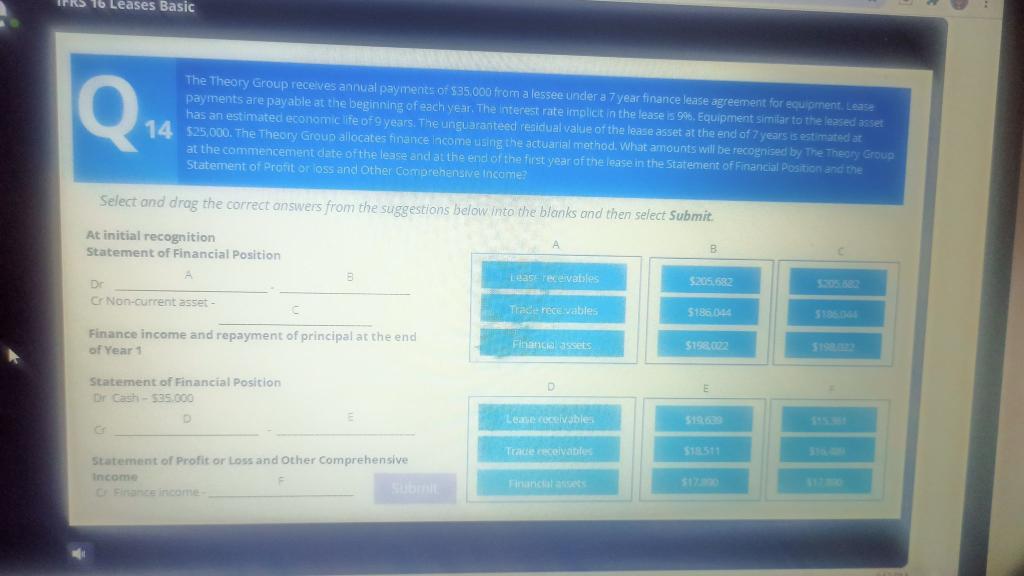

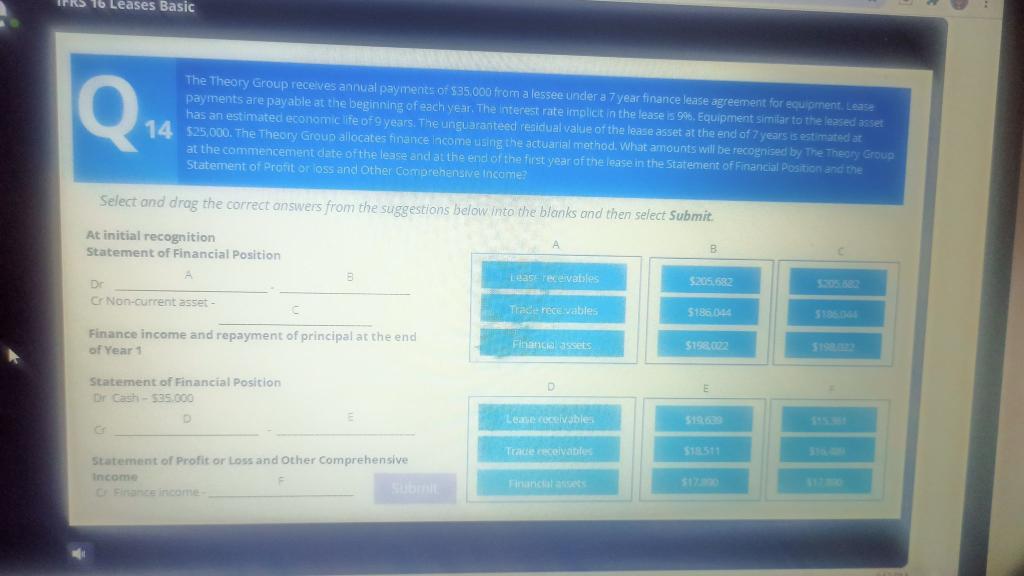

16 Leases Basic Q. The Theory Group receives annual payments of $35.000 from a lessee under a year finance lease agreement for equipment. Lease payments are payable at the beginning of each year. The interest rate implick in the lease is 9%, Equipment similar to the lessed asset has an estimated economic life of years. The unguaranteed residual value of the lease asset at the end of 7 years is estimated at 14 525,000. The Theory Group allocates finance income using the actuarial method. What amounts will be recognised by The Theory Group at the commencement date of the lease and at the end of the first year of the lease in the Statement of Financial Position and the Statement of Profit or loss and Other Comprehensive income Select and drag the correct answers from the suggestions below into the blanks and then select Submit At initial recognition Statement of Financial Position B Leasreceivables 5205.682 Dr C Non-current asset- Trade recevable 5186.04 5195 Finance income and repayment of principal at the end of Year Finance asset $1980 Statement of Financial Position Dr Cash - $35.000 Lease receivable Tradeceivable Statement of Profit or loss and Other Comprehensive income cate income 16 Leases Basic Q. The Theory Group receives annual payments of $35.000 from a lessee under a year finance lease agreement for equipment. Lease payments are payable at the beginning of each year. The interest rate implick in the lease is 9%, Equipment similar to the lessed asset has an estimated economic life of years. The unguaranteed residual value of the lease asset at the end of 7 years is estimated at 14 525,000. The Theory Group allocates finance income using the actuarial method. What amounts will be recognised by The Theory Group at the commencement date of the lease and at the end of the first year of the lease in the Statement of Financial Position and the Statement of Profit or loss and Other Comprehensive income Select and drag the correct answers from the suggestions below into the blanks and then select Submit At initial recognition Statement of Financial Position B Leasreceivables 5205.682 Dr C Non-current asset- Trade recevable 5186.04 5195 Finance income and repayment of principal at the end of Year Finance asset $1980 Statement of Financial Position Dr Cash - $35.000 Lease receivable Tradeceivable Statement of Profit or loss and Other Comprehensive income cate income