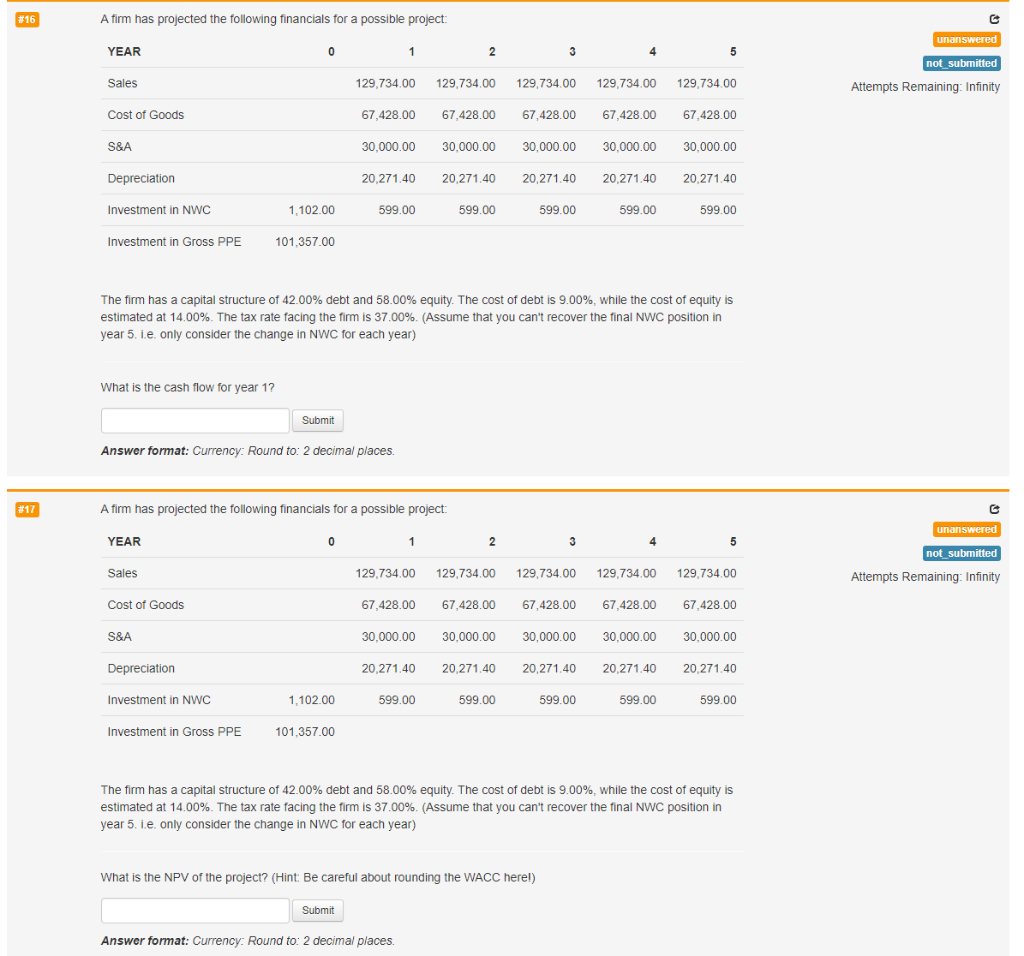

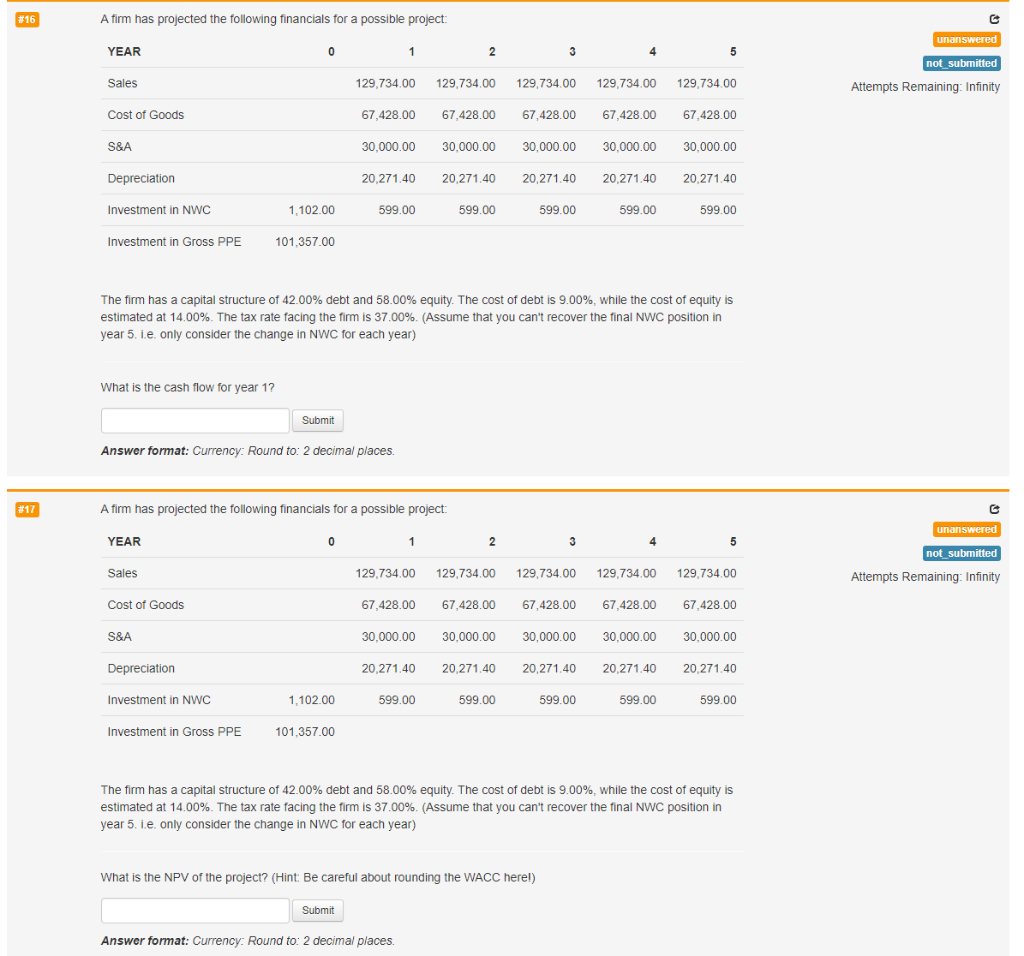

#16 A firm has projected the following financials for a possible project: unanswered YEAR 0 1 2 3 5 not submitted Sales 129,734.00 129,734.00 129.734.00 129.734.00 129,734.00 Attempts Remaining: Infinity Cost of Goods 67,428.00 67,428.00 67,428.00 67,428.00 67,428.00 S&A 30,000.00 30,000.00 30,000.00 30.000.00 30,000.00 Depreciation 20,271.40 20,271.40 20,271,40 20,271.40 20,271.40 Investment in NWC 1,102.00 599.00 599.00 599.00 599.00 599.00 Investment in Gross PPE 101,357.00 The firm has a capital structure of 42.00% debt and 58.00% equity. The cost of debt is 9.00%, while the cost of equity is estimated at 14.00%. The tax rate facing the firm is 37.00%. (Assume that you can't recover the final NWC position in year 5. i.e. only consider the change in NWC for each year) What is the cash flow for year 1? Submit Answer format: Currency: Round to: 2 decimal places. #17 A firm has projected the following financials for a possible project: unanswered YEAR 0 1 2 2 3 4 5 not_submitted Attempts Remaining: Infinity Sales 129,734.00 129,734.00 129,734.00 129,734.00 129.734.00 Cost of Goods 67,428.00 67,428.00 67,428.00 67,428.00 67,428.00 S&A 30,000.00 30,000.00 30,000.00 30,000.00 30,000.00 Depreciation 20,271.40 20,271.40 20,271.40 20,271.40 20,271.40 Investment in NWC 1,102.00 599.00 599.00 599.00 599.00 599.00 Investment in Gross PPE 101.357.00 The firm has a capital structure of 42.00% debt and 58.00% equity. The cost of debt is 9.00%, while the cost of equity is estimated at 14.00%. The tax rate facing the firm is 37.00%. (Assume that you can't recover the final NWC position in year 5. i.e. only consider the change in NWC for each year) What is the NPV of the project? (Hint: Be careful about rounding the WACC here!) (! Submit Answer