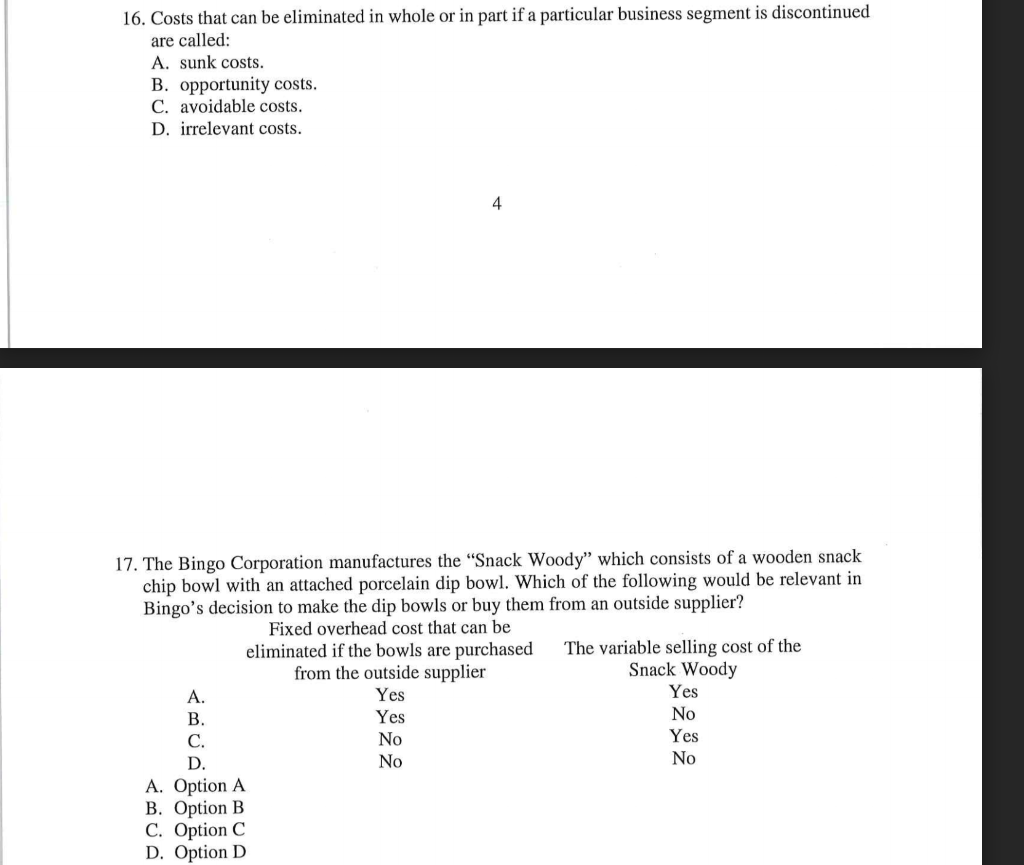

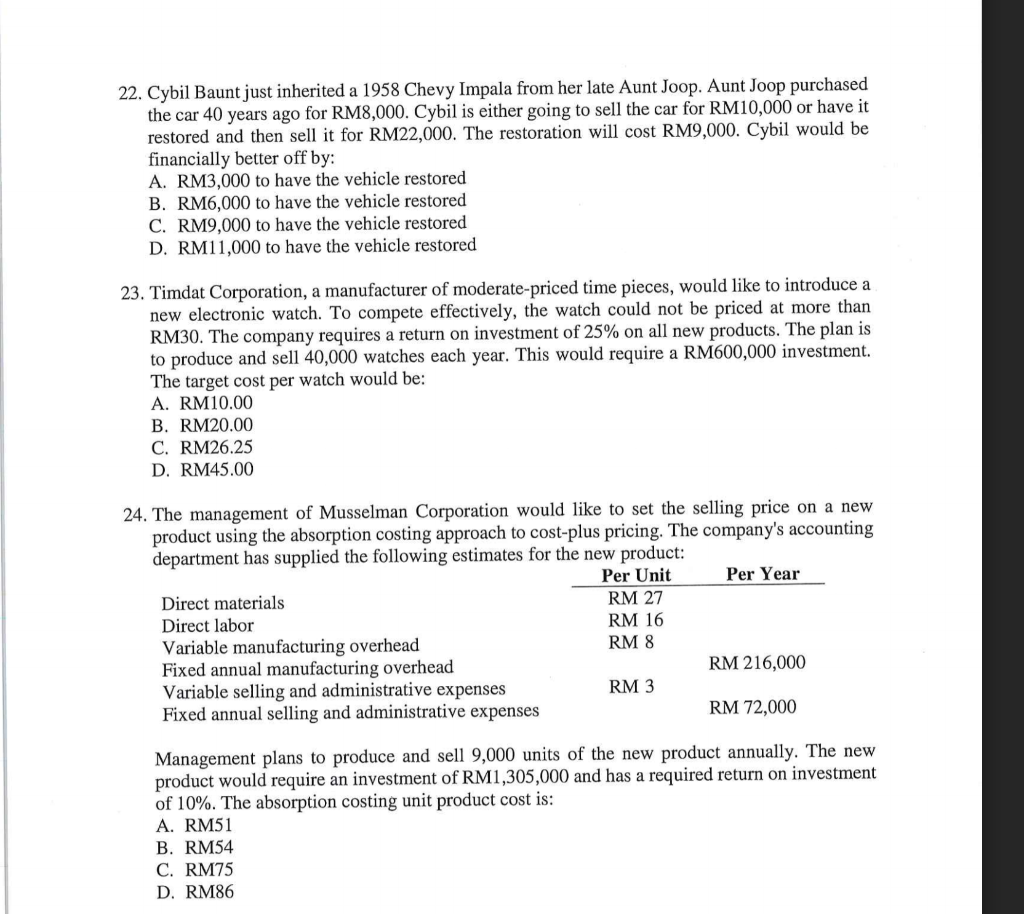

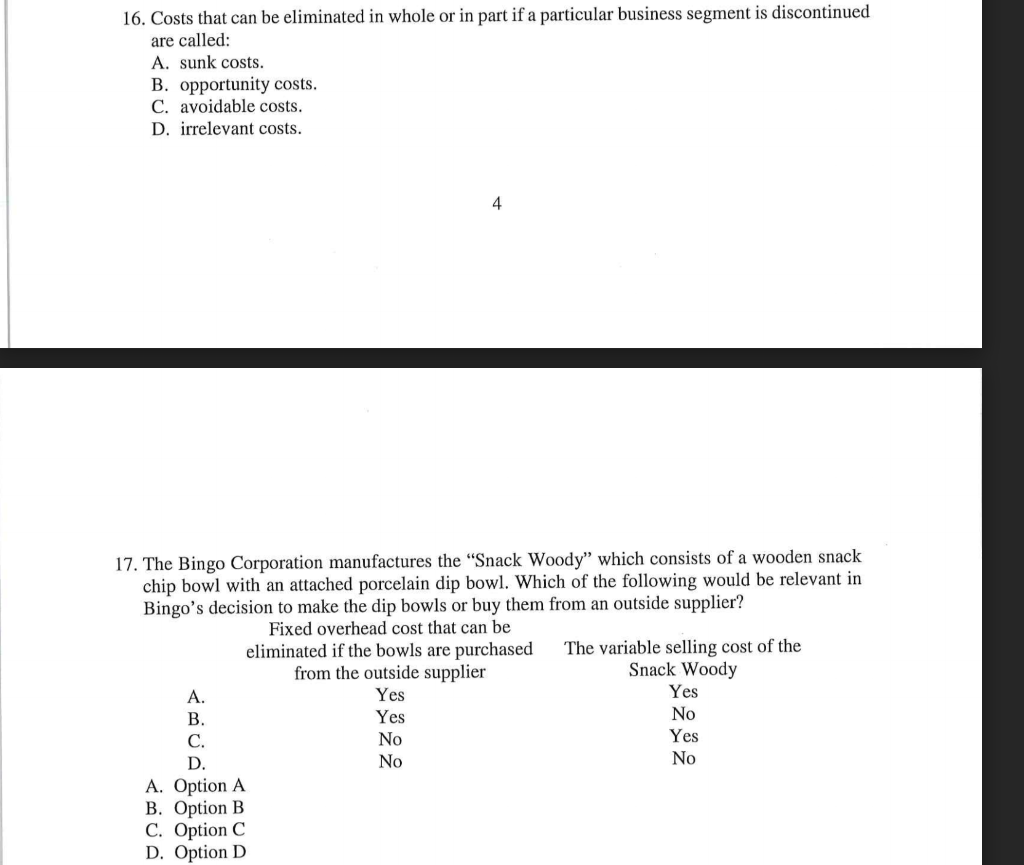

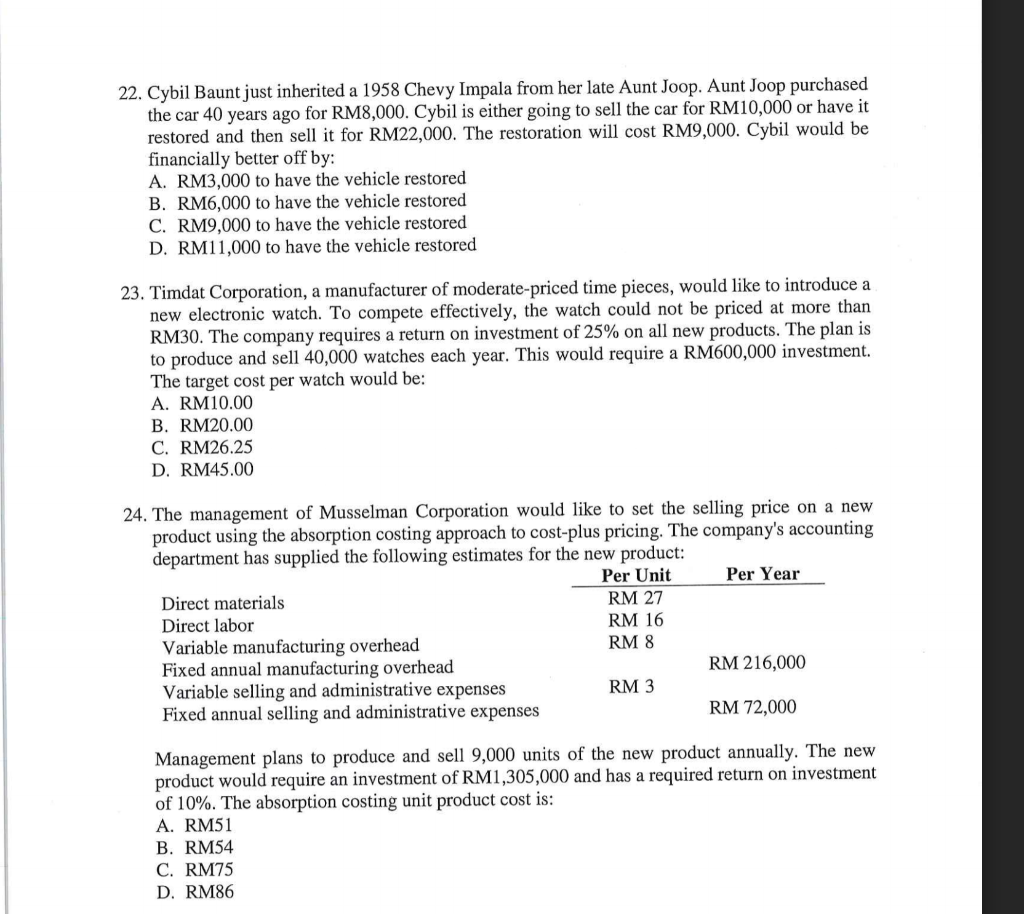

16. Costs that can be eliminated in whole or in part if a particular business segment is discontinued are called: A. sunk costs. B. opportunity costs. C. avoidable costs. D. irrelevant costs. 4 17. The Bingo Corporation manufactures the "Snack Woody" which consists of a wooden snack chip bowl with an attached porcelain dip bowl. Which of the following would be relevant in Bingo's decision to make the dip bowls or buy them from an outside supplier? Fixed overhead cost that can be eliminated if the bowls are purchased The variable selling cost of the from the outside supplier Snack Woody