000 3500 65,000 LG, 39.00 337675 64,550 Intangible assets: Patent Total intangible assets Total assets 64,550 SOUL Liabilities 30,955 52,800 83,755 Current liabilities: Accounts payable Notes Payable-Current Portion Total current liabilities Long-term liabilities: Notes payable Total long-term liabilities Total liabilities 178,800 178.800 262,555 Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 140,540 185.210 Statement of Cash Flows GLE 31 2017 $ 1,031,770 Cash flows from operating activities: Cash received from customers Deduct cash payments for: Merchandise (705,915) Creditors (23,430) Operating Expenses (271,865) Interest (10,450) Net cash flow Paided by operating activities 1. Oll, GG0 20,10 Cash flows from investing activities: Cash payment for purchase of truck Cash payment for purchase of equipment Net cash flow_ ISCO for investing activities (5,000) (80,000) Cash flows from financing activities: Cash received from issuing stock Deduct cash paid for dividends Deduct cash paid for note payments Net cash flow Us Hur decrease in cash Cash at the beginning of the year Cash at the end of the year 40,540 (58, uw (12,000) (46,400) financing activities (1760) 5. QUESTIONS a. What was the book value of the Machinery on 12/31/2016? 132,ow b. What is the book value of the Store Equip. on 12/31/2017? c. Suppose the company keeps the truck until 2022 (after it is fully depreciated): Can the company continue to use the truck in 20227 Yes d. If you answered yes, how much is the depreciation expense on the truck in 20222 5 6 Fish & Bait Company, Inc. Income Statement for vea cred Dec 21 207 ROU $ 1,070,050 15,500 Revenue from sales: Sales Less: Sales returns and allowances Net sales Cost of goods sold Gross profit $ 1,054,550 725,350 329,200 a: $ inc es: Tu es: ot 128,500 14,150 2250 1,200 $ 14GIO Pat Tot Operating expenses: Selling expenses: Sales salaries expense $ Advertising expense Depreciation expense - store equip Store supplies expense Total selling expenses Administrative expenses: Office salaries expense Depreciation expense - trucks Office Rent expense Depreciation expense - machinery Utilities expense Bad debts expense Office supplies expense Total administrative expenses Total operating expenses from operations Other income and expenses: Interest expense Net Inc 85,000 2600 24,000 Zo oo 17,500 1,950 1,650 176,600 = 32270 Choo & Li 10,450 24 50 S T. Fish & Bait Company, Inc. Retained Earnings Statement $ 205,200 (12,000) Retained earnings Less: Dividends net incon decrease in retained earnings Retained earnings._UCC315 Zoll 184,250