format: Currency: Round to: 2 decimal places. #16 A firm has projected the following financials for a possible project: unanswered YEAR 0 1 2 3 5 not submitted Sales 129,734.00 129,734.00 129.734.00 129.734.00 129,734.00 Attempts Remaining: Infinity Cost of Goods 67,428.00 67,428.00 67,428.00 67,428.00 67,428.00 S&A 30,000.00 30,000.00 30,000.00 30.000.00 30,000.00 Depreciation 20,271.40 20,271.40 20,271,40 20,271.40 20,271.40 Investment in NWC 1,102.00 599.00 599.00 599.00 599.00 599.00 Investment in Gross PPE 101,357.00 The firm has a capital structure of 42.00% debt and 58.00% equity. The cost of debt is 9.00%, while the cost of equity is estimated at 14.00%. The tax rate facing the firm is 37.00%. (Assume that you can't recover the final NWC position in year 5. i.e. only consider the change in NWC for each year) What is the cash flow for year 1? Submit Answer format: Currency: Round to: 2 decimal places. #17 A firm has projected the following financials for a possible project: unanswered YEAR 0 1 2 2 3 4 5 not_submitted Attempts Remaining: Infinity Sales 129,734.00 129,734.00 129,734.00 129,734.00 129.734.00 Cost of Goods 67,428.00 67,428.00 67,428.00 67,428.00 67,428.00 S&A 30,000.00 30,000.00 30,000.00 30,000.00 30,000.00 Depreciation 20,271.40 20,271.40 20,271.40 20,271.40 20,271.40 Investment in NWC 1,102.00 599.00 599.00 599.00 599.00 599.00 Investment in Gross PPE 101.357.00 The firm has a capital structure of 42.00% debt and 58.00% equity. The cost of debt is 9.00%, while the cost of equity is estimated at 14.00%. The tax rate facing the firm is 37.00%. (Assume that you can't recover the final NWC position in year 5. i.e. only consider the change in NWC for each year) What is the NPV of the project? (Hint: Be careful about rounding the WACC here!) (! Submit Answer format: Currency: Round to: 2 decimal places