A. Yes Yes B. Yes No C. No Yes D. No No A. Option A B. Option B C. Option C D. Option D 22. Cybil Baunt just inherited a 1958 Chevy Impala from her late Aunt Joop. Aunt Joop purchased the car 40 years ago for RM8,000. Cybil is either going to sell the car for RM10,000 or have it restored and then sell it for RM22,000. The restoration will cost RM9,000. Cybil would be financially better off by: A. RM3,000 to have the vehicle restored B. RM6,000 to have the vehicle restored C. RM9,000 to have the vehicle restored D. RM11,000 to have the vehicle restored 23. Timdat Corporation, a manufacturer of moderate-priced time pieces, would like to introduce a new electronic watch. To compete effectively, the watch could not be priced at more than RM30. The company requires a return on investment of 25% on all new products. The plan is to produce and sell 40,000 watches each year. This would require a RM600,000 investment. The target cost per watch would be: A. RM10.00 B. RM20.00 C. RM26.25 D. RM45.00 24. The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product: Per Unit Per Year Direct materials RM 27 Direct labor RM 16 Variable manufacturing overhead RM 8 Fixed annual manufacturing overhead RM 216,000 Variable selling and administrative expenses RM 3 Fixed annual selling and administrative expenses RM 72,000 Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of RM1,305,000 and has a required return on investment of 10%. The absorption costing unit product cost is: A. RM51 B. RM54 C. RM75 D. RM86